Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

Unemployment rate rises to 5%, highest in 3 months

The number of jobless Filipinos rose by about 570,000 to 2.54 million in October from a year earlier, even as overall employment increased by 460,000, the Philippine Statistics Authority (PSA) reported on Wednesday, underscoring persistent vulnerabilities in the labor market despite headline job gains.

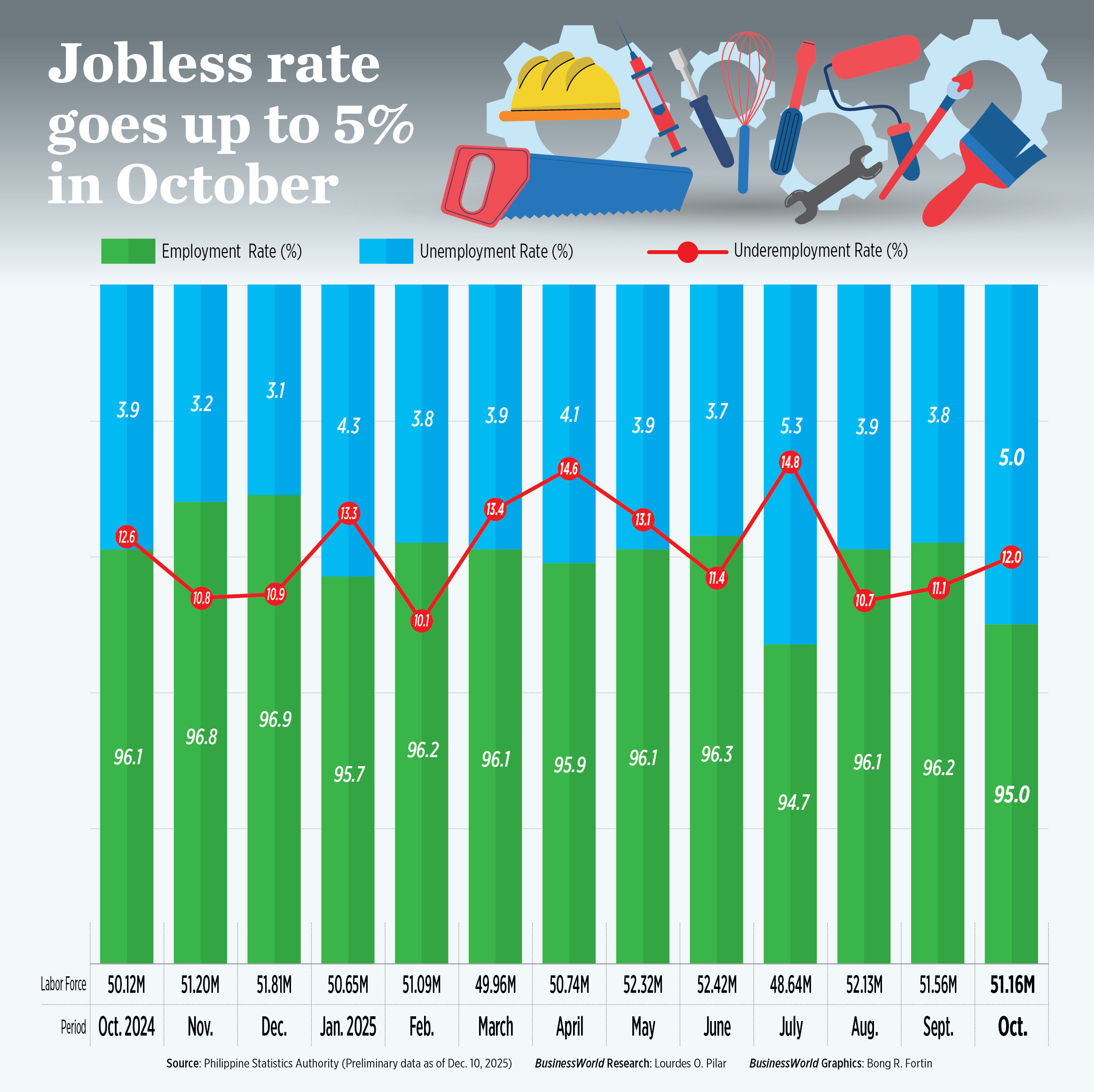

This brought the jobless rate to 5% from 3.8% in the previous month and 3.9% a year ago. It was also the highest in three months or since the post-pandemic high of 5.3% in July.

The unemployment rate averaged 4.13% in the first 10 months from 4% in the same period a year ago.

PSA Undersecretary and National Statistician Claire Dennis S. Mapa attributed the rise in joblessness to recent typhoons and the increase in labor force participation.

The labor force participation rate (LFPR) rose to 63.6% in October from 63.3% a year earlier but fell from 64.5% in September, the statistics agency said in a statement. The estimated LFPR in October translates to 51.16 million Filipinos versus 50.12 million in the same month last year.

However, Mr. Mapa cited “good signs” such as rising employment in the agriculture sector, which added 168,000 jobs from a year ago.

“We saw an increase of 1.87 million in agriculture and forestry jobs quarter on quarter, with the biggest contributor being the growing of paddy rice, as the peak season for rice farming falls in the fourth quarter,” Mr. Mapa said during a briefing.

The PSA’s latest labor force survey showed that while many found work, a significant segment remains jobless — meaning economic improvements may not be reaching all sectors.

Still, the increase in employed people — particularly those aged 15 and over — reflects underlying demand in industries like retail, construction and services. Such gains offer hope that economic activity is picking up ahead of the holiday season.

In October, services accounted for the biggest share of total employment at 60.6%, followed by agriculture with 21.5% and industry at 17.9%.

Underemployment, which covers workers seeking more hours or better-paying jobs, eased to 12% in October from 12.6% a year earlier, but inched up from 11.1% in September. The number of unemployed Filipinos stood at 2.54 million in October, higher than 1.97 million in the same month last year.

“October’s labor market reflects continued progress in improving the quality of work available to Filipinos,” Department of Economy, Planning, and Development Secretary Arsenio M. Balisacan said in a statement.

In a note, Chinabank Research said the unemployment rate climbed in October, as not all new entrants in the labor market found jobs.

“On a positive note, there were gains recorded across industries, including challenged sectors like agriculture and manufacturing,” Chinabank said. “Looking ahead, job creation could pick up during the holiday season.”

PSA data show annual employment gains were spread across several sectors in October, including public administration (+257,000), accommodation and food services (+180,000), agriculture (+168,000), and manufacturing (+152,000).

“However, we note that the sector remains vulnerable to weather-related risks. Meanwhile, despite an uncertain global trade environment, manufacturing jobs increased (+152,000) with local factories expressing improved sentiment in the year-ahead outlook,” Chinabank said.

On the other hand, annual job losses were concentrated in services (-520,000), with notable declines in repair services, household services, and funeral-related activities.

Wholesale and retail trade also saw an annual drop (-66,000) in jobs in October.

Chinabank said this “could indicate that the softness in household consumption growth seen in the third quarter could persist this quarter.”

“Nevertheless, increased seasonal demand during the holidays could support job opportunities in the sector,” it added.

John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, said the latest numbers signal that the economy is struggling to create enough jobs.

“Yes, there are red flags. Job creation is slowing, underemployment remains high, and the sectors that usually absorb workers (retail, construction, services) are expanding weakly,” he told BusinessWorld over Viber.

“The worsening unemployment despite higher labor force participation shows that the labor market is widening, but not deepening, meaning more people are willing to work, but the economy is not generating enough stable, quality jobs to match that demand,” he added.

However, IBON Foundation Executive Director Jose Enrique “Sonny” A. Africa cautioned that these “good signs” in agricultural jobs may be overstated.

Looking at the sector historically, agricultural employment has actually fallen from an annual average of 10.8 million in 2022 to around 10 million in the first 10 months of 2025, he said.

“The only ‘good signs’ we should be looking for are steady and rapid increases in the National Government budget for farmers and fisherfolk in terms of production subsidies, extension services, and rural infrastructure,” Mr. Af-rica told BusinessWorld via Viber. — EMPS

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld