Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

Yields on gov’t securities climb amid BSP bets

Yields on government securities (GS) traded in the secondary market climbed last week after the Bangko Sentral ng Pilipinas (BSP) hinted at a rate hike in their meeting next month.

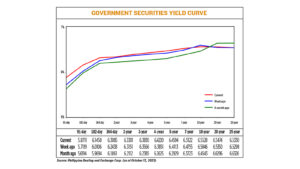

GS yields, which move opposite to prices, climbed by 4.60 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Oct. 13 published on the Philippine Dealing System’s website.

Rates mostly increased across the board, with yields on the 91-, 182- and 364-day Treasury bills (T-bills) rising by 15.92 bps, 13.52 bps and 6.47 bps to 5.8711%, 6.1458%, and 6.3085%, respectively.

The belly of the curve went up as rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) climbed by 1.50 bps (6.3301%), 2.64 bps (6.3830%), 3.69 bps (6.422%), 4.81 bps (6.4594%), and 3.67 bps (6.5122%), respectively.

At the long end, rates were mixed as the 20-, and 25-year debt papers inched up by 1.24 bps (6.5474%) and 0.32 bps (6.533%), respectively, while the 10-year debt paper fell by 3.18 bps to yield 6.5528%.

On Friday, total GS volume traded fell to PHP 3.99 billion from PHP 10.59 billion a week earlier.

Last week’s yield movements were mostly due to expectations of a BSP rate hike in November, analysts said.

“Government bond yields increased after BSP Governor Remolona hinted on a possible rate hike before the year ends,” a bond trader said in an e-mail.

BSP Governor Eli M. Remolona, Jr. last week said the Monetary Board is open to hiking borrowing costs by 25 bps in their Nov. 16 review following the release of data showing faster-than-expected September inflation.

Headline inflation accelerated for a second straight month to 6.1% in September from 5.3% in August. This brought the nine-month inflation average to 6.6%, still higher than the BSP’s 5.8% forecast and 2-4% target.

The Monetary Board has kept the benchmark interest rate at 6.25% for four straight meetings after it hiked borrowing costs by 425 bps from May 2022 to March 2023 to help tame inflation.

The potential BSP hike has been priced in gradually in local yields for the past few weeks, Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message.

“[This,] as we saw the front end to the belly of the curve inched higher by 6-19 bps after the previous monetary policy meeting,” Ms. Araullo said in a Viber message.

Some investors, however, still expect inflation to go down significantly by yearend, she added.

“This divide managed to cap the upward movement in yields from the previous days after opportunistic buying emerged,” Ms. Araullo said.

The bond trader added that the “upside was limited from some safe-haven demand from the outbreak of the Israel-Palestine war.”

The death toll in the Gaza Strip and the West Bank reached 2,383 Palestinians dead and 10,814 injured on Sunday morning, according to Palestinian health ministry sources, Reuters reported.

In Gaza, the death toll climbed to 2,329 Palestinians killed and 9,714 wounded, while in the West Bank, 54 were recorded dead and 1,100 wounded since the conflict between Hamas and Israel started on Oct. 7.

Ms. Araullo added that local market activity was driven by the bond auction last week.

“Week on week, local yields on the long end were lower by 2-7 basis points as buying emerged from local investors betting on a more dovish US central bank,” she said.

The Bureau of the Treasury (BTr) raised PHP 30 billion as planned via the reissued 10-year bonds it auctioned off last week as total bids reached PHP 40.828 billion, higher than the offered volume.

The bonds, which have a remaining life of five years and three months, were awarded at an average rate of 6.512%, with accepted yields ranging from 6.35% to 6.625%

For this week, Ms. Araullo said the market could remain cautious amid still-elevated inflation in the US, which could cause the Federal Reserve to keep rates higher for longer.

“Yield movement is likely to remain rangebound until further data releases imply that local prices managed to show signs of easing,” she added.

“Yields might correct to the downside as the potentially weaker US retail sales and softer Chinese economic growth report might bolster views of a near-term downside in global activity,” the bond trader said. — A.M.P. Yraola with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld