The US dollar isn’t out just yet

There’s still greater demand for US dollars and USD-denominated assets but could the recent US banking issues hold bank the greenback’s strength?

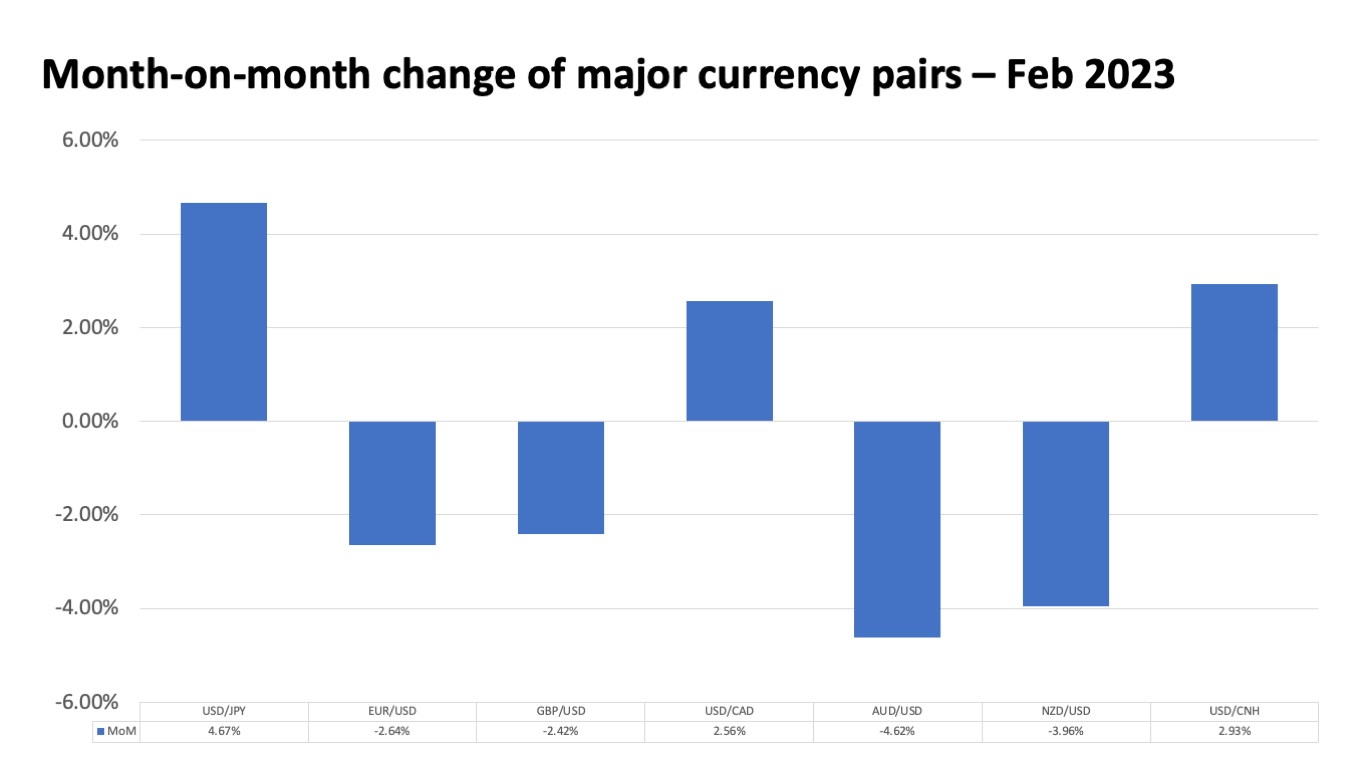

Markets underestimated Fed hawkishness as the risk rally that started in January saw a complete reversal in February.

It started when US non-farm payrolls for January exceeded expectations, adding 517,000 new jobs versus 189,000 forecast. The unemployment rate also fell to a 53-year low of 3.4% with two job openings for every unemployed individual, further highlighting the strong labor market.

US inflation indices also surprised everyone by coming out higher than expected. The consumer price index (CPI) grew by 6.4% year-on-year versus 6.2% forecast while the Fed’s preferred inflation gauge, the core personal consumption expenditure (PCE) increased 4.7% year-on-year versus 3.9% forecast. Other economic data releases in retail sales and purchasing managers index (PMI) showed robust business activity, despite elevated interest rates.

However, US dollar may see another challenge to its strength as the bank runs on Silicon Valley Bank (SVB) and other smaller financial institutions in March have investors thinking that the Fed may have tightened too much. European currencies such as the euro and pound sterling are also adversely affected by struggling Credit Suisse.

Month-on-month change of major currency pairs – Feb 2023

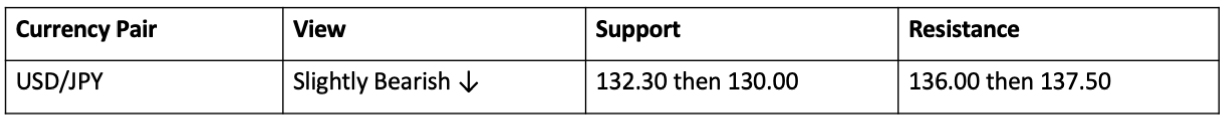

It did not help that Japan’s 4Q 2022 gross domestic product (GDP) grew at a much weaker 0.6% versus 2% forecast, as the return of tourists was not able to offset a slowdown in capital expenditure and exports. The Bank of Japan (BOJ) also maintained the status quo of loose monetary policy and incoming BOJ Governor Kazuo Ueda has not made any opposing comments, despite initial hawkish impressions. USD/JPY went from a low of 128.68 in the first couple of days to trending upward all the way back above the 136.17 by February 24.

But with the Japanese yen, traditionally a safe haven currency, Japan could still see flows coming in from troubled banks in the US and Europe.

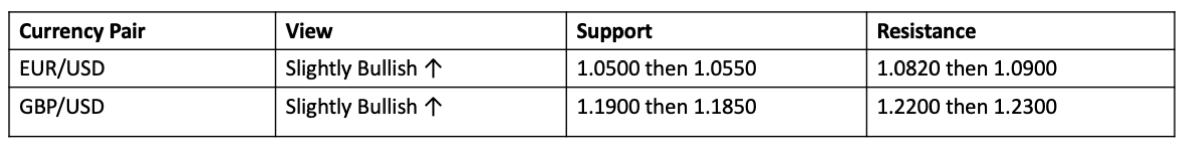

European Central Bank (ECB) President Christine Lagarde reiterated that the central bank will likely hike by 50 basis points (bps) in March to a 3% deposit rate, even as Euro zone inflation slowed from 9.2% in December to 8.6% in January. However, the EUR/USD still fell from a high of 1.0990 on the first day of the month all the way down to 1.0548 as US dollar strength dominated. The euro’s only reprieve is that the European Union (EU) has been able to completely replace Russian oil imports with supply from US, Norway and Qatar, tempering domestic demand for US dollars.

The pound sterling was still able to put up a fight as United Kingdom (UK) 4Q 2022 GDP grew by 0.4% amidst recession fears. GBP/USD traded from a high of 1.2376 down to a low of 1.1944 on February 24, but bounced back to 1.2022 by the end of the month. January UK inflation also remained elevated at 10.1% which could necessitate further rate hikes by the Bank of England (BOE).

However, both currencies are at risk should issues surrounding Credit Suisse’s stability negatively affect confidence in the European banking system. Immediately after SVB’s closure, Credit Suisse and the Swiss National Bank quickly initiated talks to reassure the public that the bank will not fail.

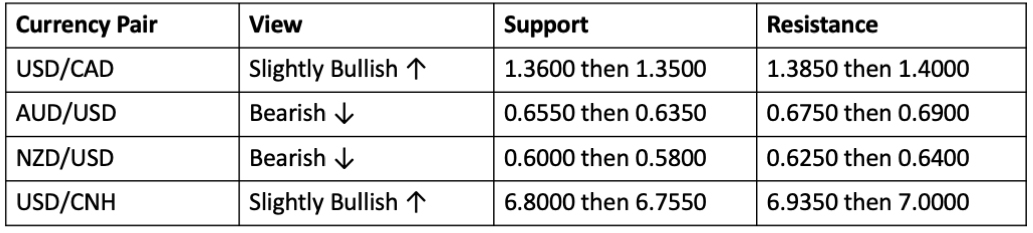

Optimism on China’s reopening waned as the giant did not have its explosive start and impact on commodity markets as anticipated. West Texas Intermediate (WTI) Crude Oil decreased slightly, from an average price of USD 78.16/barrel in January to USD 76.86/barrel in February. Gold and copper prices also decreased by coming from a sustained rally in January.

Canada CPI continued its descent with the January figure slowing to 5.9% year-on-year, reaffirming the Bank of Canada’s (BOC) decision to pause its hiking cycle at 4.5%. USD/CAD started the month at 1.3291 and has climbed to 1.3647 by the end, driven by a hawkish Fed in contrast with a dovish BOC.

With 4Q 2022 inflation for both Australia and New Zealand well above 7%, the Reserve Bank of Australia (RBA) hiked 25 bps to 3.35% while the Reserve Bank of New Zealand (RBNZ) hiked an even greater 50 bps to 4.75%. AUD/USD fell from 0.7137 down to 0.6726 and NZD/USD fell from 0.6506 down to 0.6185. AUD underperformed the most also because of weakness in the Australian job market.

China was still in a slow start, especially since the nation was coming from its Lunar New Year holidays.

Relations between the US and China soured after a Chinese-operated balloon off the southeastern US coast was shot down after being suspected over spying on US military sites. China claimed the balloon was just a weather-monitoring device that accidentally drifted into US airspace.

The offshore yuan started the month at 6.7195 and ended it at 6.9810. With record low 4Q 2022 GDP growth of 2.9% and January inflation at 2.1%, the People’s Bank of China (PBOC) is in no hurry to be hawkish and might instead consider more growth-centered policy.

The above forecasts are the foreign exchange traders’ personal opinions and may not reflect the official views of the bank.

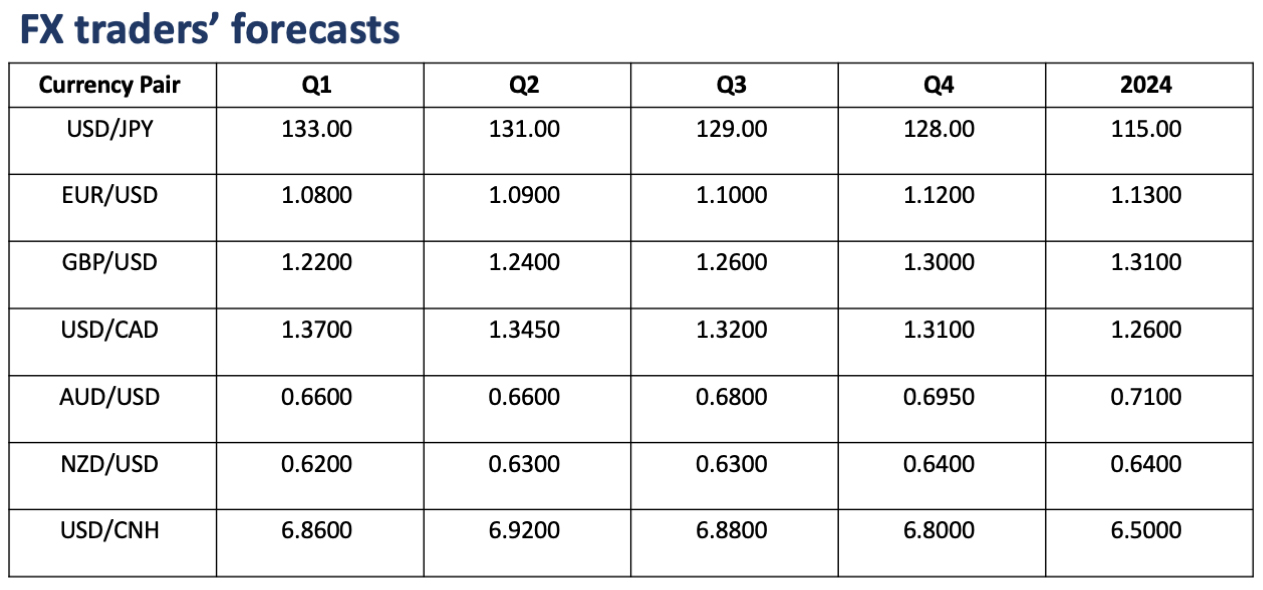

Our FX traders’ personal views have altered slightly to account for greater US dollar strength than originally anticipated. A strong labor market and sticky inflation will have markets continuously on the lookout for the Fed’s terminal rate. The higher and longer US rates are projected to be, the greater the demand for US dollars and USD-denominated assets. But with the issues surrounding SVB and US regional banks, it remains to be seen whether the USD can hold onto its strength or whether the Fed can remain hawkish for longer.

Earl Andrew “EA” Aguirre is a Market Strategist at Metrobank’s Financial Markets Sector and has 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By EA Aguirre

By EA Aguirre