US downgrade: Not the first time

It is unfortunate that Fitch Ratings did not think the US government could handle its fiscal challenges within the next few years. Still, US treasuries remain a haven for investors.

Just before Asia markets opened on August 2, 2023, Fitch Ratings downgraded the United States’ long-term credit rating to AA+ from AAA, a rating that the US had held since 1994.

The move surprised global markets and US politicians alike, who all thought that the recent suspension of the USD 31.4 trillion debt ceiling in June should have averted a historic US default and subsequent rating downgrade. But repeated political standoffs over the very same debt ceiling have negatively affected the ratings agency’s confidence in US fiscal management.

Fitch stated that it expects fiscal deterioration over the next three years. The suspension of the debt ceiling does not address how the US government will dial down on spending programs to reduce its budget deficit.

Government debt is also forecasted to reach 118% of gross domestic product (GDP) by 2025, compared to the 39% median of other AAA nations. These factors will likely make it more difficult for the US government to repay its debts in the event of future economic crises.

Despite the bad news, US treasury bonds traded sideways during Tokyo trading time, with yields on 10-year bonds initially falling 2 basis points (bps) and then ending the New York session a little over 5 bps higher at 4.0775%.

The US dollar weakened against Group-of-10 (G10) currencies but quickly recovered. The Japanese yen (JPY) in particular fell from 143.30s to 142.80s on the news but quickly traded above 143.00 again as the day went on. Global equity markets fared worse, with Europe’s Stoxx 600 and Japan’s Nikkei 225 indices down 1.4% and 2.3%, respectively.

On the other hand, the US S&P 500 index was only down 0.8% in pre-market and then closed -1.38%, but more likely because of strong labor data supporting another possible Federal Reserve rate hike.

These market movements are reminiscent of the US’ previous downgrade, which may provide guidance on what to expect.

The year 2011 also saw the US government argue over raising the then USD 14.3-trillion debt ceiling. It had been three years since the Global Financial Crisis (GFC) and the economy was finally showing early signs of recovery.

Second quarter 2011 GDP had grown by 2.7% year-on-year after a disappointing 1st quarter 2011 print of -1%. The unemployment rate was at 9%, but was already coming down from the almost 10% high in 2009.

Pro-debt politicians argued that the debt ceiling had to be raised in order for government spending to sustain the momentum of the recovery. Failing to raise the ceiling could result in missed payments to social security, healthcare, and government employees.

That crisis was resolved on the August 2 deadline when the US Congress passed the Budget Control Act of 2011, which allowed the debt ceiling to reach over USD 2 trillion. Despite averting a default, the US was downgraded by ratings agency Standard & Poor’s (S&P) to AA+ from AAA because it found the agreed-upon fiscal consolidation plan unsatisfactory.

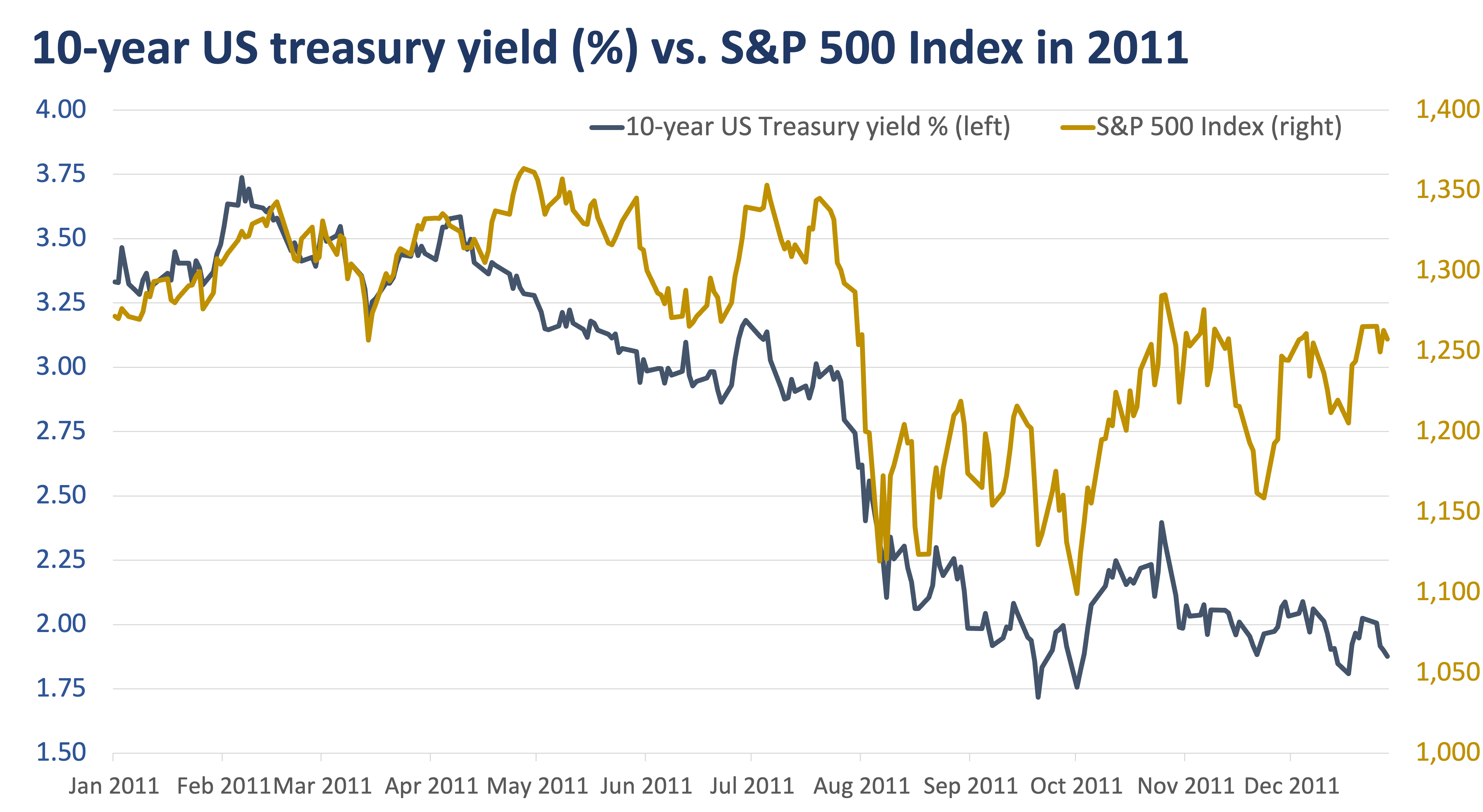

This resulted in a risk-off move in global markets. The S&P 500 fell almost 7% overnight. Surprisingly, 10-year US treasury yields had already been rallying as the debt ceiling deadline approached and still continued to rally by 40-50 bps in the days following the S&P downgrade.

This supported the view that US treasuries will continue to be a safe haven asset, even when there is a crisis in the US, similar to what happened during the GFC.

The trajectories of 10-year treasury yields and the S&P 500 diverged shortly after the US was downgraded by ratings agency Standard & Poor’s.

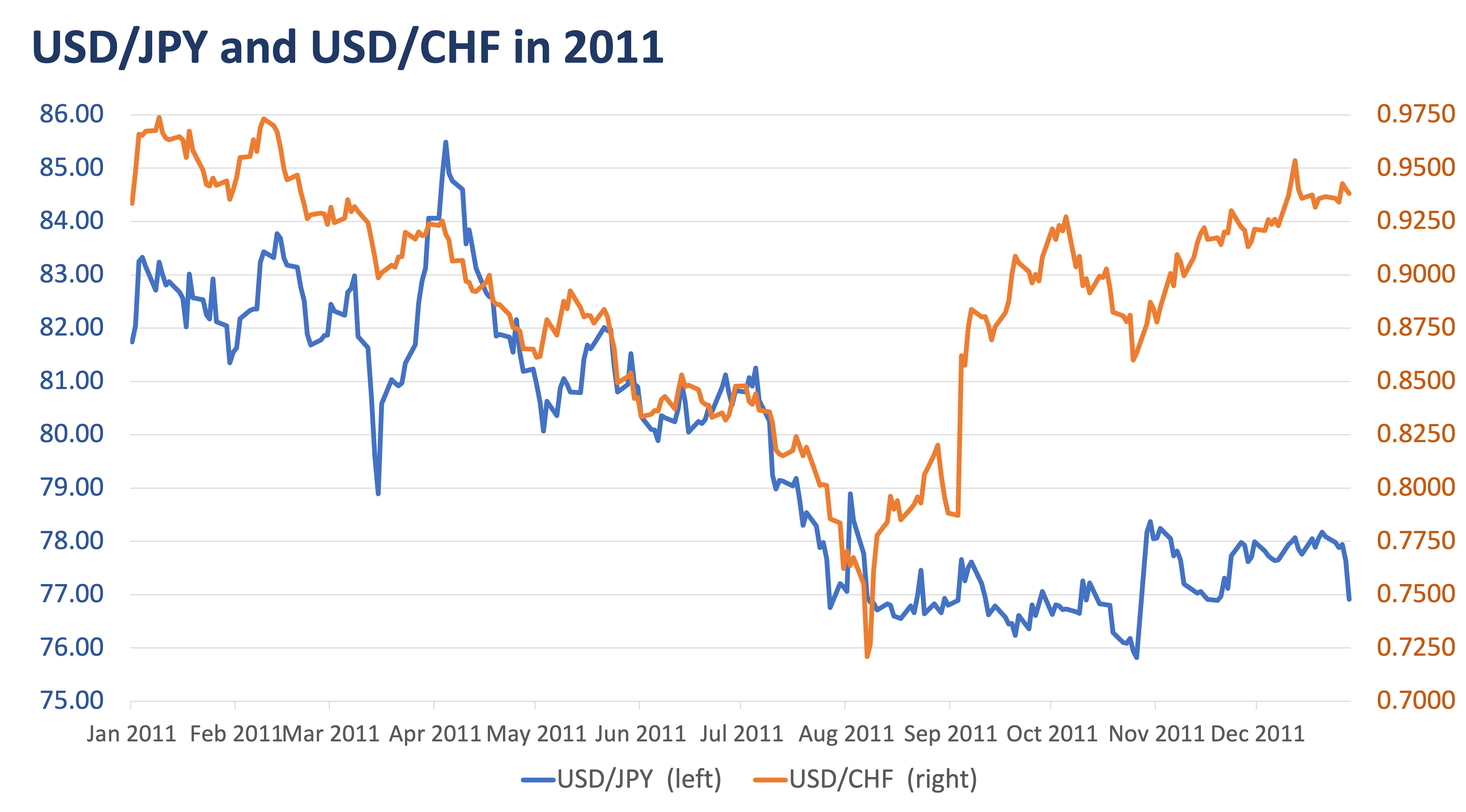

In the foreign exchange space, the US dollar weakened against the Japanese yen (JPY) and Swiss franc (CHF), which are considered safe haven currencies due to their politically stable nations.

But this would reverse as the year went on. From the USD/JPY’s August low of 76.55, the currency pair gained 0.47% to close the year at 76.91. On the other hand, USD/CHF would grow by a staggering 30% from a low of 0.7209 in August to 0.9381 by yearend, but this was mainly due to the Swiss National Bank establishing a peg of CHF 1.20 per EUR 1.00 to support Swiss exporters’ business with the Euro zone.

The US dollar initially weakened against the yen and Swiss franc until August 2011. However, it strengthened by the end of the year.

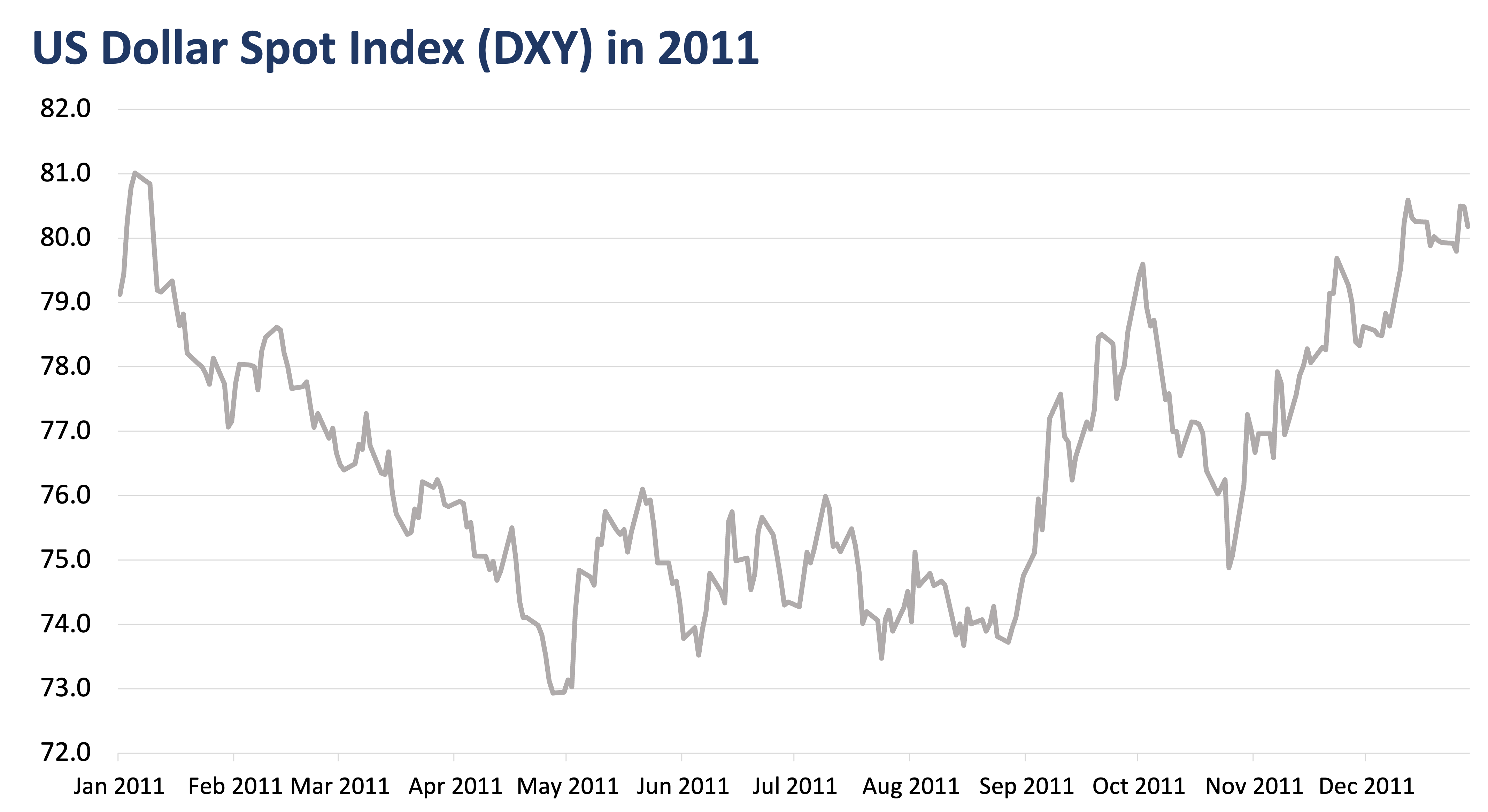

The US dollar spot index (DXY), which tells us how strong or weak the US dollar is compared to other currencies, also came off its August 2011 low of 73.674 and closed the year much higher at 80.178 or an increase of 8.83%.

By the end of 2011, the US economy had expanded by a net positive 1.5% and the unemployment rate had slightly decreased to 8.9% as the nation continued to recover from the effects of the GFC.

The US dollar strengthened against other currencies by the end of 2011.

Today, the US economy cannot be any more different from what it was in 2011. Inflation remains sticky and the Federal Reserve’s policy rate is at its highest level since 2006, but the first estimate for 2nd quarter 2023 GDP growth came out at a better-than-expected 2.4% year-on-year.

The unemployment rate remains low at 3.6% even after one of the worst global pandemics in history. In his July monetary policy meeting, Fed Chair Jerome Powell even said that Fed staff are no longer forecasting the possibility of a US recession later in the year.

Given today’s relatively better economic environment, US markets were able to stomach the Fitch downgrade much faster than the S&P downgrade in 2011. Treasury Secretary Janet Yellen summarized her observations succinctly when she said, “Fitch’s decision does not change what Americans, investors, and people all around the world already know: that Treasury securities remain the world’s preeminent safe and liquid asset, and that the American economy is fundamentally strong.”

And even at AA+, the US is still in the company of other advanced economies such as Austria, Finland, and New Zealand.

Coincidentally, this credit rating downgrade also came at a time when the US Treasury recently announced that it will ramp up quarterly refunding of longer-term securities to USD 103 billion next week from USD 96 billion previously and USD 102 billion expected.

It will also incrementally increase the size of its auctions in future quarters. Markets have been anticipating this surge in issuances as the increase in US bond supply serves to replenish the Treasury’s cash buffers that were depleted during the debt ceiling crisis.

With the refunding operations and the rating downgrade combined, it is possible that global investors will demand higher yields, especially for longer tenors.

Here is the key takeaway: US treasury securities continue to be liquid and defensive investments in the face of economic headwinds, both global and in the US. These securities are available in short-term treasury bills and longer-term notes and bonds.

Should you be interested in adding US treasury securities to diversify your investment portfolio, you may contact your investment specialist or relationship manager to learn more.

EARL ANDREW “EA” AGUIRRE is a Market Strategist at Metrobank’s Financial Markets Sector and has 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By EA Aguirre

By EA Aguirre