Additional Tier 1 Bonds: 3 things to know

Bonds are usually safer financial instruments compared to common equity. Then again, not all bonds are created equal.

Swiss regulators recently wiped out USD 17 billion of Credit Suisse’s Additional Tier 1 bonds as part of an agreement for UBS to rescue its struggling rival. The news about these two big Swiss banks sent shockwaves through the financial markets, with investors now wondering just what makes these bank-issued bonds so different from the rest.

1. The most junior form of liability… or is it equity?

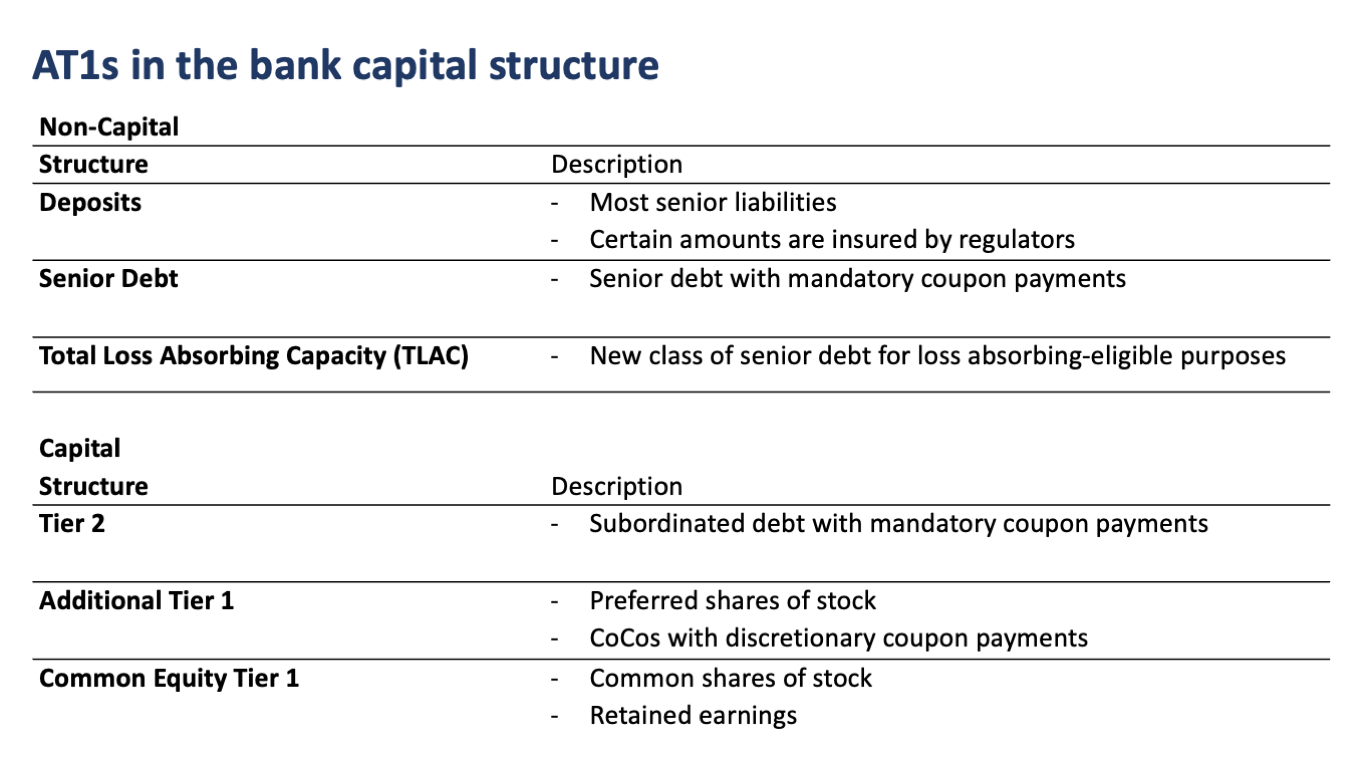

True to its name, Additional Tier 1 (AT1) bonds add to a bank’s Common Equity Tier 1 (CET1), which measures a bank’s financial strength and includes its common shares of stock and retained earnings.

This makes AT1 bonds the most junior form of debt, and, in times of crisis, they are the first to incur losses after a bank’s shareholders.

Source: CreditSights

Source: CreditSights

AT1 bonds also fall under a broader term called Contingent Convertibles or CoCos – hybrid securities with features common to both bonds and stocks. In the case of AT1 bonds, a bank with severely low capital ratios may trigger a conversion of the bonds into equity shares of stock.

2. Regulators can enforce a complete write-off.

Worse yet, if a bank is no longer able to operate due to insufficient liquidity or capital or both, then the handling regulatory body can choose to completely write-off the bank’s outstanding AT1 bond issuances.

In the case of Credit Suisse, its AT1 bondholders were furious that a write-off was triggered, considering that the bank was still operational, and its shareholders would continue to benefit from the UBS takeover.

However, the bond prospectus contained language that allowed for the bonds to be written off if “extraordinary government support is granted.” The European Central Bank and Bank of England were quick to announce that bondholders of banks under their jurisdiction will continue to enjoy seniority over shareholders. Nevertheless, it does not change the fact that all AT1 bonds can be reduced to nothing if the situation calls for it.

3. Higher yielding… if the bank pays.

Given their low seniority in the capital structure and the possibility of conversion into equity or write-off, AT1 bonds tend to be issued at higher coupon rates to compensate investors for the added risks. However, a bank may choose not to pay coupons on these bonds if it is unable to do so.

AT1 bonds are also perpetual bonds, which means that they do not have a specific maturity date. Instead, they have call dates when a bank may choose to buy back the bonds from investors. Normally, this is done in a low-interest environment so that a bank can refinance its debt at a cheaper rate.

When traded on the secondary market, AT1 bonds sometimes offer above-average yields, since prices can be so volatile. This yield is also known as the yield-to-call (YTC). While the returns may look attractive relative to other more senior bonds, the YTC is realized only if a bank is able to pay its coupons and buy the AT1 bond back from the investor on the next call date.

In summary, Additional Tier 1 bonds are hybrid securities issued by banks to raise additional capital. During periods of financial distress, AT1 bonds may be converted into equity shares of stock or completely written off by regulators.

Because of these added risks, investors are compensated with relatively higher coupon rates. However, banks may choose not to pay coupons or the principal amounts as they are due.

Given all these conditions, are AT1 bonds for you? It will depend greatly on your own financial sophistication and risk appetite. A well-performing bank and the right economic conditions can help turn AT1 bonds into great investment opportunities.

But with global interest rates approaching their peak, we see just as much value in other safer investments issued by governments, such as sovereign bonds and peso government securities, which promise punctual coupon and principal payments.

EARL ANDREW “EA” AGUIRRE is a Market Strategist at Metrobank’s Financial Markets Sector and has 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By EA Aguirre

By EA Aguirre