Peak rates: How high can the overnight rates go?

The recent pronouncements of US Federal Reserve Chairman Jerome Powell have been taken by the market as a signal of more aggressive rate hikes. How high can the Fed Funds rate go? And how will the BSP respond?

As of March 10, 2023, markets appear to be pricing in peak US Fed Fund rates of 5.50% to 5.75% instead of just 5% to 5.25%. So where can the BSP benchmark rate end up? Will it be pressured by Fed action, or will it focus more on domestic inflation, given that February inflation was below market consensus and expectations?

Back in October 2022, Bangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla declared that the BSP policy rate (RRP, or reverse repurchase rate) should be at least 100 basis points (bps) higher than the US Federal Funds rate (FFR) to ensure stability in the dollar-peso exchange rate, which was then averaging at PHP 58.8 per US dollar while inflation was doing around 7%.

Note that the depreciation of the exchange rate adds to inflationary pressures, so the BSP can use interest rates as a tool to manage the exchange rate fluctuations and hence help curb inflation from a too-weak peso.

Interest rate differentials

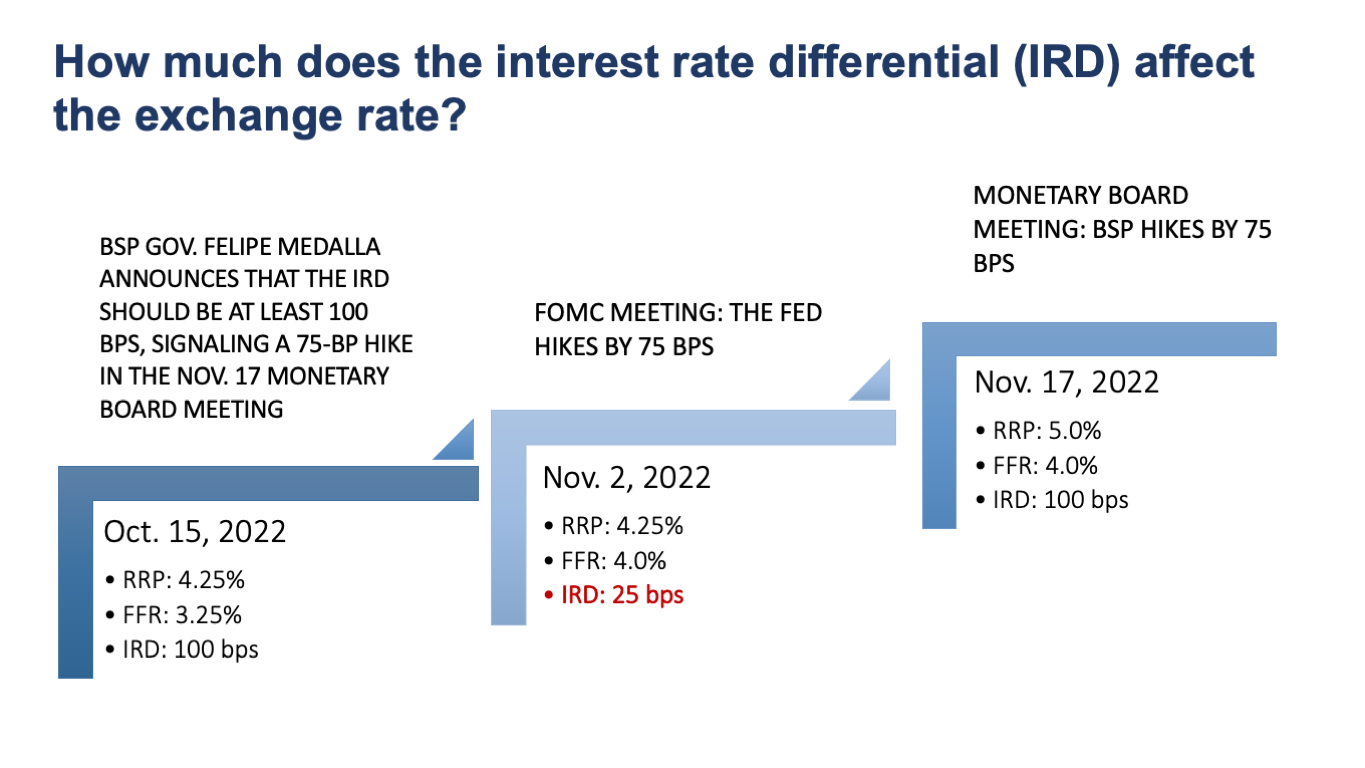

Though the BSP kept to its 100-bp overnight rate differential with US policy rates for the remaining months of 2022, there was a short period where it came down to 25 bps in November (see below), as the Federal Open Market Committee’s (FOMC) rate-setting meeting was scheduled about two weeks before the BSP’s Monetary Board meeting.

However, the peso was stable even after the said FOMC meeting, where there was a 75-bp FFR hike and there were no movements yet on the RRP, resulting in a 25-bp overnight rate differential.

Then again, as Medalla had already signaled before the FOMC meeting that the BSP would match the Fed point-by-point in November to keep the 100-bp IRD, the 25-bp rate differential was a non-event as far as the peso was concerned.

This is an indication that a narrow focus on overnight rate differentials, as the primary determinant of the exchange rate, appears to be too simplistic. Signals from central banks and even other factors can affect the exchange rate and should be brought to bear.

An internal paper by Metrobank Research even suggests that factors such as the interest rate differential between the 10-year PH and US bonds, the absolute level of the PH 10-year bond rates, and the level of gross international reserves all play an equally important role in shaping the exchange rate and should be given wider consideration.

BSP shifts language

Of late, the BSP is now emphasizing that it will prioritize the inflation outlook and inflation expectations over Fed rate hikes this year. This can be taken to mean that its policy rate decisions would be based on managing inflation expectations in the Philippines, perhaps because the country’s inflation trended higher than expected in January 2023 at 8.7% and that local inflation is now behaving differently from that of the US.

As mentioned, market traders are now expecting a steeper Fed funds terminal rate of between 5.5% and 5.75% (Fed funds futures) given the more aggressive statements from US Fed Chair Jerome Powell before Congress last March 7.

On the other hand, we expect RRP rates to peak at 6.5% given still elevated inflation, continued supply-side pressures, and the expected second-round effects.

Although the Fed has maintained that rate cuts are unlikely to happen within the year, it may signal towards the end of 2023 that rate cuts will likely start in 2024 as US inflation substantially eases towards the Fed’s target of 2%, and if other economic data, such as the US jobs report, suggest that inflationary pressures are easing.

Such a signal in 2023 will likely have the same price action on the USD/PHP as announcing rate cuts toward year-end 2023 as the market prices things forward.

This gives the BSP room to signal cuts or to cut rates toward yearend, as inflation is expected to trend downward for the rest of the year given base effects. The possible slowdown in major economies also tends to reduce local inflationary pressures. The RRP may then come back down to 6.0% as early as year-end 2023, which is our view. The RRP would then be expected to come down further to the 5% level by 2024, as inflation expectations further decline, even as the Fed starts cutting rates in 2024.

Risks to the call

Some market players want the Fed to hike rates to even 6% and beyond. Should that happen, this may pressure the BSP to postpone any rate cuts until some clarity in inflation expectations becomes evident.

Domestic inflation can still surprise on the upside, given the Chinese reopening this year and the resumption of price pressure on oil and commodities as China resumes oil demand in earnest. A peak RRP rate of 6.75% cannot be discounted, and rate cuts to the 6% level may have to be pushed to a later date should that happen.

In the meantime, the current view is that peak inflation in the Philippines may have already happened, so while the BSP may have some more work to do in terms of rate hikes of up to 6.5%, a policy reversal will happen as soon as inflation expectations settle downwards, likely towards year-end 2023.

As of this writing, however, the Fed Funds futures have drastically gone down to 4.51% by September 2023 (which implies rate cuts) after news of the Silicon Valley Bank (SVB) run.

This has heightened fears of cracks in the financial system amid aggressive rate increases by the Fed. Some are worried that a contagion effect in the industry could lead to more stress for the US economy. As for any local impact, it may give room for the BSP to act more independently from the Fed.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her Bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano