SVB debacle: Is this a Lehman moment for the Philippines?

(First of two parts) With the recent Silicon Valley Bank (SVB) collapse that triggered memories of Lehman Brothers’ downfall and the 2008 Great Recession, it would be worth exploring if there might be the parallels today, especially from the point of view of the man on the street.

With the recent collapse of Silicon Valley Bank (SVB), talk immediately centered on a possible “Lehman Brothers moment”. What would this mean for the Philippines?

But rather than talk in arcane macroeconomic terms about events in 2008, we simply revisit these crises from the point of view of “the man on the street”, using public data available to casual researchers who just want quick takeaways.

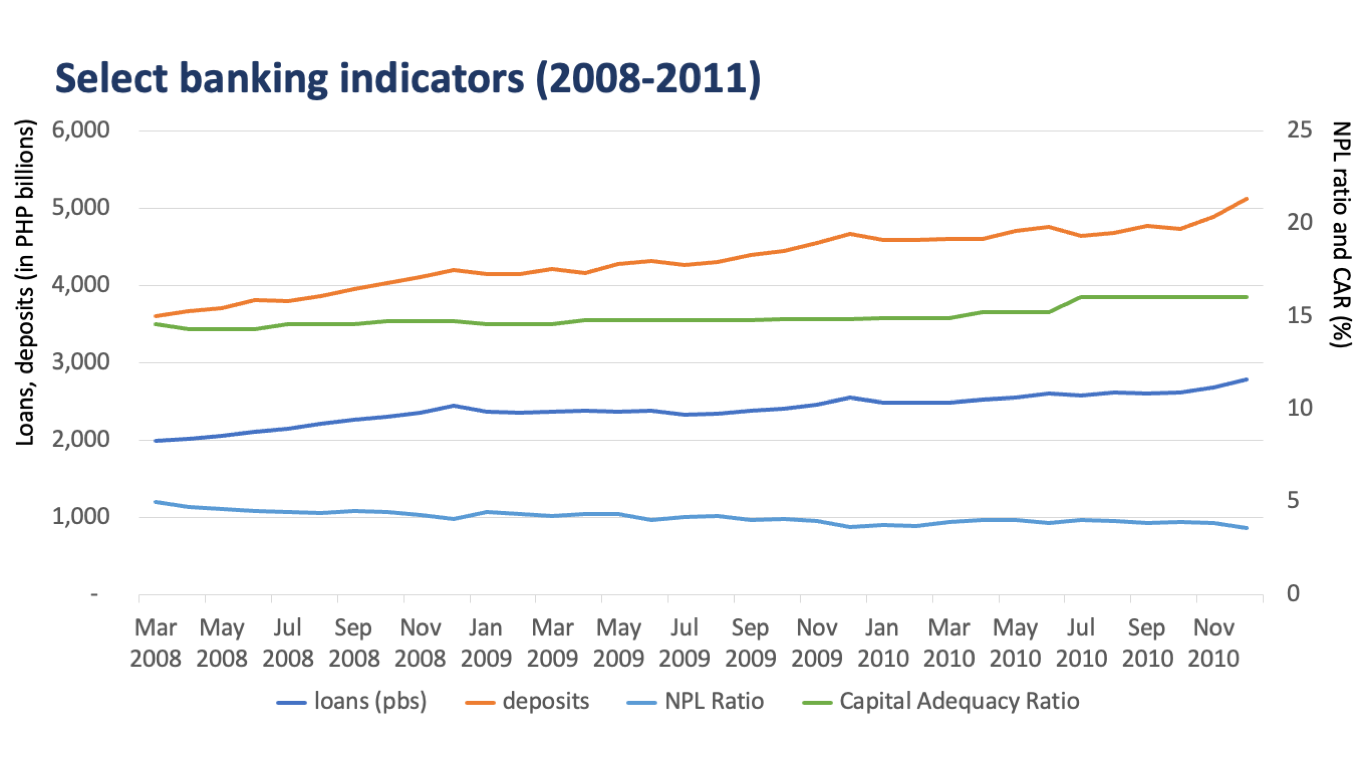

Post-Lehman PH Banking – Business as Usual

The man on the street taking a look at the Philippine banking sector post-Lehman would not notice anything that jumps out of the ordinary when looking at graphs of loans, deposits, non-performing loans (NPLs), and capital adequacy ratios.

To a layman, these numbers say “it’s all good”, which is hardly surprising as the Philippines was not at the center of the storm when the 2008 financial crisis blew up and wrecked the global economy. This is not to say that there was no impact on the domestic economy. After all, Lehman’s demise was a precursor to the Great Recession of 2008.

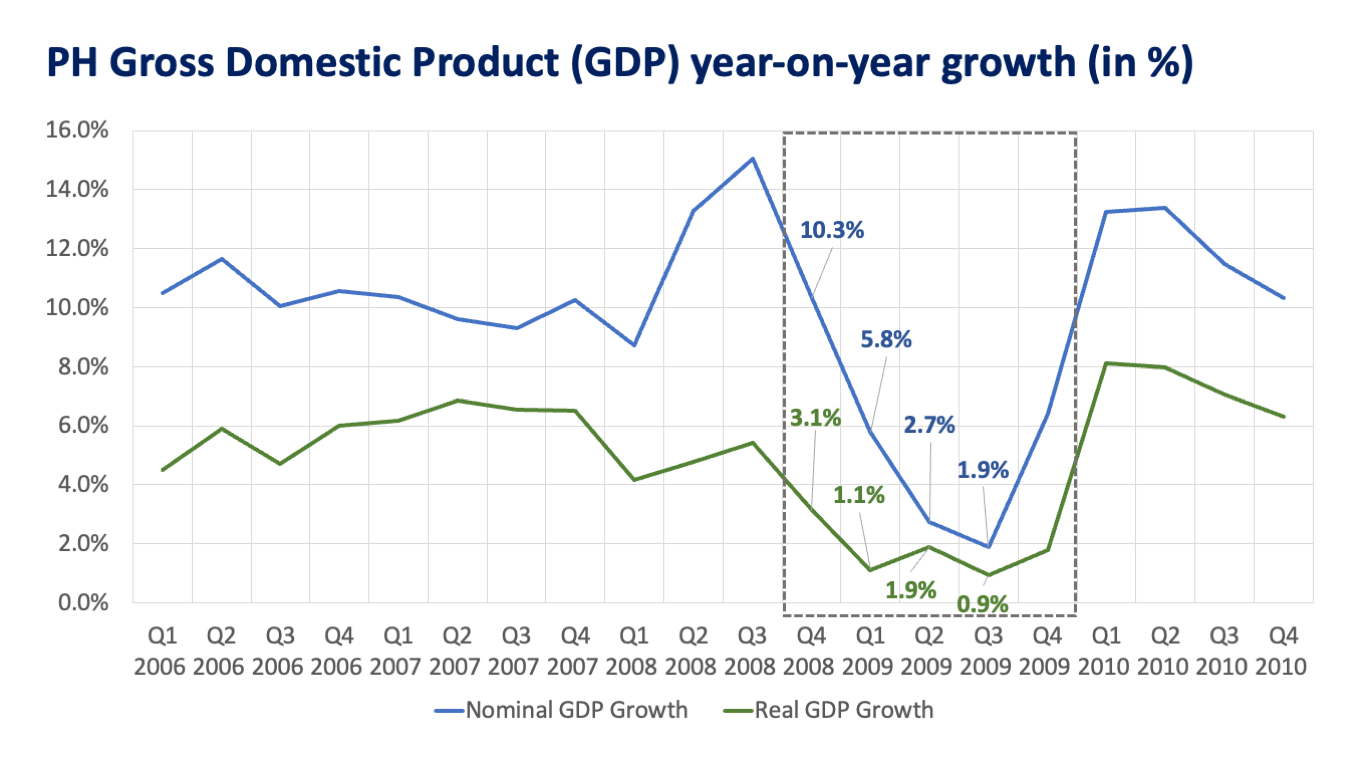

Post-Lehman Philippine Macroeconomy – A dent in GDP growth

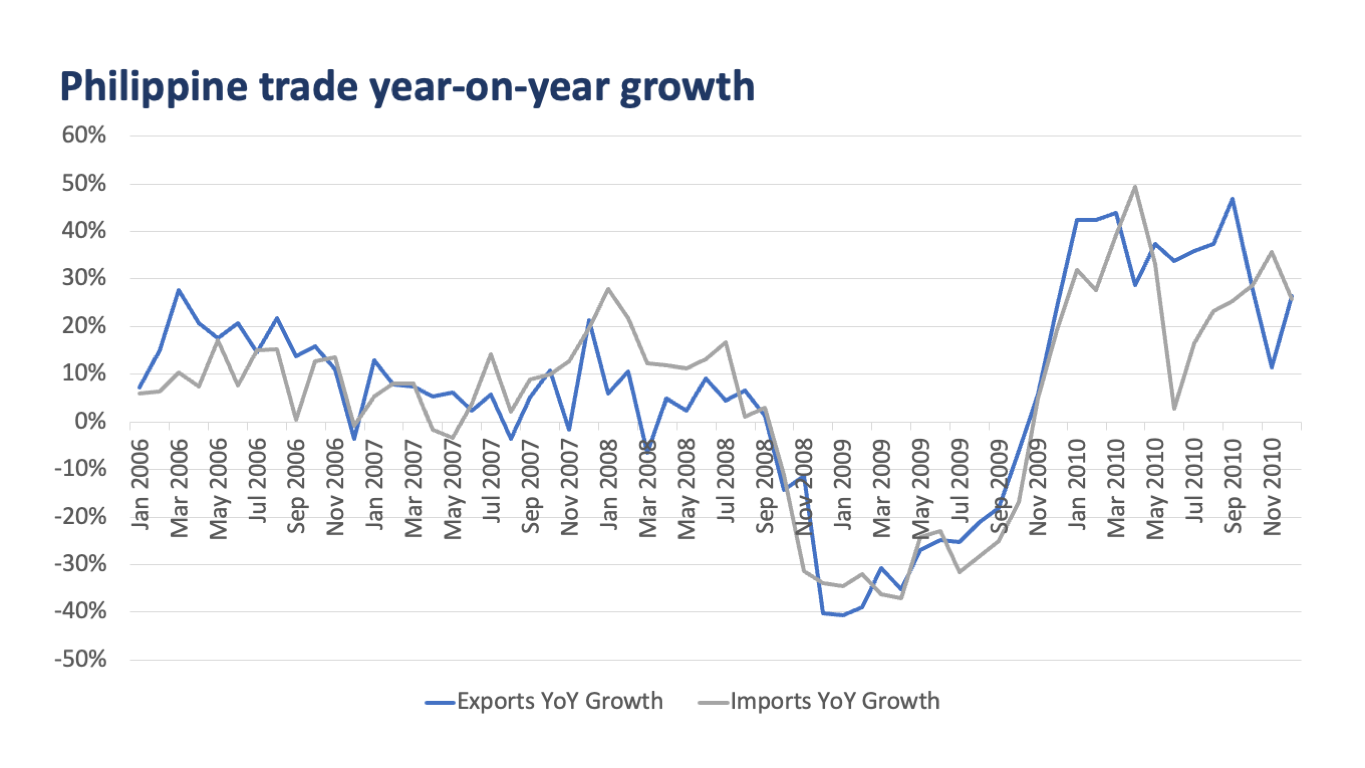

The collapse of Lehman Brothers caused global markets to start fearing which global financial institutions were next given unknown holdings of toxic assets. It came to a point where even Letters of Credit (LCs) were suspect, and global trade ground to a halt. The Philippine economy was affected through trade, consumption, investments, and the fiscal deficit.

Output contracted due to affected sectors, most especially manufacturing and retail and wholesale trade. Manufacturing was hit by the slump in exports because of the global downturn. Imports were not spared.

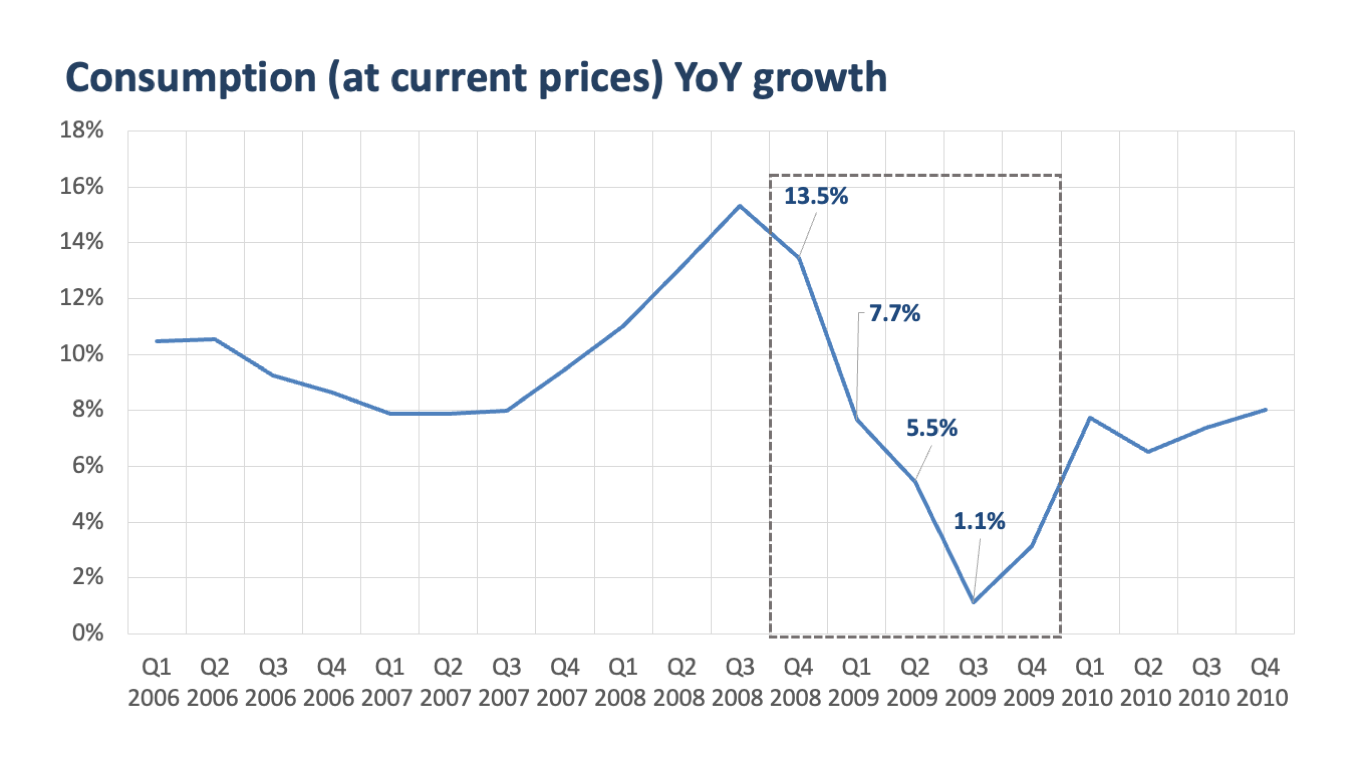

On the other hand, the lower growth rates of the wholesale and retail trade sector were partly attributed to a slowdown in personal consumption. Note that the financial crisis coincided with the lingering effects of a sharp rise in food and fuel prices which peaked in mid- to late-2008, leading households to reduce their consumption.

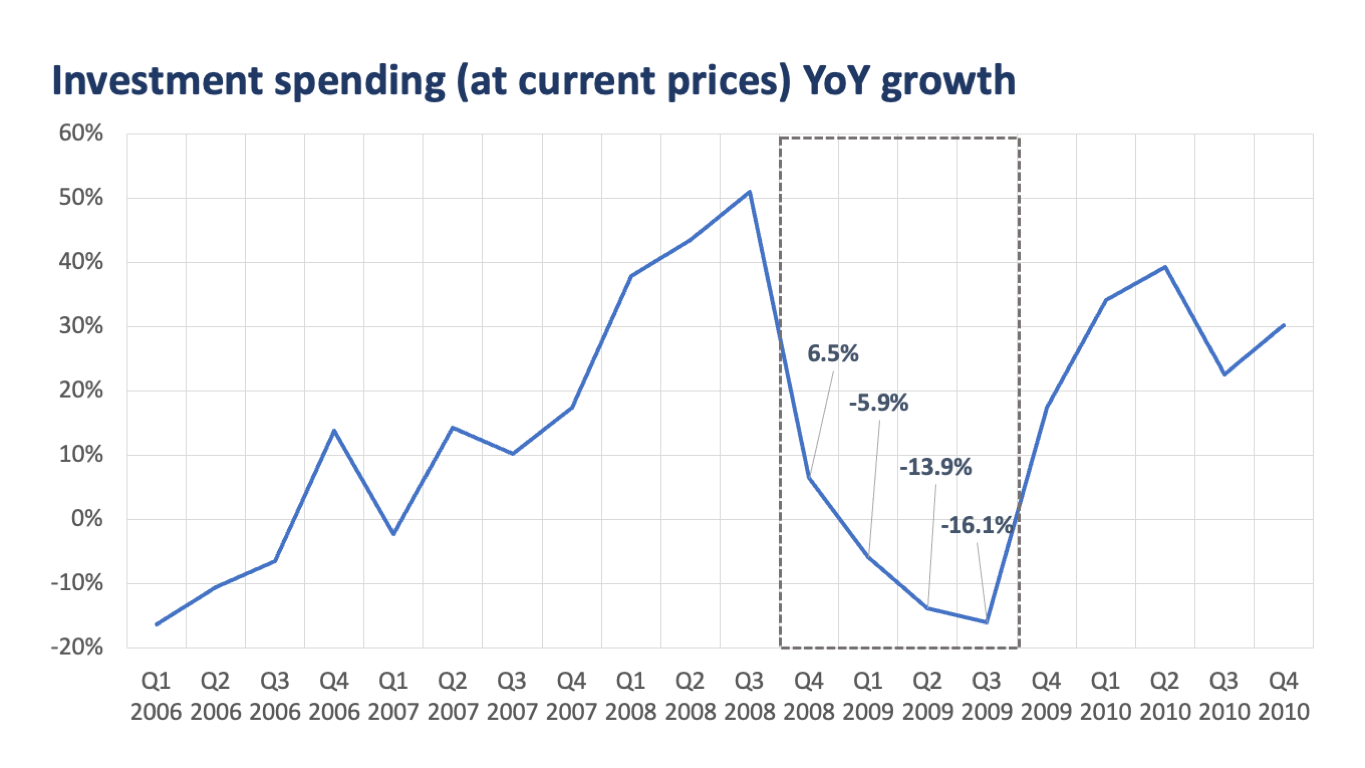

Investment spending likewise slowed as businesses saw a decline in the demand for their products.

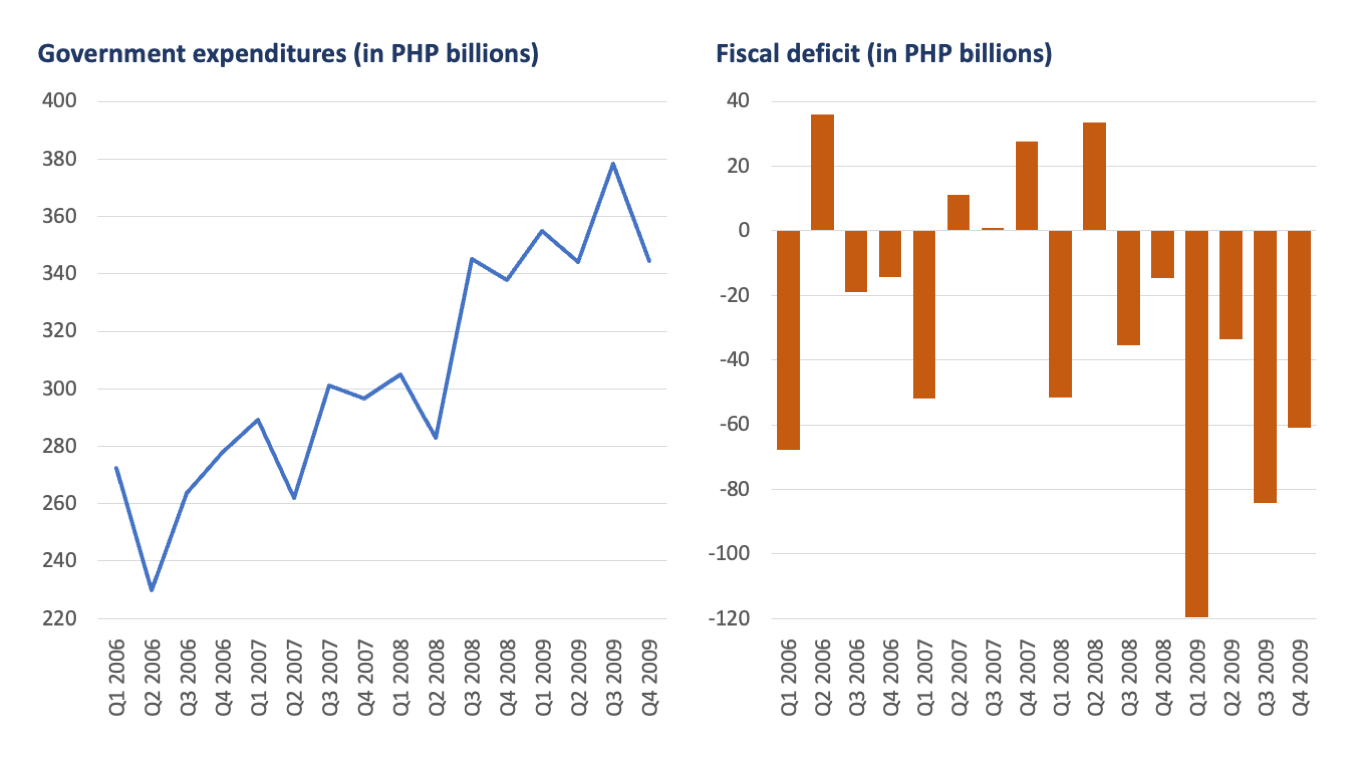

To offset the contraction in consumption, investments, and exports, the Philippine government increased its expenditures. At that time, the government was reluctant to cut expenditures during a period when the economy was substantially slowing down. This led to a widening of the fiscal deficit, especially in 2009.

Takeaways

In a nutshell, the man on the street would say that the Philippine banking sector post-Lehman was generally okay, and it withstood the financial turmoil triggered by the Lehman downfall and the resulting contraction in global trade.

It was, however, a different story for the real economy, which suffered from the adverse consequences brought on by the great recession.

So with the recent collapse of SVB, is the Philippines about to experience something similar to a post-Lehman Philippine moment? More on this in part 2 of our series.

MARC BAUTISTA, CFA is the bank’s Research and Business Analytics Head. ANNA ISABELLE “BEA” LEJANO and INA JUDITH CALABIO are Research & Business Analytics Officers at Metrobank.

DOWNLOAD

DOWNLOAD

By Marc Bautista, CFA, Anna Isabelle “Bea” Lejano, and Ina Judith Calabio

By Marc Bautista, CFA, Anna Isabelle “Bea” Lejano, and Ina Judith Calabio