Quarterly Economic Growth Release: More BSP cuts to come

DOWNLOAD

DOWNLOAD

Monthly Economic Update: Fed catches up

DOWNLOAD

DOWNLOAD

Inflation Update: Steady and mellow

DOWNLOAD

DOWNLOAD

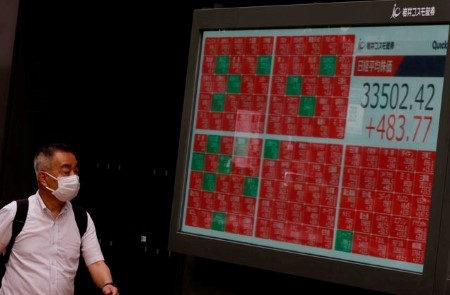

Japan’s Nikkei falls for fifth straight day as yen, Wall Street weigh

TOKYO, July 10 (Reuters) – Japan’s Nikkei share average slumped to a fifth straight losing session on Monday – its longest streak this year – weighed down by a stronger yen and weakness on Wall Street last week.

The Nikkei slid 0.61% to close at 32,189.73, in a volatile session that saw the index rise as much as 0.53% in the morning and then drop 1% in the afternoon.

The index has retreated 4.63% since closing at a 33-year peak of 33,753.33 a week earlier.

Of the Nikkei’s 225 components, 150 fell, while 73 advanced and two were flat.

Energy was the only sector that rose, following crude oil’s USD 2 surge to a nine-week high on Friday, while the basic materials sector recovered early declines to end flat. Healthcare stocks paced decliners, falling 1.34%.

The broader Topix skidded 0.51% to 2,243.33.

The Nikkei rallied 27% since mid-March to hit last week’s high. It dropped below the closely watched 25-day moving average on Thursday for the first time in three months.

“Whether or not the Nikkei can recover above the 25-day moving average in a short time is a focal point for the market,” said Nomura Securities strategist Maki Sawada.

US stock futures were a key trading cue for Japanese traders on the day, she added.

S&P 500 E-mini futures pointed to a 0.48% lower restart, after the index declined 0.29% on Friday.

The Nikkei’s worst-performing stock was Yaskawa Electric, which dived 3.44% after reporting disappointing financial results as the Japanese earnings season gets underway.

Automakers also underperformed after Japan’s currency strengthened about 2 yen against the dollar on Friday, lowering the value of overseas revenue.

Nissan lost 2.55%, while Honda declined 1.72%.

Chip-related shares also fell, with Tokyo Electron off 1.5% and Advantest tumbling 2.5%.

(Reporting by Kevin Buckland; Editing by Savio D’Souza and Sohini Goswami)

This article originally appeared on reuters.com

By Reuters

By Reuters