Peso GS Weekly: Take advantage of the 7-year auction

There is an opportunity brewing in medium-term bonds this week.

WHAT HAPPENED LAST WEEK

Yields of peso government securities (GS) saw a move higher last week after domestic inflation for the month of August surprised to the upside, rising to 5.3% year-on-year, significantly higher than Bloomberg estimates of 4.7%. The peso yield curve started to steepen, i.e., yields of long-term bonds relatively higher than the shorter tenors as sellers of 9- to 15-year bonds emerged after the data release.

Later in the week, the Bureau of the Treasury (BTr) priced the new 3-year benchmark, Fixed Rate Treasury Note (FXTN) 3-29, at the coupon rate of 6.25%. Awarded yields were capped with the high set at 6.373%. The BTr partially awarded the bids as volume tendered was weak at PHP 28.987 billion, lower than the PHP 30 billion volume offering. Yields of peso GS shifted upwards in the following days as they realigned to the new 3-year benchmark. US yields gradually moved higher as well, causing medium- to long-term peso GS to cheapen.

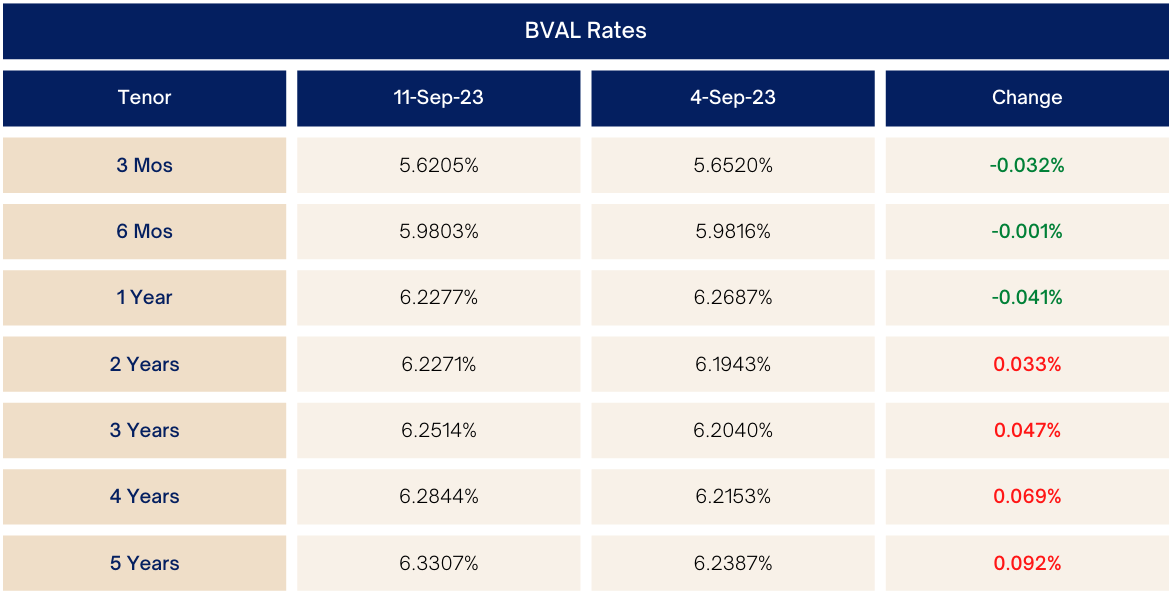

Week-on-week, the peso yield curve steepened and yields moved higher by 3 to 7 basis points (bps) as some de-risked ahead of the upcoming 7- and 10-year supply.

Market Levels (week-on-week)

WHAT WE CAN EXPECT

We think that this week’s 7-year auction should provide a decent opportunity for investors to reposition in medium-term bonds. Bids closer to 6.5% would be favorable, as we have seen strong demand at this level for 9- to 10-year bonds.

Investors may also find that short-term bonds at current elevated levels have a more attractive premium over comparable T-bills. We expect peso GS yields to trade within a tighter range, as any potential selloff will likely be capped by reinvestments from the FXTN 3-25 maturity.

See our updated top picks below:

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco