Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

Yields on PH gov’t debt climb

YIELDS on government securities inched up last week as the market continued to digest the central bank’s decision to keep its monetary policy settings steady.

YIELDS on government securities inched up last week as the market continued to digest the central bank’s decision to keep its monetary policy settings steady.

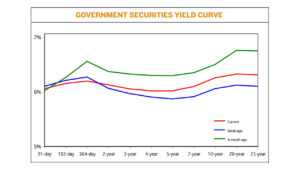

GS yield, which move opposite to bond prices, increased by an average of 7.05 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference rates as of May 26 published on the Philippine Dealing System’s website.

The short end of the curve dipped, with the 91-, 182-, and 364-day Treasury bills (T-bills) declining by 3.30 bps (to 5.79%), 4.30 bps (5.8632%), and 5.53 bps (5.8961%), respectively.

Meanwhile, rates at the belly rose. Yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) went up by 4.72 bps (5.8433%), 6.39 bps (5.787%), 8.50 bps (5.7606%), 11.08 bps (5.7603%), and 13.99 bps (5.8208%), respectively.

At the long end of the curve, the 10-, 20-, and 25-year T-bonds increased by 14.94 bps (5.9397%), 15.17 bps (5.9923%), and 15.85 bps (5.9814 bps), respectively.

Total GS volume reached PHP 4.66 billion, lower than the PHP 10.56 billion seen on May 19.

Yields moved up following the Bangko Sentral ng Pilipinas’ (BSP) decision to keep benchmark rates steady, which was seen as a “hawkish hold” by the market, Security Bank Chief Economist Robert Dan J. Roces said in an e-mail.

There was also a lack of solid catalysts, Mr. Roces added.

“Surprisingly weak demand for the seven-year auction pushed yields higher by 5-10 bps post-auction award, with primary market bid to cover only reaching 1.2 times,” ATRAM Trust Corp. Chief Investment Officer Alessandra P. Araullo said in a Viber message.

“The BSP exacerbated the already defensive environment by delivering hawkish comments in pursuit of their inflation-targeting mandate,” Ms. Araullo added

The Philippine central bank on May 18 held benchmark interest rates steady and signaled the policy rate will remain unchanged at its next two to three meetings as inflation continues to ease.

The Monetary Board kept its benchmark interest rate unchanged at 6.25% this month. Interest rates on the overnight deposit and lending facilities were also maintained at 5.75% and 6.75%, respectively.

This was the first time the BSP left rates untouched after nine meetings. Since it began its aggressive monetary tightening cycle in May 2022, the BSP had raised borrowing costs by a total of 425 bps.

Even as BSP Governor Felipe M. Medalla signaled that they may hold rates steady for their next two to three meetings, the central bank’s statement called the May 18 decision a “prudent pause” amid ongoing price pressures and said they remain “ready to respond” to emerging inflation threats.

Meanwhile, the Bureau of the Treasury last week made a full award of the reissued seven-year T-bonds it auctioned off at a lower average rate on expectations of easing inflation, which could strengthen the case for steady benchmark borrowing costs in the near term.

The government raised PHP 25 billion as planned from the reissued seven-year bonds it offered on Tuesday, with total bids reaching PHP 30.625 billion.

The bonds, which have a remaining life of six years and 11 months, were awarded at an average rate of 5.774%, with accepted yields ranging from 5.648% to 5.85%.

Ms. Araullo added that local yields reacted to rising global rates amid the debt ceiling impasse in the United States.

US President Joseph R. Biden, Jr. and Republicans in the House of Representatives are in their final stages of negotiations seeking to raise the USD 31.4-trillion debt ceiling and avert a default, which the US Treasury department warned that could happen as early as June 1, Reuters reported.

Mr. Roces said hawkish signals from US Federal Reserve officials also affected sentiment.

At its May 3 meeting, the Fed signaled it was open to pausing its most aggressive rate hiking cycle since the early 1980s at its meeting that ends June 13, leading investors to pile back into equities and other riskier assets, Reuters reported.

Since May 3, Dallas Federal Reserve Bank President Lorie Logan and St. Louis Fed President James Bullard have said that inflation does not appear to be cooling fast enough.

Unexpectedly strong economic data on Friday appeared to bolster their case, with underlying core inflation at 4.7%, up from 4.6% in March and well above the Fed’s 2% inflation goal.

Markets are now pricing in a roughly 50-50 chance that the Fed raises rates by another 25 bps at its June meeting, up from an 8.3% chance seen of an expected rate hike one month ago, according to CME’s FedWatch Tool.

For this week, yields could face upward pressure “as the markets demand more premium to new issues given the still-defensive market tone,” Ms. Araullo said.

“The market might look over to specific market factors such as the potential resolution of the US debt ceiling as well as the upcoming local inflation print as cues for market direction,” she added. — By TCSM with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld