March 2023 global currencies recap: Complete reversal

The US dollar has weakened against other currencies in March. Will it recover soon?

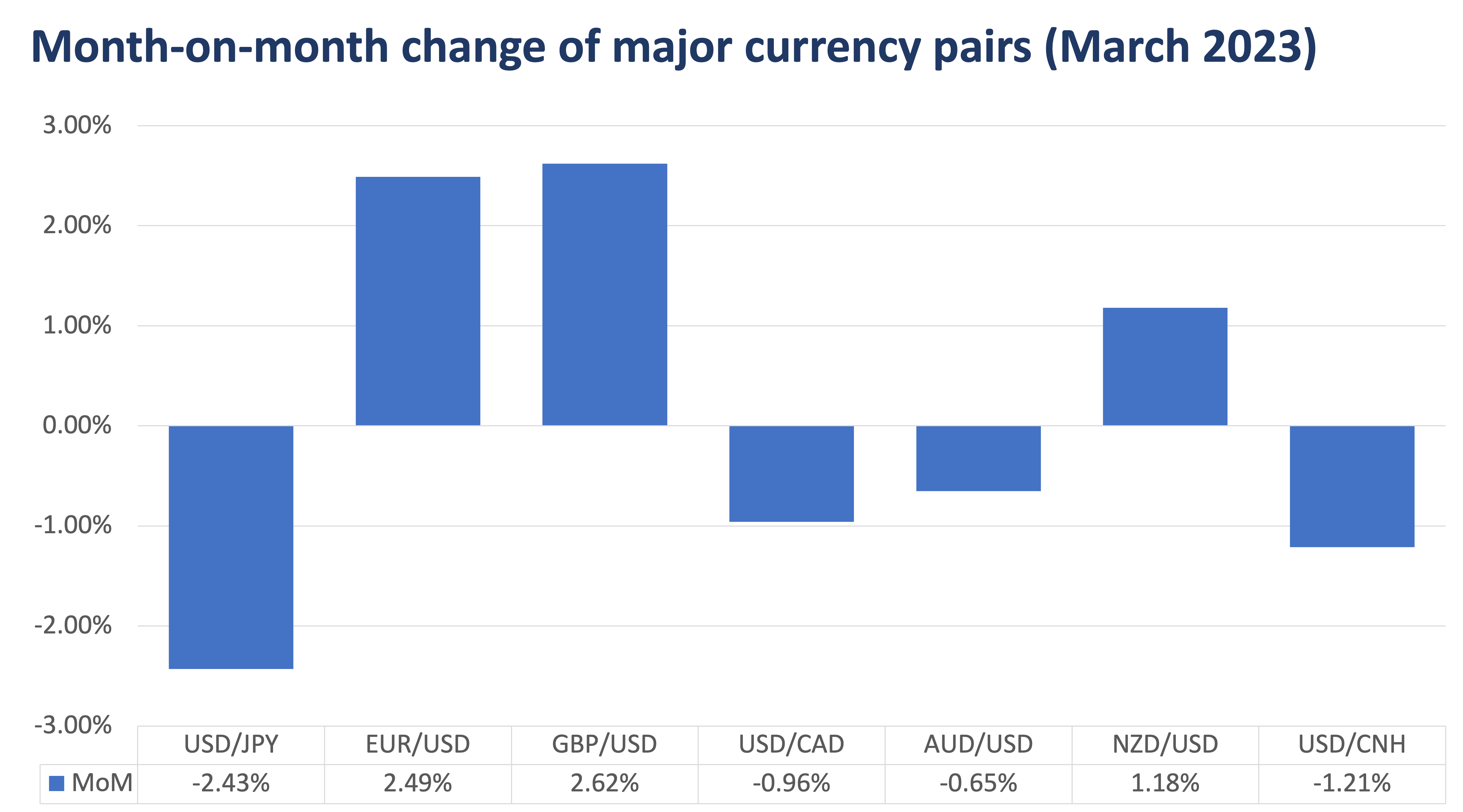

March 2023 initially had the US Dollar on a strong start as Federal Reserve Chair Jerome Powell testified before US Congress that inflation figures were still too strong and that policy interest rates had to move higher for longer.

However, this was followed by the closure of Silicon Valley Bank (SVB) and Signature Bank while First Republic teetered on the edge. The banking crisis that started in the US made its way to Switzerland as investors were once again skeptical of Credit Suisse, which had already been struggling over the last two years.

Markets abandoned the US dollar for other safe haven assets such as US treasury bonds, gold, and the Japanese Yen. Even when the US Federal Reserve and Swiss National Bank stepped in to restore confidence in the banking system, a slew of weaker-than-expected US economic data in Producers Price Index (-0.1% vs. 0.3% est.), Retail Sales (-0.4% vs. -0.3% est.), and 4Q 2022 Gross Domestic Product (GDP) (2.6% vs. 2.7% est.) continued to push the dollar to its lowest level year-to-date.

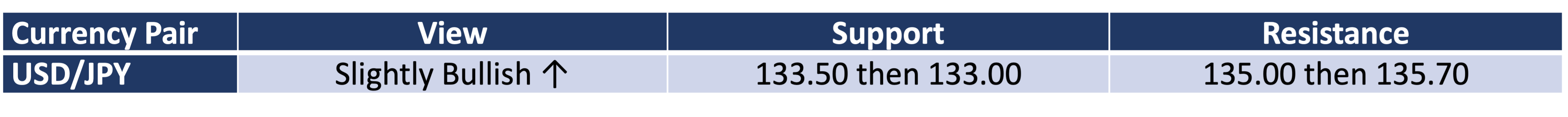

The Japanese yen (JPY) appreciated all the way to 132.86. However, demand for JPY as a safe haven currency has dwindled as markets have started to move past the banking crisis, especially after the top US banks released better-than-expected earnings for the 1st quarter of 2023.

Markets had also expected the new Bank of Japan (BOJ) Governor Kazuo Ueda to initiate discussions on reducing Japan’s ultra-loose monetary policy, but he has instead lowered these expectations in the near term, preferring not to make any sudden changes to policy.

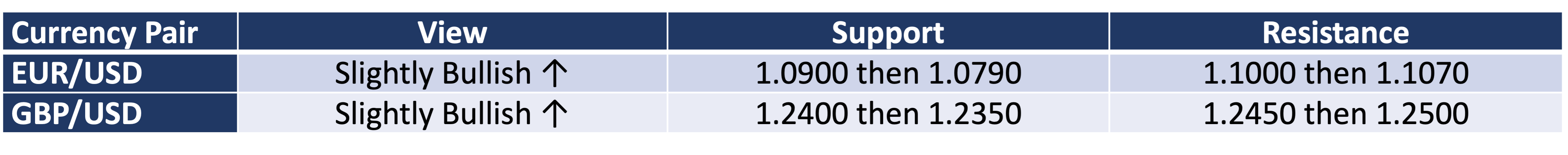

Both the euro (EUR) and British pound (GBP) rallied following SVB’s collapse and were relatively insulated from the Credit Suisse issue after Swiss regulators stepped in and arranged the bank’s sale to its rival UBS.

The European Central Bank (ECB) met market expectations by hiking its three policy rates by 50 basis points (bps). ECB President Christine Lagarde continued to point towards stubbornly high inflation as the main focus, with Germany’s Consumer Price Index (CPI) for February remaining the same as January at 8.7% year-on-year.

The pound sterling was the clear winner last month as the United Kingdom’s (UK) February CPI rebounded to 10.4% vs. 9.9% estimate and 4th quarter 2022 GDP grew by 0.6% vs. 0.4% estimate. The Bank of England (BOE) hiked its policy interest rates by only 25 bps to 4.25%, but with UK inflation still in double-digit territory relative to its peers, the central bank still has some ways to go to bring down inflation.

EUR/USD and GBP/USD closed the month at 1.0839 and 1.2337, respectively.

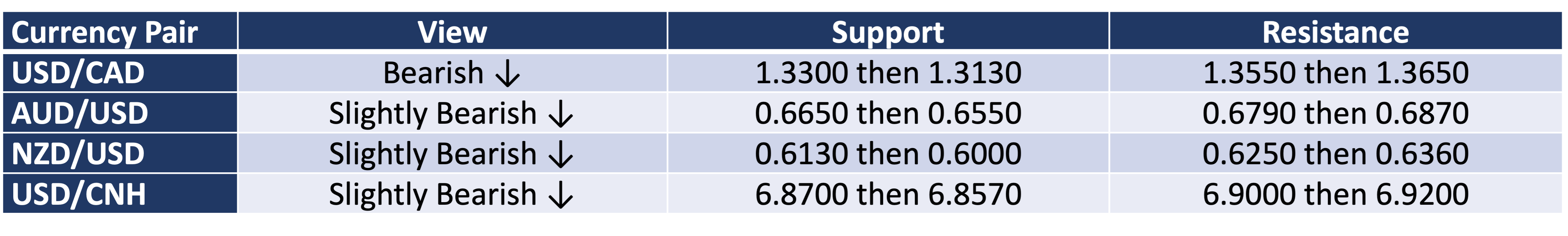

The Canadian dollar had a rough start as it tracked weaker oil prices and was weighed down by a dovish Bank of Canada (BOC). The BOC decided to pause its hiking cycle for the first time in nine months.

Its policy interest rate stands at 4.5% as its governing council believes that current borrowing costs are restrictive enough to bring inflation down to the 2% level. Canada’s February CPI printed lower at 5.2% vs. 5.4% estimate.

USD/CAD went lower after a bounce in oil prices and the currency pair closed the month at 1.3516. With OPEC+ cutting its supply of oil, this should help the Canadian dollar continue to outperform.

The Australian dollar and New Zealand dollar took opposite paths in March, following the divergent tones of their respective central banks. The Reserve Bank of Australia (RBA) kept its policy rate steady at 3.6% in order to monitor the effect of higher rates on the economy.

AUD/USD closed slightly lower at 0.6685, aided by stronger Employment Change (64.6k vs. 48.5k estimate) and Retail Sales (0.2% vs. 0.1%). On the other hand, the Reserve Bank of New Zealand (RBNZ) hiked its policy rate by 50 bps to 5.25% when markets were expecting only 25 bps. NZD/USD made its way higher to 0.6258. However, the view for both of these currencies is slightly bearish as global investors slowly return to the US dollar.

The Offshore Chinese yuan became a pseudo-safe haven currency as solid economic data helped it stand out in a month when markets could not turn to the US and Switzerland.

China outperformed in its manufacturing and non-manufacturing Purchasing Managers’ Index (PMI) figures, bringing the currency pair down to 6.8703 from highs of 7.0000. This also helped indirectly lift other emerging market currencies in Asia.

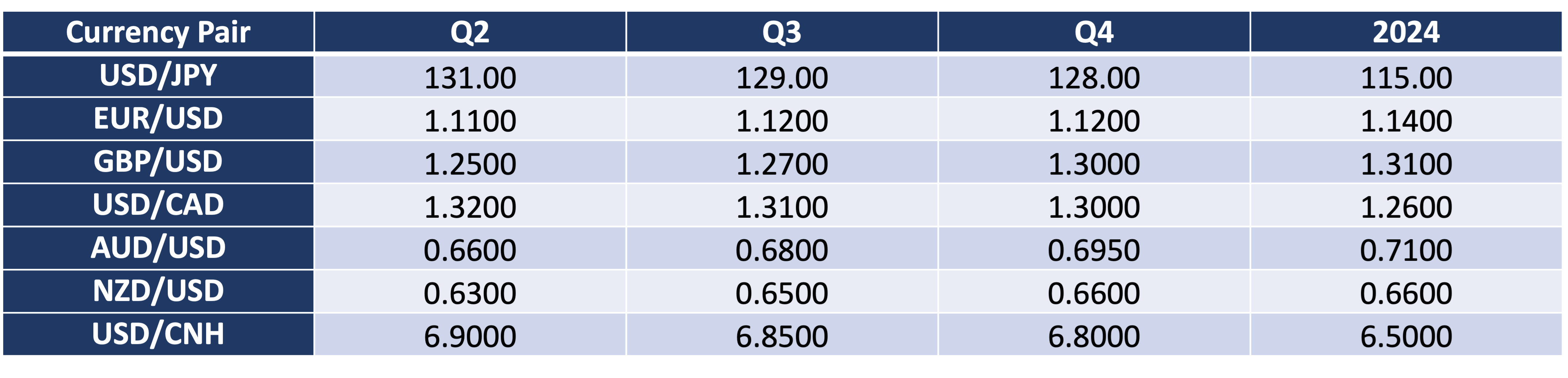

FX Traders’ Forecasts

The above forecasts are the foreign exchange traders’ personal opinions and may not reflect the official views of the bank.

The month of March saw a complete reversal in the US dollar after weaknesses were found in the country’s financial system. But after the initial panic, prudent investors were quick to realize that these weaknesses were also brought about by the regional banks themselves.

SVB was an isolated case as the bank’s client base was too concentrated on technology startups. The bank was also a victim of high interest rates after it had to sell some of its bond holdings at a loss in order to fund withdrawals.

Eventually, the US government stepped in to protect depositors, introduce new liquidity tools, and restore confidence in the banking system. Withdrawals from regional banks went to the large banks, which produced better-than-expected earnings for the 1st quarter of 2023. The US dollar may have lost in March but it is starting to climb its way back up.

EARL ANDREW “EA” AGUIRRE is a Market Strategist at Metrobank’s Financial Markets Sector and has 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By EA Aguirre

By EA Aguirre