January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

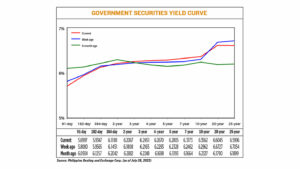

Yields on government debt mixed

Yields on government securities (GS) ended mixed last week following the US Federal Reserve’s rate hike and the release of the August domestic borrowing plan.

GS bond prices went up as yields dropped up by an average of 0.54 basis point (bp) week on week, based on PHP Bloomberg Valuation Service Reference Rates as of July 28 published on the Philippine Dealing System’s website.

GS volume traded rose to PHP 9.52 billion on Friday from PHP 7.43 billion on July 21.

The rates at the short end of the curve went down, with the 91-, 182-, and 364-day Treasury bills (T-bills) decreasing by 10.83 bps, 2.18 bps, and 2.63 bps, respectively, to yield 5.6997%, 5.9347%, and 6.1188%.

At the belly, the two-, three-, four-, five-, and seven-year Treasury bonds saw their yields climb by 2.59 bps (to 6.2067%), 2.86 bps (6.2451%), 3.77 bps (6.2670%), 4.77 bps (6.2805%), and 7.11 bps (6.3173%), respectively.

At the long end of the curve, the 10-year debt inched up by 6 bps week on week to yield 6.3562%, while the 20- and 25-year tenors declined by 6.82 bps and 10.58 bps, respectively, to fetch 6.6045% and 6.5996%.

ING Bank N.V.-Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail that it was an eventful week for central banks and bond traders, with yields reflecting changes in monetary policy.

“The US Fed and the ECB (European Central Bank) hiked rates as expected while also outlining their bias for future policy moves. The Fed showed a more hawkish tone, but also left the door open for a pause in the September decision,” Mr. Mapa said.

“Local bond yields tracked the directional moves of global bond yields with some yields moving higher, reflecting the rate hikes while longer dated tenors reflected expectations that the major central banks were approaching the end of their tightening,” he added.

The Fed last week raised its interest rates by 25 bps. This brought the benchmark overnight interest rate to a 22-year high of 5.25%-5.5% range, the highest increase in 2022 years, as it continues to ramp up its combat against inflation.

The Fed hike is the 11th rate increase in its last 12 meetings directed in fighting high inflation when policy makers began tightening in March 2022, Reuters reported.

Meanwhile, the ECB raised interest rates for the ninth consecutive time last week. With the latest 25-bp move, the ECB’s deposit rate stands at 3.75%, its highest level since 2000 — before euro notes and coins were even in circulation. The main refinancing rate was set at 4.25%.

“Sellers pushed yields 5-11 bps higher across the curve after the Bureau of the Treasury (BTr) announced their borrowing schedule for August,” ATRAM Trust Corp. Chief Investment Officer Alessandra P. Araullo said in a Viber message.

The BTr last week said it plans to raise PHP 225 billion from the domestic market in August. This is 25% higher than the PHP 180-billion borrowing plan for July.

The government plans to borrow PHP 75 billion via T-bills, and PHP 150 billion through T-bonds in August.

The government will offer PHP 5 billion worth of 91-day, 182-day, and 364-day T-bills on July 31, Aug. 7, 14, 22, and 29.

For the long-term tenors, the BTr will auction off PHP 30 billion in five-year T-bonds on August 1, and PHP 30 billion in six-year T-bonds on Aug. 8.

It also will offer PHP 30 billion in 10-year debt on Aug. 15, P30 billion in 15-year notes on Aug. 23 and PHP 30 billion in five-year bonds on Aug. 30.

Ms. Araullo said most selling activity was seen in the belly to the long end of the curve as fresh supply of bonds is expected next month.

“Some de-risking of GS investors continued following the widely expected 25-bp hike at Wednesday’s FOMC (Federal Open Market Committee) meeting. Bid and offer levels in the secondary market remained wide by 20-30 bps with lack of local catalysts and the overall defensive tone in the GS space,” she added.

For this week, Ms. Araullo expects yields to edge lower, with traders positioning ahead of the release headline consumer price index data on Aug. 4 and the Bangko Sentral ng Pilipinas’ (BSP) policy meeting on Aug. 17, which will be the first review to be held with new BSP Governor Eli M. Remolona.

“At the moment, the BSP governor’s tone is quite mixed as they believe that the tightening cycle is not yet done. However, a pause in their monetary policy tightening is also considered if headline inflation shows more signs of cooling than expected,” she said. “Upward pressure in local yields is still on the table as well driven by the supply risk, considering that the GS market expects fresh bonds on the five-year and 6-year tenor in the coming weeks.”

Mr. Mapa added that markets will continue to react to reports out this week, such as domestic inflation data to be released on Friday. — Lourdes O. Pilar with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld