Peso GS Weekly: Take advantage of recent sell-off

Given the elevated levels last week, we continue to remain opportunistic buyers on selloffs in the peso GS space.

Access this content:

If you are an existing investor, log in first to your Metrobank Wealth Manager account.

If you wish to start your wealth journey with us, click the “How To Sign Up” button.

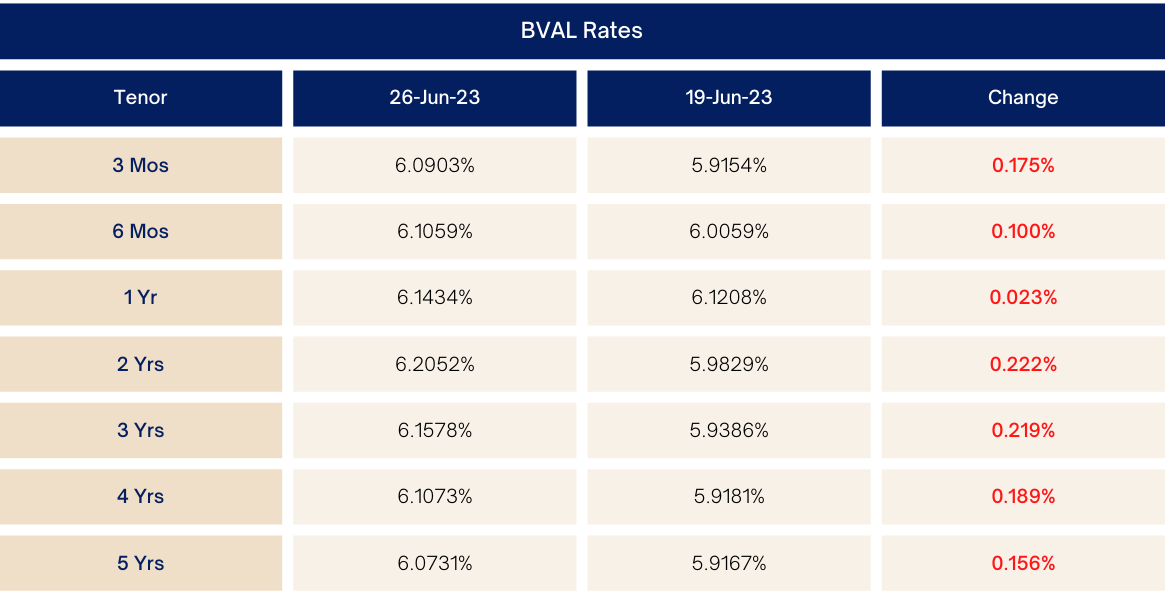

Market Levels (week-on-week)

Last week:

The peso government securities (GS) market opened in muted fashion last week with little activity observed as most investors and dealers wait for firmer leads to move yields either way.

Some buying activity was initially seen in 9-year bonds given their decent pick-up in yields against longer-dated securities, but interest quickly faded. The relatively weak 6-year auction reception for the reissuance of Fixed Rate Treasury Note (FXTN) 7-67 caused appetite for risk to sour even further with bids climbing by as much as 10 basis points (bps) higher post-auction.

Players continued to de-risk or sell their peso GS holdings mid-week ahead of the policy rate decision of the Bangko Sentral ng Pilipinas (BSP), with 20-year FXTN 20-25 trading close to the 6.2

Read More Articles About:

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco