Quarterly Economic Growth Release: More BSP cuts to come

DOWNLOAD

DOWNLOAD

Monthly Economic Update: Fed catches up

DOWNLOAD

DOWNLOAD

Inflation Update: Steady and mellow

DOWNLOAD

DOWNLOAD

Remittances climb 2.7% in August

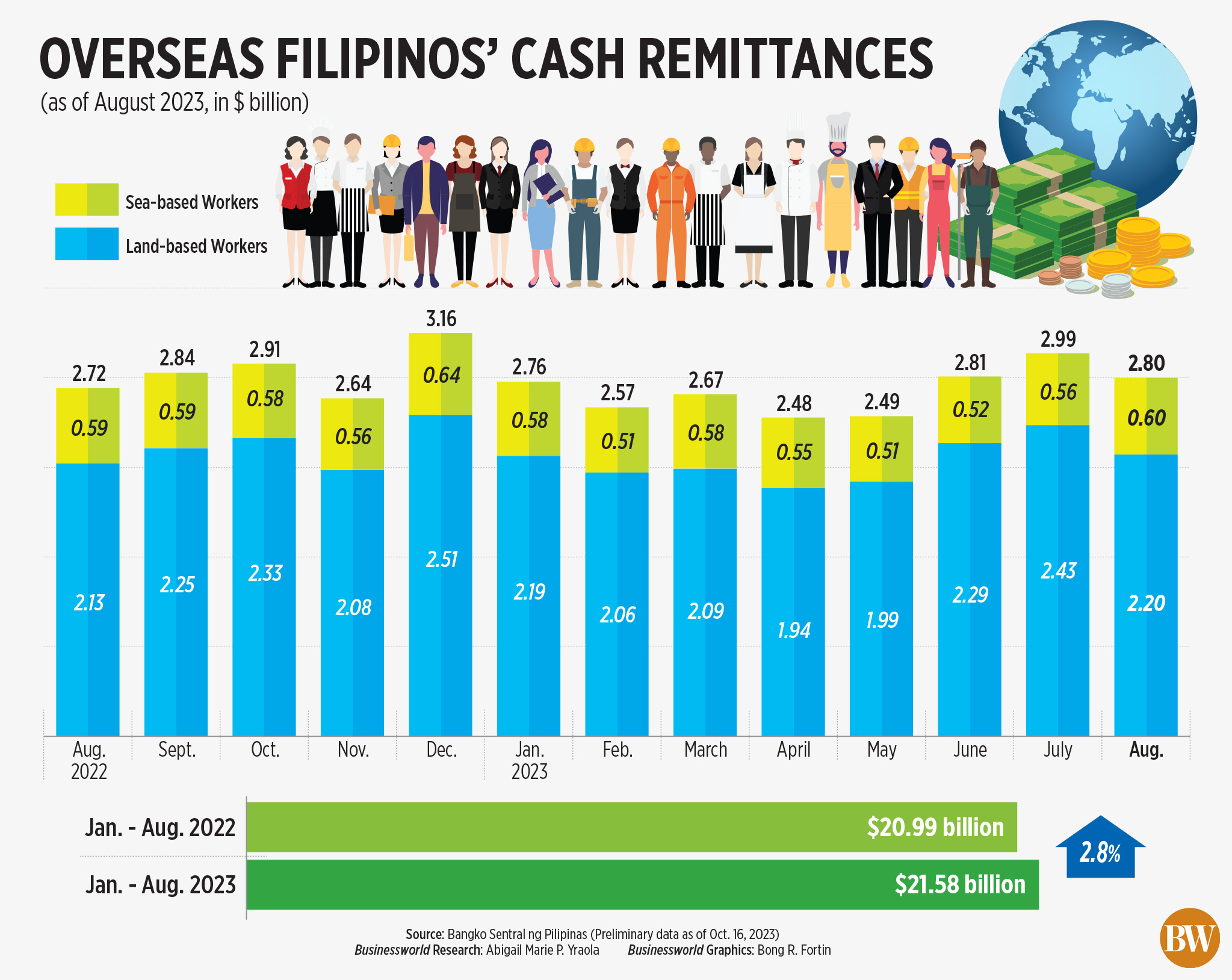

Money sent home by overseas Filipino workers (OFWs) increased by 2.7% year on year in August, the fastest pace since May, data from the Bangko Sentral ng Pilipinas (BSP) showed.

Cash remittances coursed through banks rose by 2.7% to USD 2.79 billion in August from USD 2.72 billion in the same month in 2022. This was the fastest rate in three months since the 2.8% seen in May, but slower than 4.3% in August 2022.

“The growth in cash remittances during the month was due primarily to increased receipts from both land- and sea-based workers,” the BSP said in a statement.

However, cash remittances in August were the lowest since the USD 2.49 billion in May. Month on month, cash remittances fell by 6.5% from USD 2.99 billion in July.

Remittances from land-based workers jumped by 3.2% year on year to $2.2 billion in August, while cash sent by sea-based workers inched up by 1% to USD 600 million.

“The continued growth (in remittances) nevertheless is still a good signal/bright spot for the overall economy as a growth driver),” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

For the first eight months of 2023, cash remittances jumped by 2.8% to USD 21.58 billion from USD 20.99 billion a year ago.

“This is largely in line with expectations as remittances continue to be a consistent source of foreign exchange and once converted, a viable driver of domestic purchasing power,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa likewise said in a Viber message.

The bulk of the cash remittances or USD 17.71 billion came from land-based workers during the eight-month period, up by 3.1% year on year. Sea-based workers sent USD 4.41 billion during the January-to-August period, up by 1.9% year on year.

“The growth in cash remittances from the United States (US), Saudi Arabia, and Singapore contributed mainly to the increase in remittances in the first eight months of 2023,” the BSP said.

The US is the biggest source of cash remittances at 41.6% during the period ending August. It was followed by Singapore (6.9%), Saudi Arabia (5.9%), Japan (4.9%), United Kingdom (4.9%), United Arab Emirates (4.1%), Canada (3.5%), Qatar (2.8%), Taiwan (2.7%) and South Korea (2.6%).

Mr. Ricafort noted OFWs have been sending more money to take advantage of the favorable peso-dollar exchange rate.

“The US dollar/peso exchange already went up nearly PHP 6 or nearly 12% to PHP 56.80 levels currently versus PHP 51 levels since 2022 or before the start of the Russia-Ukraine war on Feb. 24, 2022,” he said.

“As OFW remittances have more peso equivalent for every US dollar sent, this is a source of consolation for OFWs and their families/dependents coping with higher prices/inflation and higher interest rate payments (on loans),” he added.

Headline inflation quickened for the first time in seven months to 5.3% in August, which marked the 17th month that inflation surpassed the BSP’s 2-4% target.

“As inflationary pressures remain such as higher rice and oil/petroleum prices that would lead to higher prices of other affected goods and services, OFW remittances could continue by a similar pace year on year, similar to GDP growth for the coming months,” Mr. Ricafort said.

The BSP sees inflation averaging 5.8% this year. Economic managers are targeting 6-7% gross domestic product (GDP) growth this year.

Remittances also typically accelerate in the fourth quarter ahead of the Christmas holidays, which could support the peso exchange rate, Mr. Ricafort added.

However, Mr. Ricafort noted that a possible global economic slowdown and a prolonged Israel-Hamas war could affect remittances.

Israel accounts for USD 74.4-million remittances during the eight-month period or 0.3% of the total remittances. In 2022, remittances from Israel reached USD 110.6 million.

Meanwhile, personal remittances, which include inflows in kind, went up by 2.8% to USD 3.1 billion in August from USD 3.02 billion in the same month a year ago. Month on month, personal remittances fell by 6.5% from USD 3.32 billion.

For the January-to-August period, personal remittances increased by 2.9% to USD 24.01 billion from USD 23.34 billion a year ago.

The central bank expects remittances to grow by 3% this year. — AMCS

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld