A domino effect in the making: Trump’s megabill and the Philippines

With the passage of the One Big Beautiful Bill Act, the first domino of an ambitious plan has fallen. What can we expect next?

We have been witness to numerous discussions on whether US President Donald Trump’s One Big Beautiful Bill Act (OBBBA) would kickstart the US economy. Despite all the back and forth on this bill, one expectation remains clear: the bill is estimated to increase the US’s debt by USD 3.4 trillion over the next decade.

The pending liability from tax cuts and increased spending have implications on US interest rates and growth, but what does OBBBA’s passage mean for the Philippines?

Revving up rates

As the US seeks funding to address the increased expenditure, interest rates are expected to edge higher, perhaps as early as next year. Elevated US rates would in turn attract foreign capital to the US away from emerging market economies like the Philippines.

In response, the Bangko Sentral ng Pilipinas (BSP) could increase the Reverse Repurchase (RRP) Rate to ensure the Philippines remains a competitive choice for investors. On the flip side, higher interest discourages consumption and business investment, potentially slowing the Philippines’ economic growth.

Trade deficit tipping further

Due to the US government’s substantial borrowings, private investment is at risk of being “crowded out” as borrowing costs are pushed higher. If private investment is discouraged, US GDP growth could slow substantially.

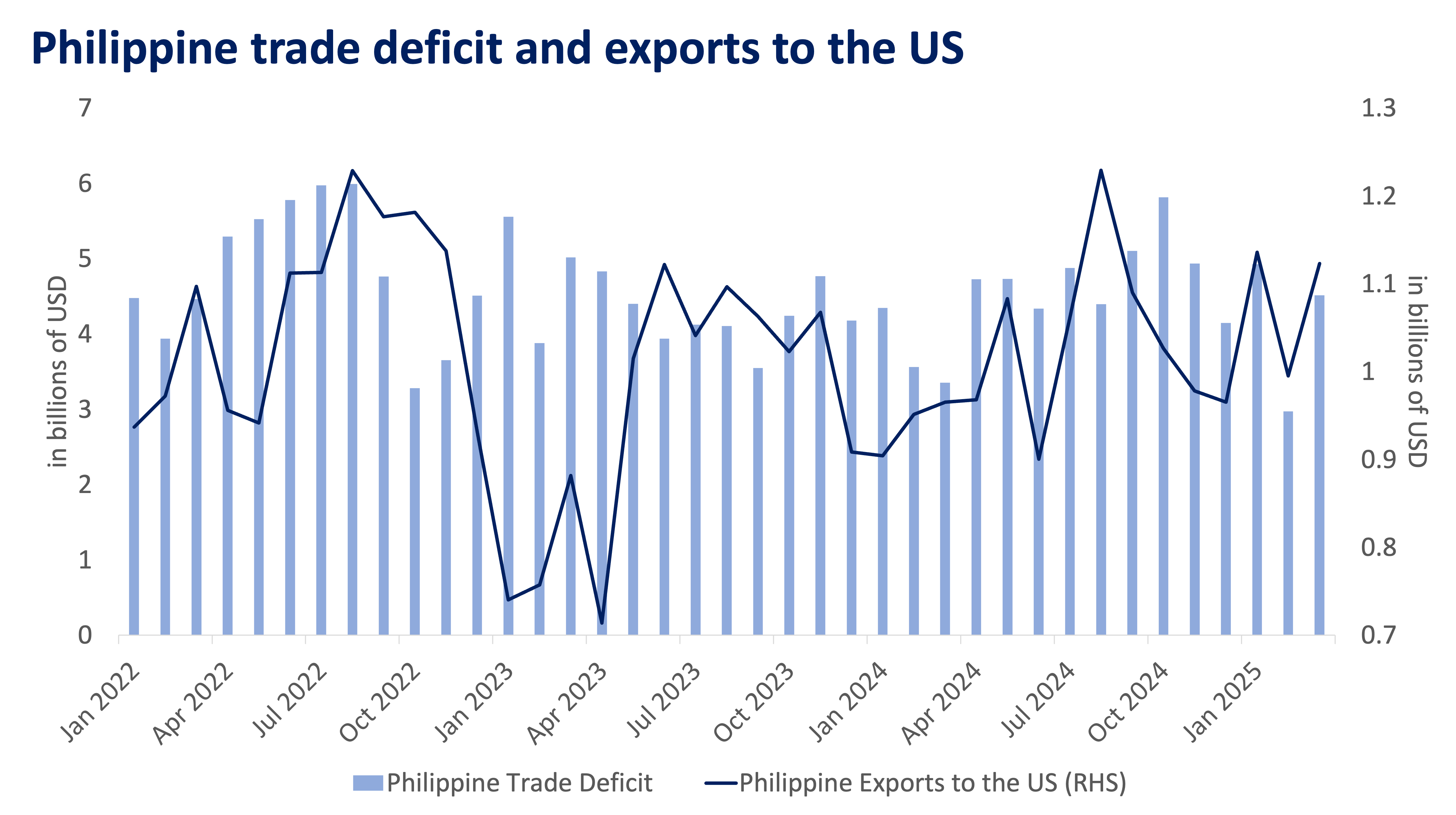

This could pose another hurdle for the Philippines considering that the US is one of the top destinations for Philippine export goods. In 2024, exports to the US amounted to USD 12.14 billion, comprising 16.6% of the Philippines’ total annual exports.

With potentially hampered US economic growth, goods from the Philippines could face a reduction in demand. Fewer exports combined with steeper tariffs can make the trade deficit more drastic and weigh on overall GDP.

Softer US growth could also limit foreign direct investment to emerging markets like the Philippines as US investors grow more conservative.

Potential remittance dip to pull down spending

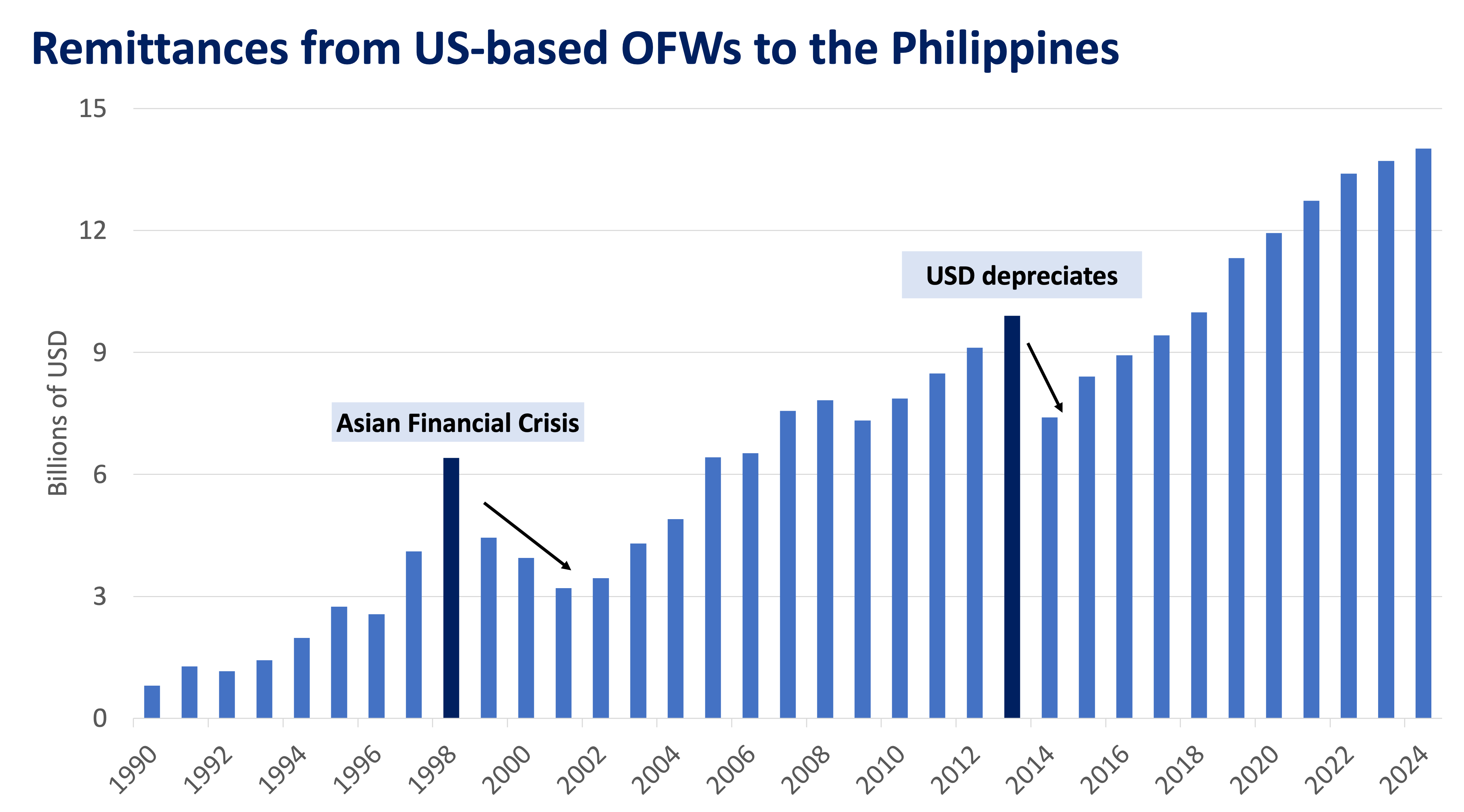

Meanwhile, the US is a hotspot for Overseas Filipino Workers (OFWs), with approximately 2 million OFWs in the US. OFWs influence the Philippine economy through remittances, which could be negatively impacted by a slowdown in US growth.

OFWs sent a record high USD 39.3 billion in remittances throughout 2024 and payments continue to grow yearly, as depicted on the graph below.

If OFWs get pay cuts or even lose their jobs, this would cap remittances headed for home. Remittance payments spur household spending, which contributes 78.2% of the Philippines’ GDP. A decline in remittances pulls down household expenditure, rocking the boat for growth.

Philippines in the clearing?

While the US faces the direct effects of Trump’s megabill, the Philippines will feel the aftershocks. After 2027, the federal funds rate is forecasted to tick up after rate cuts in the short-term.

This can, in turn, push up the BSP’s reverse repurchase rate, hindering domestic consumption. To add, if US GDP growth is dampened by crowding out of private investment, demand for exports and OFW remittances may also take a hit.

For now, these are just predictions. What happens in the next few months will determine for certain how the new legislation will affect the local economy.

CARMEN CASTAÑEDA is an intern in the Research and Market Strategy Department, Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She is currently pursuing her Bachelor’s degree in Strategic Management and Economics from the University of Notre Dame in the US in hopes of incorporating economic insights into corporate strategy. As much as possible, she enjoys trying new cuisines and exploring new cities with her loved ones.

JOAQUIM PANTANOSAS is a Management Trainee under Metrobank’s Financial Markets Apprenticeship and Strategic Training (or FAST) Program. He is currently undergoing on-the-job training under the Research and Market Strategy Department of the bank. He holds a BS in Statistics from the University of the Philippines-Diliman, where he developed an interest in quantitative research as a tool for complex problem-solving. He enjoys a good laugh with the people he cares about.

DOWNLOAD

DOWNLOAD

By Carmen S. Castañeda and Joaquim Pantanosas

By Carmen S. Castañeda and Joaquim Pantanosas