On Exchange Rates: Watch and Listen for Signals

Find out what factors affect exchange rate behavior and how signals from the central banks can influence it.

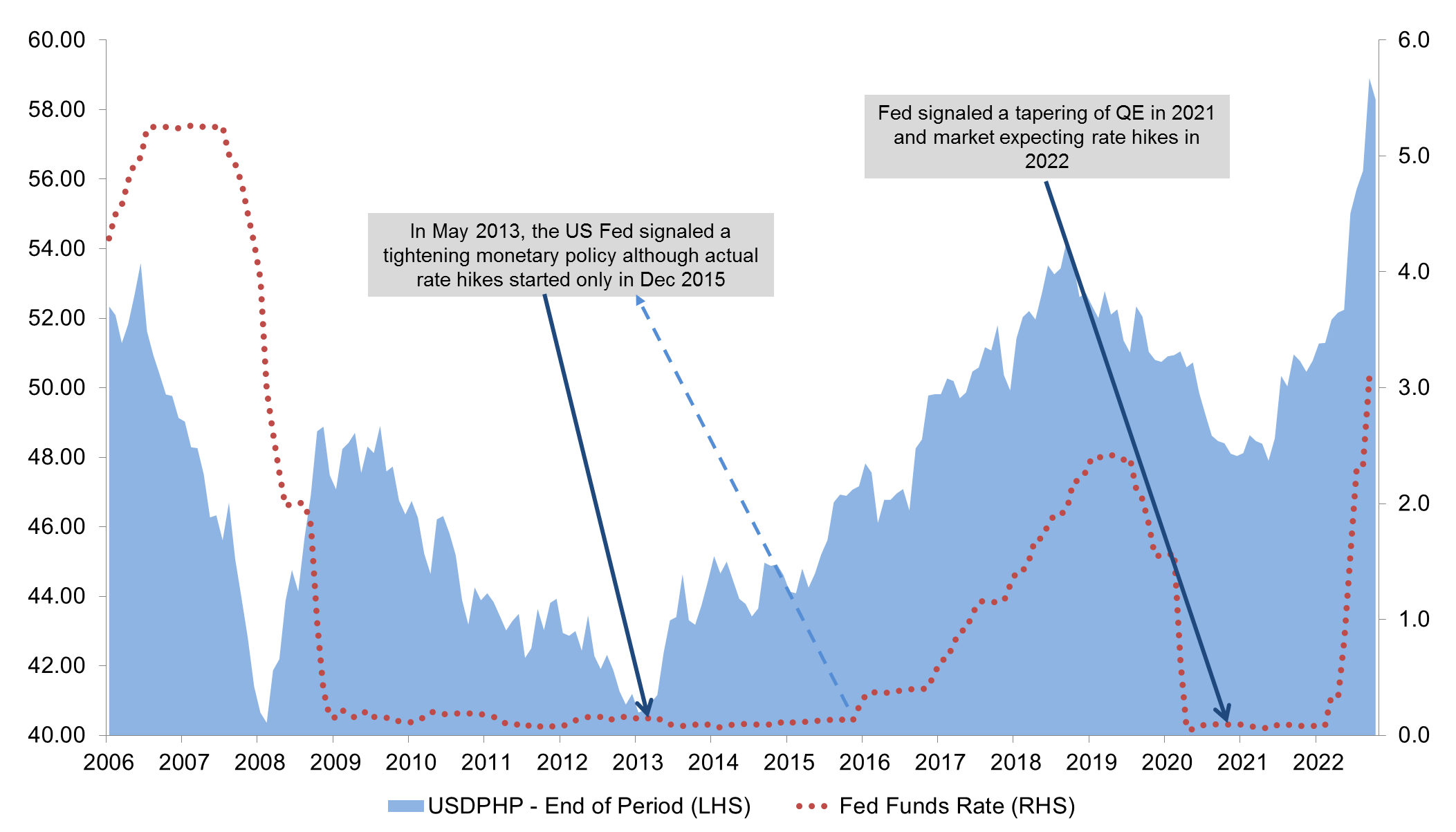

Movements in the USD/PHP rate are commonly known to be driven by overseas Filipino workers (OFW)’s remittances, the volume of exports, and differentials between the key policy rate of the Philippines and the US. However, there is also another factor that may not be as apparent: the signals communicated by the central banks.

Central banks, such as the US Federal Reserve and the Bangko Sentral ng Pilipinas (BSP), hike the key policy rate to curb inflation, ensure orderly market conditions, and manage volatility in the exchange rate.

Expectations on the key policy rate also play a crucial role in the movements of the exchange rate–not just on actual movements in the key policy rate. So, the central banks may give signals to manage expectations and subsequently, currency movements.

Case in point: though the US Fed Funds rate (FFR) was unchanged in May 2013 (see graph above), signals from the US Fed that it will tighten monetary policy led to the immediate depreciation of the USD/PHP rate, even if actual FFR hikes started in December 2015. Because markets priced in the hike and anticipated that returns for US investments will be higher than that of the Philippines, the peso depreciated.

The same situation happened in 2021. The US Fed signaled a tapering of its quantitative easing (QE), where the central bank buys securities from the open market to bring down interest rates and raise the money supply. The US Fed aslo signaled rate hikes for the following year. Because of these signals, the market priced in the anticipated tapering of QE and the contractionary monetary policy of the US Fed. This led to the depreciation of the peso even before 2022, earlier than the US Fed hikes.

In the same way, the BSP also sends signals to manage fluctuations in the exchange rate.

BSP Governor Felipe Medalla announced that the BSP would match the US Fed hikes point by point way before the Monetary Board meeting on November 17 and even before the Federal Reserve Open Market Committee (FOMC) meeting on November 2, where it was widely believed that the US Fed would hike its FFR by 75 basis points or 0.75 percent.

Even if the BSP’s meeting was still weeks away and the US Fed hiked by 75 bps resulting in only a 25-basis point policy differential between the RRP rate and the FFR during early November, the peso stayed at the PHP 58/USD level. The BSP’s intervention in the FX market by selling dollar reserves also likely aided the peso from being volatile and from further weakening.

The average policy rate differential between the PH and US is 100 bps or more, at least in 2022. So, a 25-basis point differential should have depreciated the peso.

Mr. Medalla said that the signaling was done to temper any impact on the peso because of the recent US Fed hike before the BSP Monetary Board meeting. This shows that statements from the central bank can preempt the foreign exchange market from reacting, even if there are no actual hikes. Thus signaling from the central bank can influence currency movements as much as actual policy rate hikes.

Since the BSP signaled that it would match the Fed point by point for the remainder of the year, a 75-bps hike in November and a possible 50 bps hike in December by the US Fed would likely bring RRP rates at the 5.50 percent level by yearend.

Meanwhile, US FFR rates are seen to settle at 4.50 percent, maintaining a 1 percent policy differential from the RRP. Hopefully, these signals from the BSP could help the peso from further depreciating.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her Bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano