Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

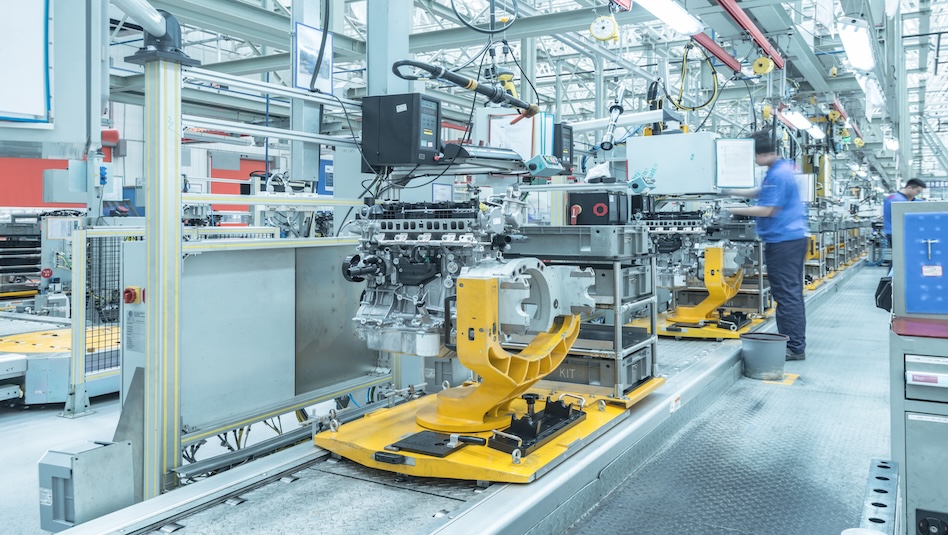

Philippine May factory activity growth slows

Growth in Philippine manufacturing activity slowed in May due to declining output and weaker demand from foreign markets amid global trade tensions.

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI), which measures the country’s monthly factory performance, settled at 50.1, slipping from 53 in April.

This was the lowest index since the 49.4 contraction in March.

This was the lowest index since the 49.4 contraction in March.

A PMI reading above 50 denotes better operating conditions month on month, while a reading below 50 shows the opposite.

“The promising growth observed at the beginning of the second quarter signaled a notable cooling in May,” Maryam Baluch, an economist at S&P Global Market Intelligence, said in a report on Monday. “While new orders continued to increase, they did so at a slower pace, overshadowed by contractions in other areas.”

S&P Global data on the Association of Southeast Asian Nations (ASEAN) showed that only the Philippines expanded in May, while Vietnam (49.8), Myanmar (47.6) and Indonesia (47.4) all declined.

In its report, S&P Global said output declined in May, the second contraction in the past three months.

“Overall, the downturn was marginal, but companies noted softer demand conditions weighed on production,” it said.

Despite continuing to signal a rise in new sales, the rate of expansion in new orders was slight and weaker than in April, it added. This was reflected in the softer rate of increase in input buying activity.

“The situation was further exacerbated by a deteriorating demand from foreign markets, with May witnessing a sharper drop in new export orders,” Ms. Baluch said. “As global trade tensions escalate, the outlook for overseas demand appears increasingly precarious,” US President Donald J. Trump paused his reciprocal tariffs in April for 90 days but continues to apply a 10% baseline tariff rate for most trading partners.

Ms. Baluch said the drop in production requirements was accompanied by a fresh decline in employment and the inventories of both purchases and finished goods.

S&P said employment numbers declined for the first time in four months.

The pace of job shedding was marginal, but the strongest in 11 months, which factories attributed to voluntary resignations and the nonreplacement of those roles.

S&P also cited the limited manpower for a renewed buildup of backlogs across Filipino producers.

“On a brighter note, inflationary pressures remain modest and historically subdued, which could play an important role in supporting demand moving forward,” she said.

However, cost burdens and output charges rose to the highest since January.

“The stability of price pressures may also provide a necessary buffer against the challenges posed by a cooldown in new orders and external market uncertainties,” she added.

S&P Global said manufacturers expect new orders to continue to rise, supported by confidence in the year-ahead outlook for production, but the degree of optimism was the third weakest in the series’ history.

Analysts also said trade tensions and softer demand weighing down the country’s manufacturing activity in May.

The anticipation for higher tariffs likely caused subdued exports, said Reinielle Matt M. Erece, an economist at Oikonomia Advisory and Research, Inc.

“The persistent trade tensions continue to weigh on global trade, causing exports to drop as higher tariffs may be imposed,” he said in a Viber message.

Philippine exports in the first four months rose 9.5% to USD 26.87 billion, according to the local statistics agency.

Mr. Erece said domestic demand slowed as the election-spending season ended. Stronger manufacturing activity is expected later this year, as local authorities continue trade talks with the US Trade Representative, he added.

John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, said companies might have been more cautious due to “election-related transition risks and global supply-chain realignments, which could lead to hesitation in new orders and production planning.”

In the coming months, easing inflation, lower interest rates and public and private sector spending post-election season might help improve factory activity in the Philippines.

Further rate cuts by the Bangko Sentral ng Pilipinas and US Federal Reserve could help cut the financing costs of some manufacturers, Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., said in a Viber message.

The Monetary Board cut the key policy rate by 25 basis points (bps) to 5.5% in April. It has cut the rate by 100 bps since it started its easing cycle in August last year.

BSP Governor Eli M. Remolona, Jr. has signaled two more rate cuts this year. The Monetary Board’s next policy meeting is on June 19. – Aubrey Rose A. Inosante, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld