Quarterly Economic Growth Release: More BSP cuts to come

DOWNLOAD

DOWNLOAD

Monthly Economic Update: Fed catches up

DOWNLOAD

DOWNLOAD

Inflation Update: Steady and mellow

DOWNLOAD

DOWNLOAD

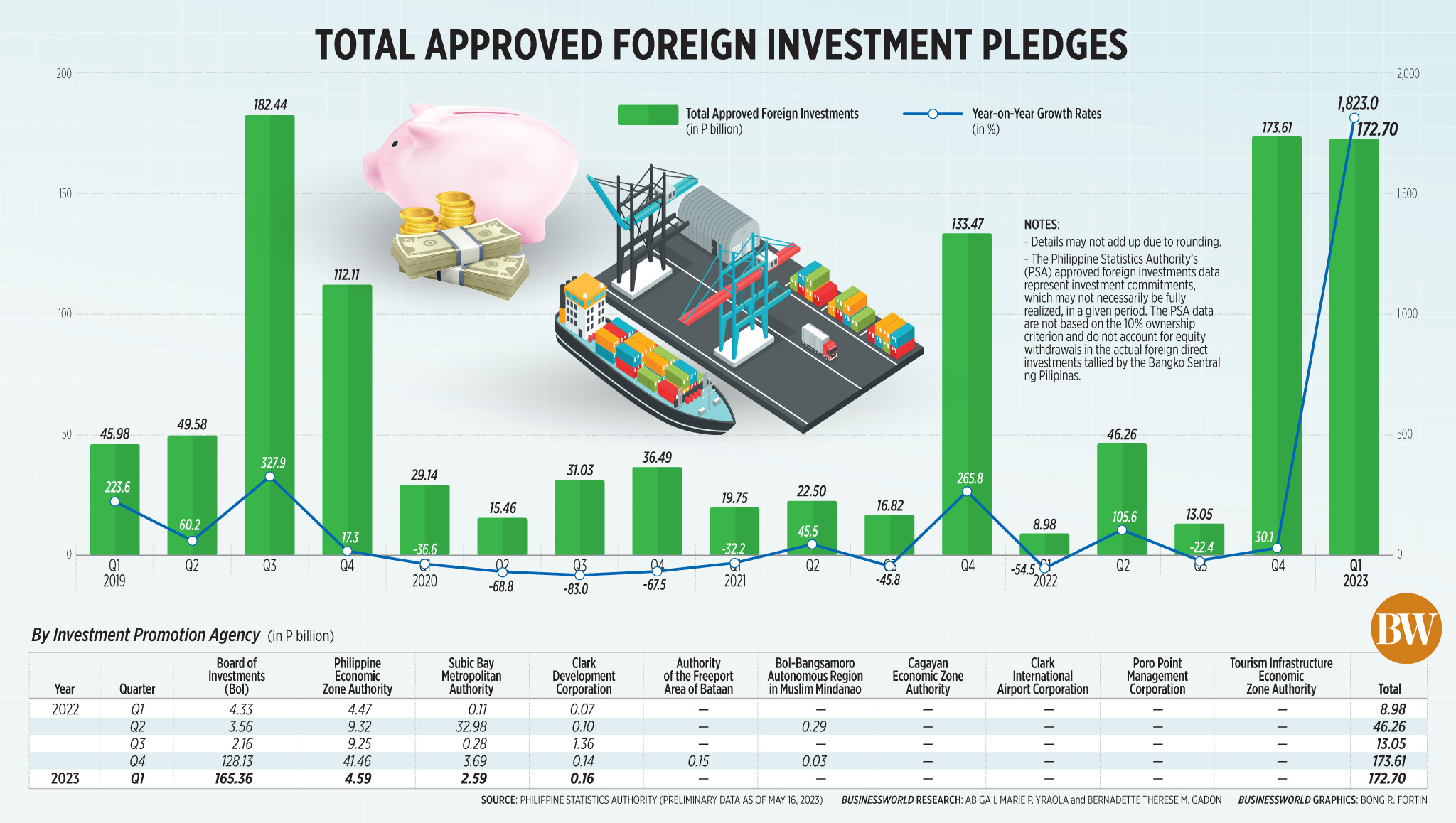

Q1 investment pledges hit PHP 172.7B

FOREIGN INVESTMENT pledges surged in the first quarter, amid the Marcos administration’s efforts to boost the country’s profile as an attractive investment destination, analysts said.

The value of foreign commitments approved by the country’s investment promotion agencies soared to PHP 172.7 billion in January to March, preliminary data from the Philippine Statistics Authority (PSA) showed.

This was nearly 20 times higher than PHP 8.98 billion in the first quarter of 2022, but slightly lower than the PHP 173.61 billion in the previous quarter.

Germany was the biggest source of approved investment pledges at PHP 156.96 billion (90.9% share), followed by Japan and the Netherlands with commitments worth PHP 3.82 billion (2.2%) and PHP 2.65 billion (1.5%), respectively.

“The Philippines is viewed as one of the most attractive investment destinations in the region, with growth projections expected to outperform if not be the one on top, due to a number of factors, including the country’s strong economic fundamentals and its competitive labor costs,” Robert Dan J. Roces, chief economist at Security Bank Corp., said.

Recent economic reforms, coupled with the economic managers’ international roadshows, have also helped attract new investments, he added.

Structural reforms pushed by the previous and current administrations are now yielding tangible results, said Domini S. Velasquez, chief economist at China Banking Corp.

These include the passage of the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, as well as amendments to the Retail Trade Liberalization Act, Public Service Act and Foreign Investment Act.

In a Viber message, Ms. Velasquez said these reforms would continue to drive investments into the country.

“When the amendment to the Public Service Act finally gains traction, we expect investments to improve even further,” she said.

Four agencies, namely the Board of Investments (BoI), Clark Development Corp. (CDC), Philippine Economic Zone Authority (PEZA) and Subic Bay Metropolitan Authority (SBMA), approved the investment pledges in the first quarter.

The BoI accounted for 95.7% of total foreign investment pledges with PHP 165.36 billion.

The PEZA approved PHP 4.59 billion worth of commitments, accounting for 2.7% of the total. SBMA and CDC approved PHP 2.59 billion and PHP 161 million worth of pledges.

About 90.9% or PHP 156.96 billion of the approved foreign investments will go to the energy industry, while PHP 10.49 billion will go to the manufacturing sector. The administrative and support service sector will get PHP 3.59 billion worth of pledges.

More than half (68%) of the foreign investment commitments or PHP 117.38 billion will be for projects in Western Visayas.

Calabarzon (Cavite, Laguna, Batangas, Rizal, Quezon) will get PHP 47.47 billion worth of investment commitments, while Central Luzon cornered PHP 3.28 billion.

Should these foreign commitments materialize, these projects are expected to generate 19,412 jobs, double the 9,655 projected jobs a year earlier.

Meanwhile, total investment commitments from foreign and Filipino nationals soared by 141.8% to PHP 480.36 billion in January to March.

Investment pledges by Filipinos stood at PHP 307.66 billion in the first quarter, accounting for 64% of the total.

The Authority of the Freeport Area of Bataan, BoI-Bangsamoro Autonomous Region in Muslim Mindanao, Cagayan Economic Zone Authority, Poro Point Management Corp., Tourism Infrastructure and Enterprise Zone Authority, and Clark International Airport Corp. did not approve any investment pledges during the period.

“Timely monetary policy, prudent fiscal policy and sound macroeconomic management will provide the necessary assurance to investors that their investments will thrive in the Philippines,” Ms. Velasquez said.

Mr. Roces also kept a positive outlook for foreign investment pledges for the second quarter, citing expectations of strong economic growth.

“However, there are some risks to the outlook, such as the global economic slowdown, geopolitical tension and El Niño feeding into inflation, which could sour sentiment,” he said.

The Philippine economy expanded by 6.4% in the first quarter, the slowest growth rate since the 3.8% contraction in the first quarter of 2021. The government is targeting 6-7% growth this year.

PSA data on foreign investment commitments, which may materialize in the near future, differ from actual foreign direct investments (FDI) tracked by the Bangko Sentral ng Pilipinas (BSP) for the balance of payments. The central bank’s monitoring goes beyond the projects and includes other items such as reinvested earnings and lending to Philippine units via their debt instruments. — By Abigail Marie P. Yraola, Researcher. Photo by Edd Gamban, Philippine Star

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld