What to do when the peso plunges to a 17-year low

There are forces pushing the value of the dollar up. Increasing policy rates in the US are mostly to blame. For now, we continue to advocate buying on dips.

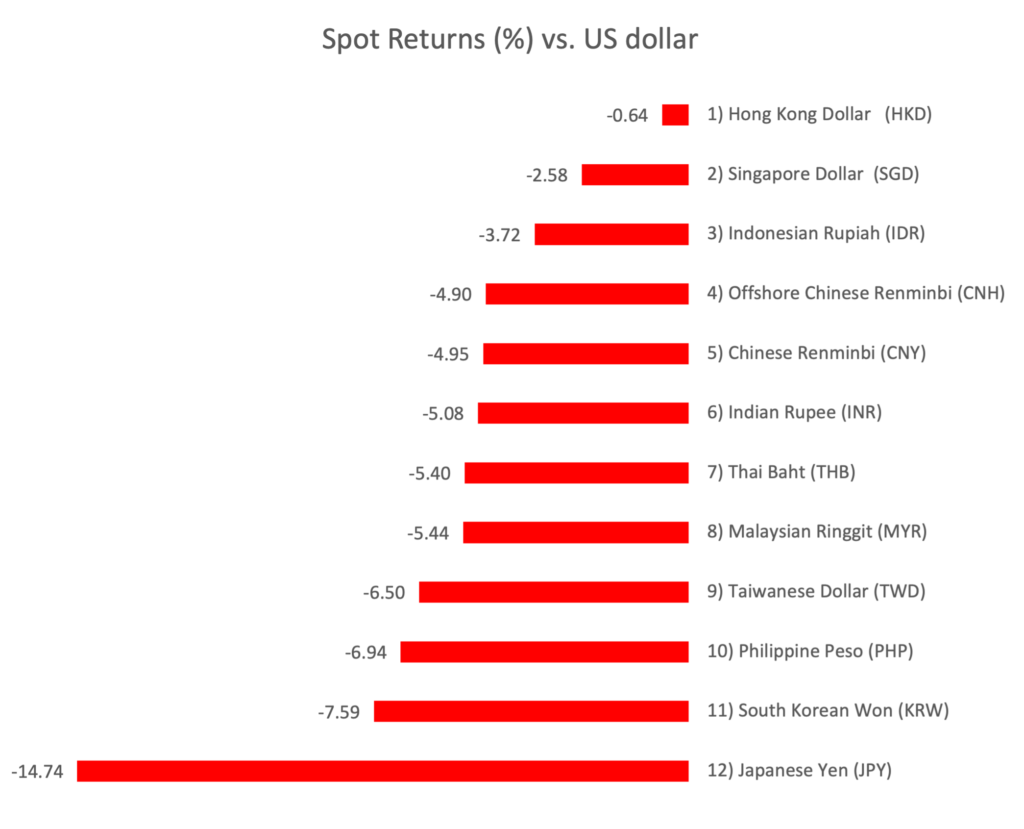

The Philippine peso has weakened sharply against the US dollar, trading close to PHP 55 to a dollar, a level not seen since November 2005. So far this year, the peso is down over 7% vs the greenback, making it the worst-performing ASEAN currency.

As all Asian currencies weakened against the US dollar in 2022, central banks in Asia are tapping into their stockpiles to bolster their weakening currencies.

What happened?

Inflation happened. More specifically, it is the four-decade high inflation in the US, which has forced the US Federal Reserve to raise rates very quickly and by a lot more than initially expected.

On June 15, the Fed hiked its benchmark interest rate by 75 basis points (0.75 percentage points) to 1.5%-1.75%, the third consecutive rate increase in as many meetings, and the largest single rate hike since 1994. Leading up to the rate policy-setting meeting, Fed Chairman Jerome Powell signaled an increase closer to 50 bps, but after higher-than-expected inflation of 8.6% for May, the Fed decided time wasn’t on their side to cool inflation down. Just as critical, the Fed said that it will continue doing what’s needed until there’s evidence that inflation is slowing. From inflation shock, we’re now in a rate shock.

Global markets, including foreign exchange markets, immediately reset expectations on US rates to between 3.5%-4% by year-end 2022, up from 2.75% just a month ago.

The higher the interest rate of a currency, the more valuable that currency becomes, and with US interest rates rising faster than those of other countries, including the Philippines, the US dollar very quickly jumped higher against the peso.

Why won’t we keep pace with the Fed to defend the peso?

Because economic recovery comes first, at least for now.

The Philippine economic recovery remains precarious compared to the US and other advanced economies that came out of the pandemic much earlier. The Bangko Sentral ng Pilipinas (BSP) is therefore wary about hitting the brakes on growth by raising rates too early. A more gradual approach was deemed necessary.

The BSP started “normalizing” its benchmark policy rates from the historic-low 2% level, which was needed to support the economy during the pandemic, with a nice-and-easy 25-bp rate hike on May 19, two months after the Fed’s rate lift-off.

The BSP responded with another 25-bp hike in the following policy rate-setting meeting on June 23, after inflation registered a 5.40% year-on-year jump in May and on expectations of accelerating inflation.

Due to higher global oil and non-oil prices, combined with the continuing shortage in domestic food supply, particularly fish, the BSP raised its average inflation forecasts to 5% in 2022, from 4.6% previously, thereby implying average inflation of 5.6% in the 2nd half of 2022; and to 4.2% in 2023, from 3.9% previously, before tapering back to a 3.3% average in 2024.

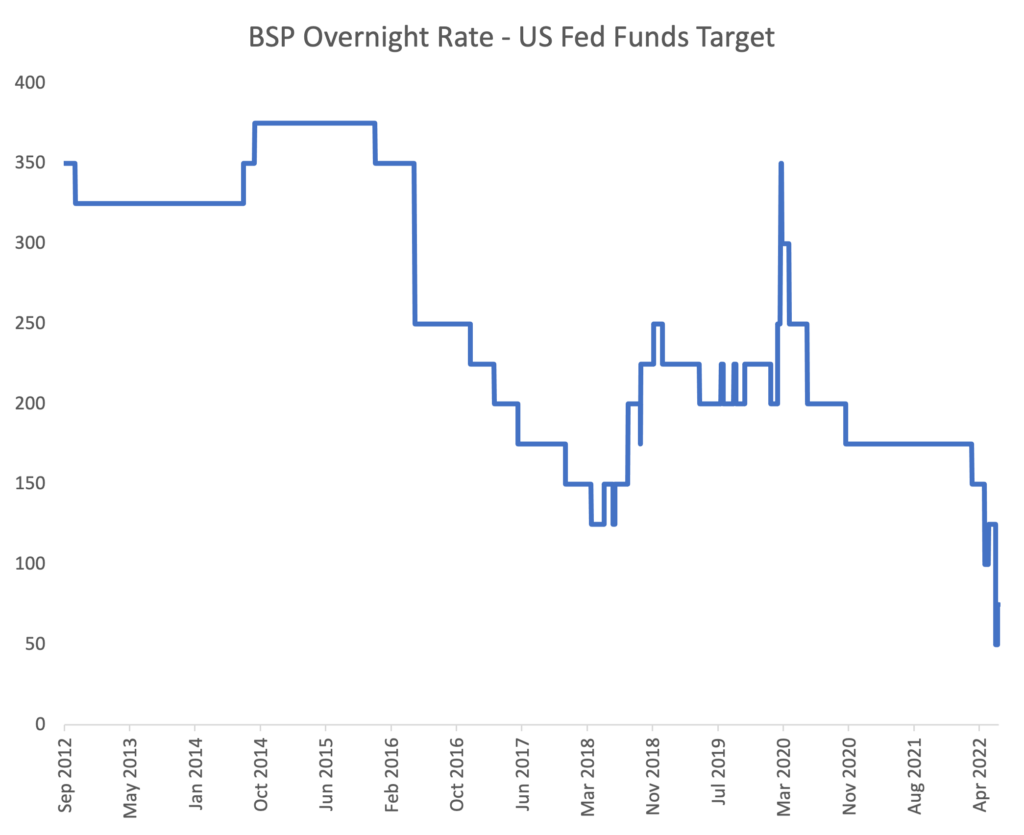

The BSP’s two consecutive rate hikes have brought the policy rate to 2.5%, compared to the Fed Fund Rate’s current level of 1.75%, or a 75-bp interest rate differential compared to the historical average of 250 bps.

The interest rate differential of the BSP’s Overnight Rate and the Fed Funds Rate now stands at 75 basis points (bps) compared to the historical average of 250 bps.

Similar to the Fed, the BSP said it is prepared to take the necessary policy actions to bring inflation back to within the 2%-4% range target over the medium term, which includes further rate hikes through the second half of 2022.

However, given the divergent policy rate path between the Fed (aggressively “hawkish”) and the BSP (persistently “dovish”), this interest rate differential will narrow quickly, and might even turn negative (where the US interest rate is higher than the Philippine interest rate).

Metrobank Research Head Marc Bautista forecasts the BSP policy rate at 3% – 5% by year-end 2022, or another minimum 50-bp hike from here, significantly slower than the 175-bp to 225-bp expected cumulative rate hikes of the Fed.

We believe this is why the peso has weakened considerably against the US dollar and is at risk of weakening further, especially after incoming BSP Governor Felipe Medalla said that the BSP’s focus will be inflation, more than the exchange rate. This may be exacerbated as demand for the US dollar picks up ahead of peak import season in the third quarter.

Metrobank Research recently revised their exchange rate forecast to PHP 55.10 by year-end 2022 (up from PHP 53.40 previously) and PHP 56.50 by year-end 2023 (from PHP 54.70 previously), near the all-time high of PHP 56.45/USD 1 on March 31, 2004.

So what do we do now?

We’ve consistently been advocating buying the US dollar vs the peso on dips since last year. Our Financial Markets Analyst Patty Membrebe reiterated this view in her recent article, “Why buy the dollar on dips” published last May 30. Given our revised forecasts, we are keeping this strategy intact.

In the near-term, the peso appears technically oversold against the US dollar, which suggests room for a pull-back towards the 54.65-level, which could offer a window to accumulate dollars. Should the exchange rate break below this level, we see the next support at 54.50. For those who can afford to wait, the peso tends to get stronger against the dollar in the fourth quarter, when strong demand for imports goes down and seasonal OFW remittances go up.

RUBEN ZAMORA is First Vice-President and Head of Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank, which manages the bank’s relationships with Non-Bank Financial Institutions, including government financial institutions, insurance companies, and asset managers. He is also the bank’s Financial Markets Strategist, focusing on fixed Income and rates advisory for our high-net-worth-individual and institutional clients. He holds a Master’s in Business Administration from the University of Chicago Graduate School of Business. He is also an avid traveler and golfer.

DOWNLOAD

DOWNLOAD

By Ruben Zamora

By Ruben Zamora