To ensure that there is available cash ready to be distributed to customers, central banks, like the BSP require all banks to set aside a specific amount in their cash reserves. This is a solution against panic.

FEATURED INSIGHTS

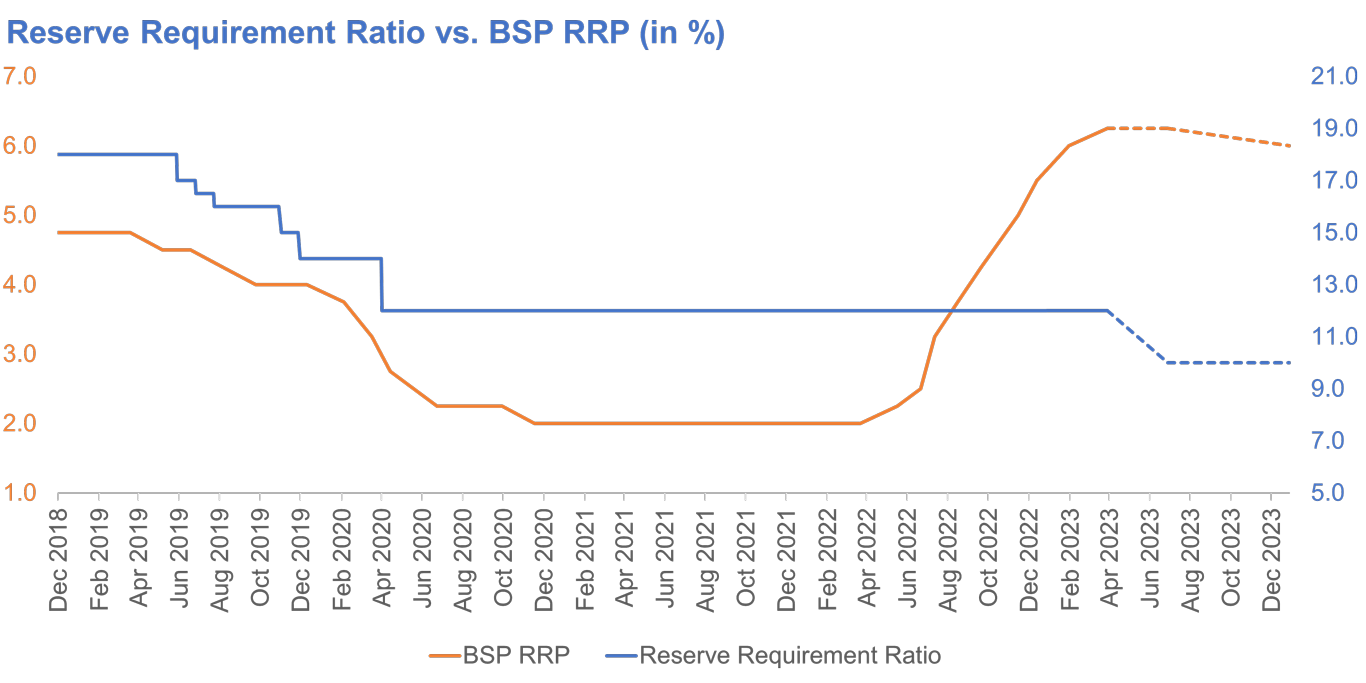

FEATURED INSIGHTSBangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla hinted at a 200-basis point (bp) cut in the reserve requirement ratio (RRR) of banks as early as June during the Monetary Board meeting last May 18. Governor Medalla said the reserve requirement of big banks, currently at 12%, should be cut before the expiration of the relief the BSP provided to micro, small and medium enterprises (MSMEs).

To recall, the BSP allowed big banks to use MSME loans to fulfill reserve requirements as an emergency measure at the height of the COVID-19 pandemic.

Changes in reserve requirements have had a significant effect on money supply in the banking system, making them a powerful means of liquidity management by the BSP.

What are Reserve Requirements?

The reserve requirement refers to the minimum amount of bank deposits and deposit substitute liabilities (examples are demand, savings, time deposit and deposit substitutes) that banks must set aside as liquid cash that they cannot lend out. This is a requirement by central banks.

Reserve requirements are imposed on the peso liabilities of universal and commercial banks, thrift banks, rural banks and cooperative banks, and non-bank financial institutions with quasi-banking functions.

The reserve requirement ratio (RRR) for big banks is currently at 12%, which is said to be one of the highest in the region. Meanwhile, reserve requirements for thrift and rural lenders are at 3% and 2%, respectively.

The most basic formula for calculating the reserve requirement consists of multiplying the RRR by the total amount of deposits. For example, if Metrobank received PHP 100,000 in deposits and the reserve requirement ratio is set at 12%, the bank must maintain a minimum of PHP 12,000.

What is the purpose of the RRR?

Banks earn money by taking in deposits, and lending and investing that money in exchange for interest payments. But suppose a large number of customers withdraw their deposits at the same time—a bank run similar to the recent collapse of Silicon Valley Bank (SVB) in the US–over certain fears like the bank suddenly becoming insolvent, or if they are running out of cash. In that case, the bank’s reserves may be used to cover those withdrawals.

The reserve requirement is also another tool that the BSP may use to manage liquidity in the financial system. If the BSP sees inflation to be lower or higher than their target, they can control liquidity by increasing or decreasing the reserve requirement aside from increasing or decreasing its key policy rate.

Reducing the reserve requirement means the BSP is executing an expansionary monetary policy, and conversely, when it raises the requirement, it’s exercising a contractionary monetary policy.

What is the effect of an RRR cut/hike?

Lowering the reserve requirement pumps money into the economy by giving banks excess reserves, which promotes the expansion of bank credit and lowers interest rates. When the BSP raises reserve requirements, banks have less to lend to consumers and businesses. This cuts liquidity and cools down the economy in return.

A prime example of the reserve requirement being used to help stimulate the economy was seen following the economic contraction caused by the pandemic. In March 2020, the central bank cut the RRR by 200 bps to 12% to cushion the impact of the coronavirus pandemic.

It must be noted, however, that Governor Medalla’s recent guidance on a RRR cut in end-June to early July is intended to be an operational adjustment rather than a monetary policy. MSME loans will no longer count as part of bank reserves so the central bank will let the emergency measure during the pandemic lapse (equal to PHP 200-300 billion in liquidity) and neutralize the impact with a 200 bps RRR cut.

While we expect that inflation is expected to sustain its downward trajectory and an easing cycle on the horizon, we believe this move is a balancing act for the lost liquidity from the system when MSME loans as reserve compliance expire.

A 200-basis point RRR cut from 12% to 10% is expected as early as next month when MSME loans as reserve compliance expire.

GERALDINE WAMBANGCO is a Financial Markets Analyst at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She provides research and investment insights to high-net-worth clients. She is also a recent graduate of the bank’s Financial Markets Sector Training Program (FMSTP). She holds a Master’s in Industrial Economics (cum laude) from the University of Asia and the Pacific (UA&P). She takes a liking to history, astronomy, and Korean pop music.

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco