Ask Your Advisor: What’s with the fewer gov’t bond offers?

Learn why was the government bond offer volume cut this quarter and what is its impact on yields

Supply and demand have long influenced many businesses and buyers’ choices.

Luxury retailers thrive in exclusivity. Although buyers do not always flock to rare finds. Factors like scale, availability of comparable options, or simply the current economic environment are at play.

So, one may ask: why did the Bureau of the Treasury (BTr) reduce its bond offerings this quarter? What is its impact on the bond market?

Compared to the previous quarter’s PHP 410 billion offering, the current quarter’s offer of PHP 365 billion was cut by PHP 45 billion—to be spread across the 3-, 10-, 20-, and 25-year bond auctions. On the other hand, 5- and 7-year bond auctions are expected to remain at their standard offerings of PHP 30 billion each.

The PHP 365-billion offer

| Auction Date | Issue Date | Tenor | Volume of Offering (in PHP Billions) |

|---|---|---|---|

| 1-Jul-25 | 3-Jul-25 | 5-Year | 30 |

| 8-Jul-25 | 10-Jul-25 | 7-Year | 30 |

| 15-Jul-25 | 17-Jul-25 | 10-Year | 25 |

| 22-Jul-25 | 24-Jul-25 | 3-Year | 20 |

| 29-Jul-25 | 31-Jul-25 | 20-Year | 20 |

| 5-Aug-25 | 7-Aug-25 | 5-Year | 30 |

| 12-Aug-25 | 14-Aug-25 | 7-Year | 30 |

| 19-Aug-25 | 22-Aug-25 | 10-Year | 25 |

| 26-Aug-25 | 28-Aug-25 | 3-Year and 25-Year | 35 (aggregate) |

| 2-Sep-25 | 4-Sep-25 | 7-Year | 30 |

| 9-Sep-25 | 11-Sep-25 | 5-Year | 30 |

| 16-Sep-25 | 18-Sep-25 | 10-Year | 25 |

| 23-Sep-25 | 25-Sep-25 | 3-Year and 25-Year | 35 (aggregate) |

Source: Bureau of the Treasury

Why is the BTr reducing its bond offer volume?

There are several reasons why the BTr would choose to reduce its bond offer volume.

One is to ease its borrowings. At the year’s start, the BTr announced borrowing PHP 1.977 trillion in bonds, partly to finance its domestic borrowing program. It has since issued PHP 1.079 trillion in bonds, or 54.6% of its target.

10-year bonds may explain why the BTr is ahead of schedule. Instead of a usual PHP 30 billion auction last April, it awarded PHP 135 billion in a rare jumbo fixed-rate treasury note (FXTN) through the new FXTN 10-73.

This allowed the generation of a large amount of 10-year funding in a short period. That means the BTr may start reducing future offer volumes, hence why the schedule above shows only PHP 25 billion for each 10-year auction.

To be sure, the media reported that the government still plans to source additional funds from the local market.

A possible new RTB in the works?

Our traders also believe that another reason for the volume reduction is to make way for a new retail treasury bond (RTB).

Bonds like RTB 5-13 and FXTN 10-60 mature on August 12 and September 9, respectively. It makes sense that the BTr could potentially issue a new bond in July to help pre-fund these maturities. The BTr has not issued an RTB this year, with the last one being the RTB 5-18, issued in February 2024.

How does this new schedule affect the peso GS market?

Since peso government securities (GS) trade in a secondary market, prices and yields can change depending on supply and demand.

When the BTr issues more bonds, supply increases beyond existing investor demand, typically resulting in lower prices and higher yields. Conversely, when the BTr reduces volumes, investor demand chases after dwindling bond supply, causing higher prices and lower yields.

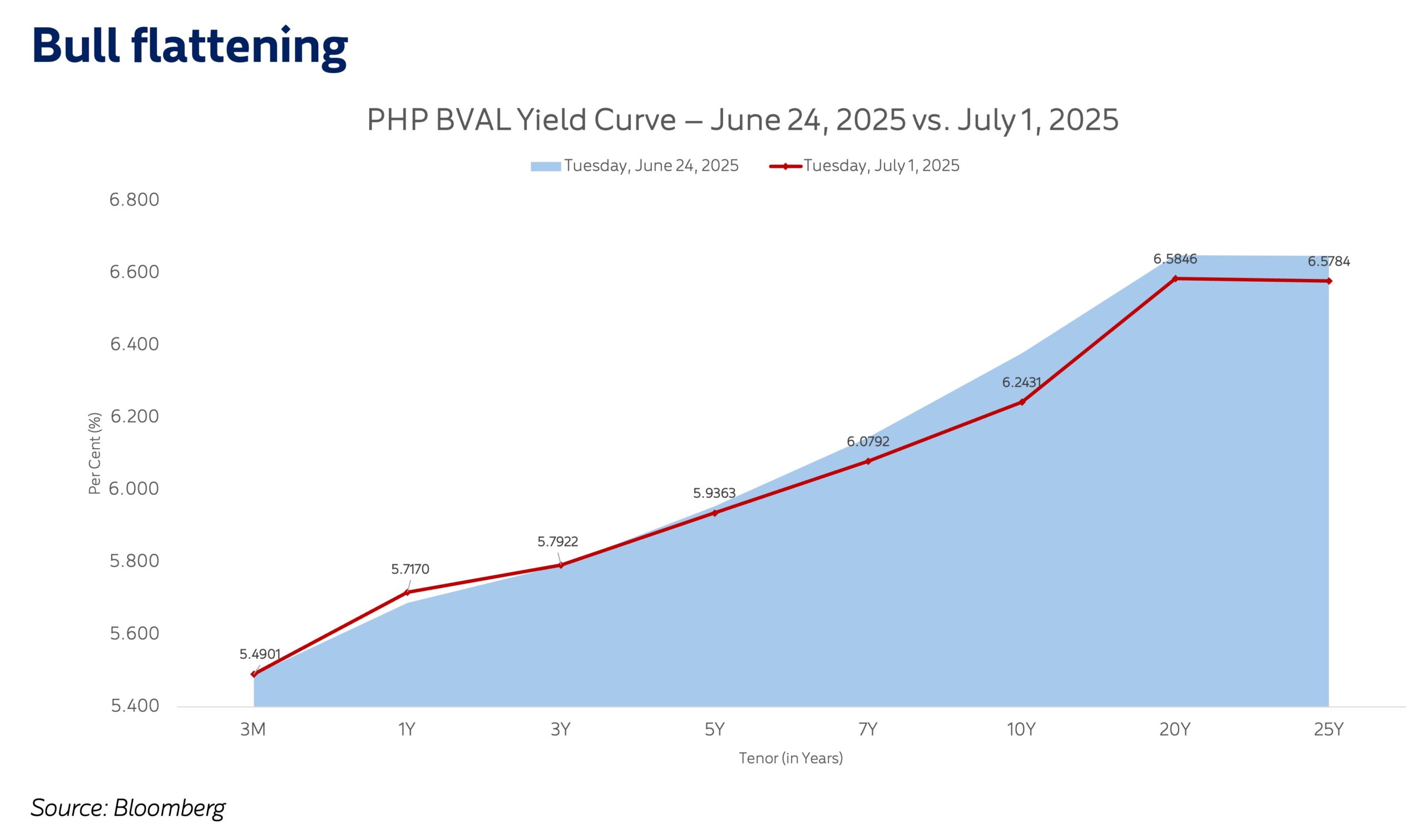

Bond yields are best mapped out on a yield curve—a chart that compares the yields of securities with different maturities, from the short-term treasury bills to the longest treasury bonds. The PHP Bloomberg Valuation (BVAL) yield curve is a proprietary service to determine the official closing GS yields for different benchmark tenors.

The chart above shows what a normal yield curve looks like—a longer tenor demands a higher return to compensate the investor for the added risk and time. A week-on-week comparison of GS yields shows that bonds longer than 5 years dropped the most after the announcement of this quarter’s borrowing schedule.

Although the BTr can always choose to reissue a different 10-year bond, investors rushed to buy the FXTN 10-73, whose yield fell as much as 13 basis points (bps) week-on-week. The benchmark 10-year bond has been a favorite of the GS buyers, with tendered bids usually reaching more than double the BTr’s offered amounts. The bond has already started to trade at a premium over its par value.

The absence of a 15-year bond auction and lower volumes for 20- and 25-year bonds pushed yields 6-7 bps lower in that part of the curve.

The overall effect is what is known in trading terminology as bull flattening—increased buying of longer-dated bonds causes longer-dated yields to fall faster than shorter-dated yields, resulting in a flatter yield curve.

Lower yields to come

The BTr’s borrowing schedule is just one element of what influences supply and demand in the GS market. Investors face the Bangko Sentral ng Pilipinas’ (BSP) plans for more interest rate cuts and the impact of the US government’s fiscal policies on global yields.

And if our traders are right about a new RTB to be issued, then expect GS yields to get pulled up again. But over the long term, we continue to see a shift lower in the entire GS yield curve as new bond issuances are eventually priced against lower interest rates.

While yields remain elevated, we recommend participating in these upcoming auctions, particularly the 5-, 7-, and 10-year bonds, which offer the best relative value.

(Disclaimer: This is general investment information only and does not constitute an offer or guarantee, with all investment decisions made at your own risk. The bank takes no responsibility for any potential losses.)

EARL ANDREW “EA” AGUIRRE is the Head of the Investment Counselor Department under the Financial Markets Sector of Metrobank. He has more than a decade of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By Earl Andrew A. Aguirre

By Earl Andrew A. Aguirre