Unwrapping the persistent price pressures in the US

Stubbornly high shelter costs have kept the US core inflation sticky. Is the softening of rental prices in sight and would this sway the hawkish US Fed?

For those who have invested in funds that put money in US assets, should they worry about sticky inflation?

It can’t be helped. However, understanding the forces behind the prices of goods and services in the US may help ease their worries, or inform their investment decisions.

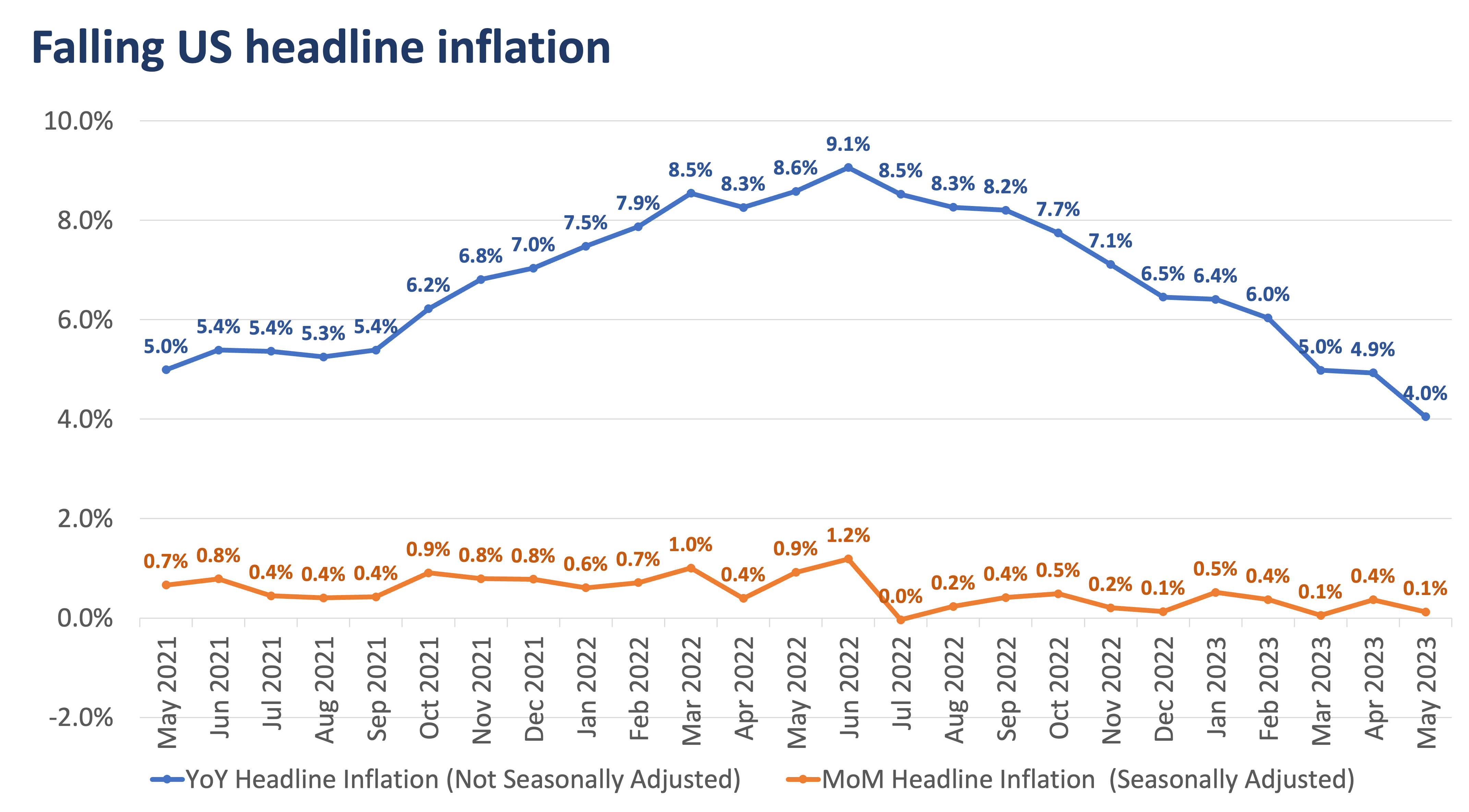

US headline Consumer Price Index (CPI) year-on-year (YoY) inflation considerably eased to 4.0% in May 2023 from 4.9% in April, marking the slowest easing since March 2021. The May inflation print came out lower than anticipated, as base effects from a significant 8.6% CPI inflation print in the same month last year helped bring down this year’s YoY data.

On a monthly basis, headline CPI only increased by 0.1% month-on-month (MoM) in May from 0.4% in April, mainly driven by decreases in energy prices including gasoline and electricity.

Headline inflation has been consistently going down since July 2022.

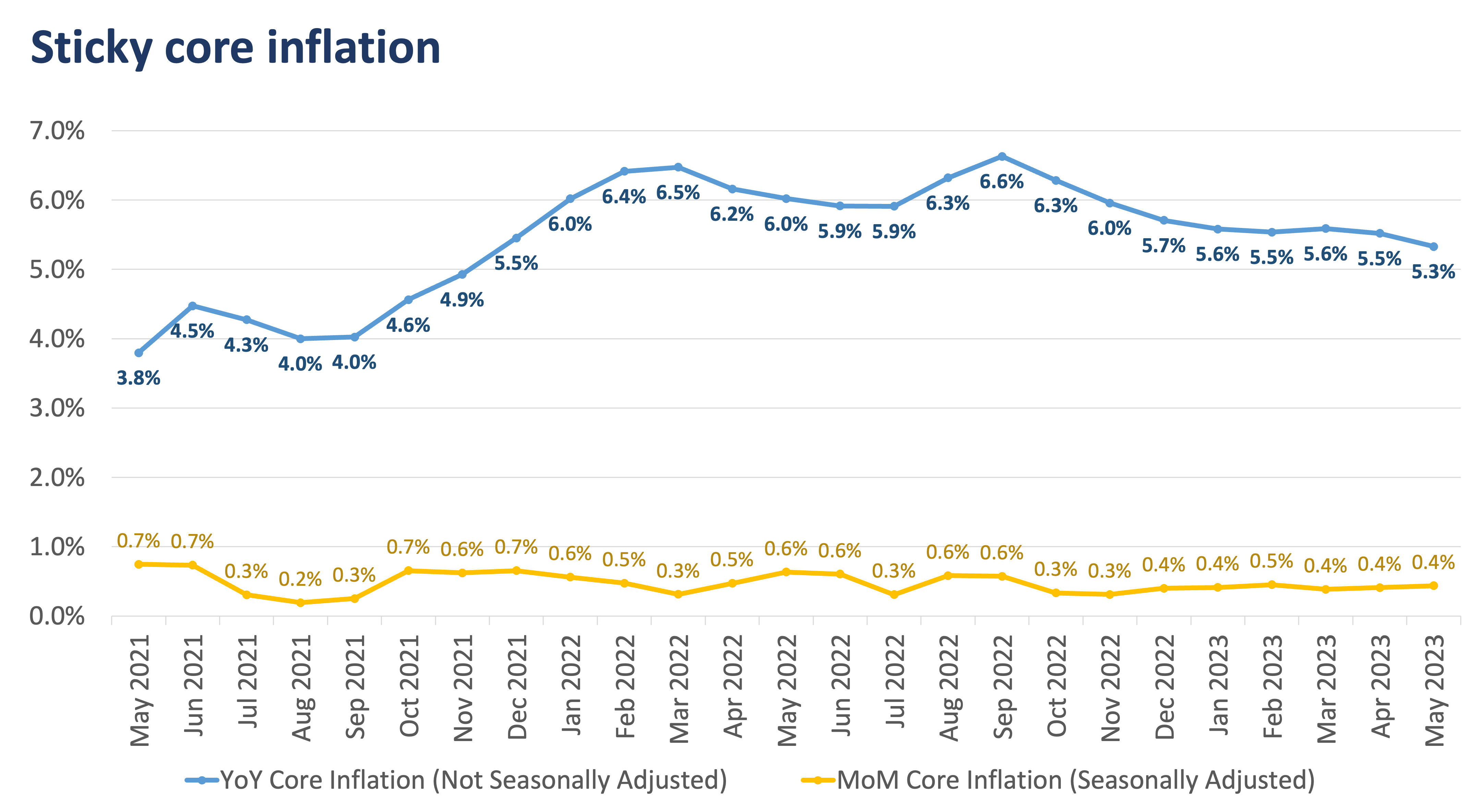

Although US headline inflation seems to be going back down to earth, some signs point to a still-elevated and still-sticky inflation. Core inflation, for instance, only meagerly eased to 5.3% in May from 5.5% in the previous month and did not subside with a 0.4% MoM increase, same as the past two months, indicating persistent price pressures keeping core inflation sticky. This led the US Fed to caution that two more hikes may still be underway.

Core inflation doesn’t seem to match the rate of decrease in headline inflation.

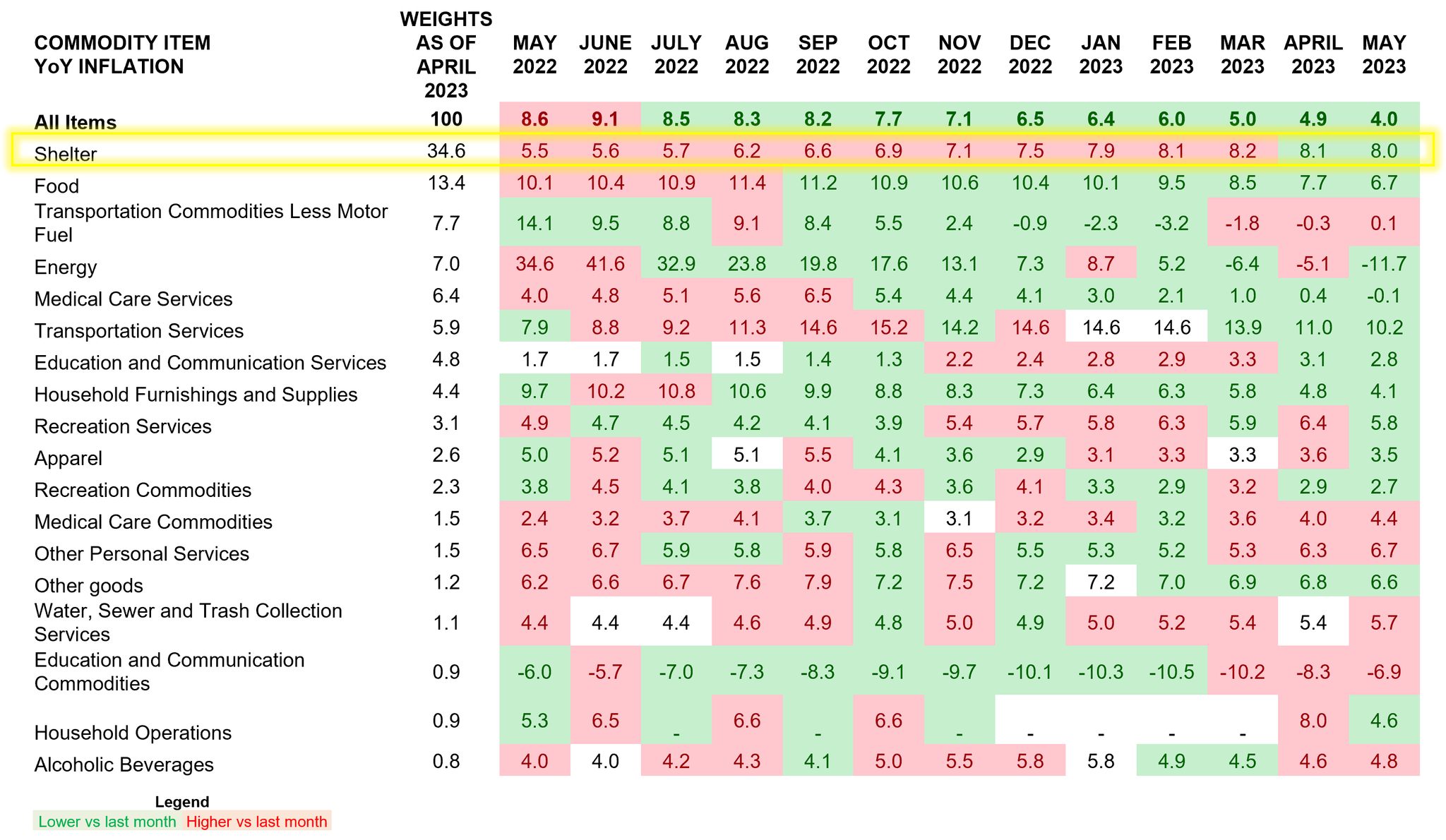

What could be keeping core inflation high? It’s the sticky rents.

Shelter, which includes rent, takes a significantly large chunk in the US CPI basket (averaging ~34% for headline inflation and ~43% for core inflation) in the past year keeping the core inflation stubbornly high. Shelter costs have been increasing since February 2021 (from 1.5%), reaching its highest in March 2023 (8.2%), and only moderately eased to 8.0% this May.

Shelter has a significant contribution to both headline and core inflation.

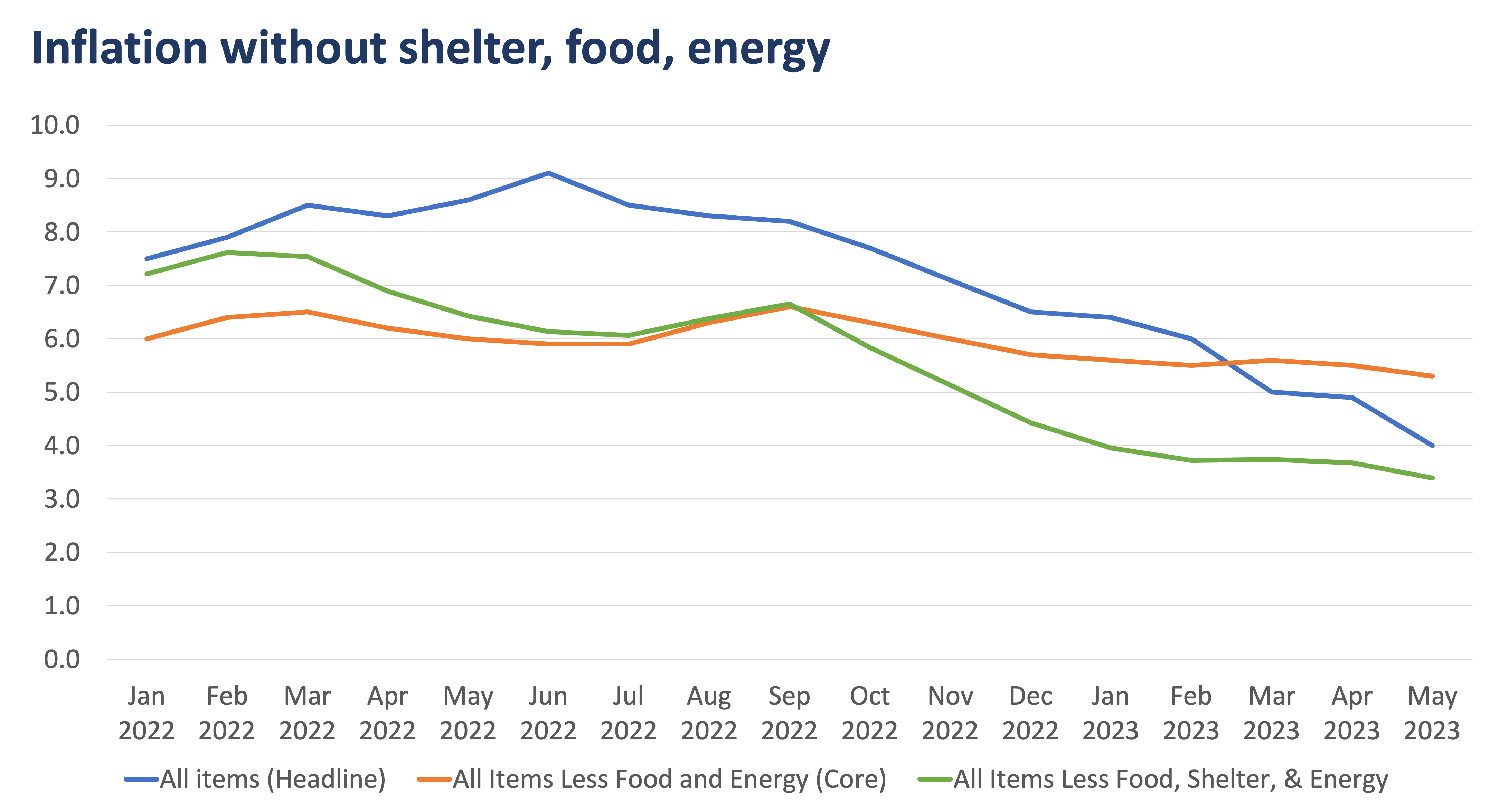

No wonder core inflation remains high, given little downward movement in shelter costs. In fact, excluding food, energy, and shelter altogether gives an inflation print of only 3.4% in May. Rental costs surged post-lockdowns in the US mainly driven by the boost in demand in rental homes due to remote work set-up and the increased preference for solo living.

If we exclude shelter, food, and energy, inflation doesn’t look as bad.

Will rents ever go down?

Metrobank’s research partner, CreditSights, uses the MoM changes in the S&P Case-Shiller Home Price Index (HPI) from 18 months ago (lagged 18 months) to determine the MoM changes in shelter CPI. The shelter CPI closely follows the trends of the S&P Case-Shiller HPI, which measures the changes in the value of the US residential housing market by looking at single-family home purchase prices.

Note that lags for home prices are used since the CPI for shelter, which includes rent, tends to follow changes in home prices with a delay of four to six quarters. This is because it takes time for lease agreements to be renewed. Landlords usually renew leases every 12 months or longer. As a result, changes in home prices don’t immediately affect new lease contracts and rental/shelter costs for at least a year.

CreditSights, through their analysis, suggests that based on the changes in the S&P Case-Shiller HPI from 18 months ago, shelter costs could continue to rise for another month or two before shifting into a more continuous and steadier downward trajectory during the second half of the year.

Meanwhile, Metrobank’s forecast of the US headline CPI inflation supports the implication of CreditSights’ analysis, with yearend print seen dropping to 2.2% albeit still slightly above the Fed’s target. This yields a full-year average of 3.2% this year.

Deceleration down the road

Should the anticipated decline in shelter costs manifest in the succeeding months, this could mean a considerable decline in both headline and core inflation later this year.

The Fed, having acknowledged the connection between housing prices and the cost of shelter, will most likely consider this in their succeeding policy decisions. Hence, despite having recently signaled two more hikes, it may still change its mind.

INA JUDITH CALABIO is a Research & Business Analytics Officer at Metrobank in charge of the bank’s research on industries. She loves OPM and you’ll occasionally find her at the front row at the gigs of her favorite bands.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, overseeing research on the macroeconomy and the banking sector. She earned her BS in Business Economics degree from the University of the Philippines Diliman and is currently pursuing her MA in Economics at the Ateneo de Manila University. In her free time, Bea enjoys playing tennis and spinning. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Ina Judith Calabio and Anna Isabelle “Bea” Lejano

By Ina Judith Calabio and Anna Isabelle “Bea” Lejano