Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

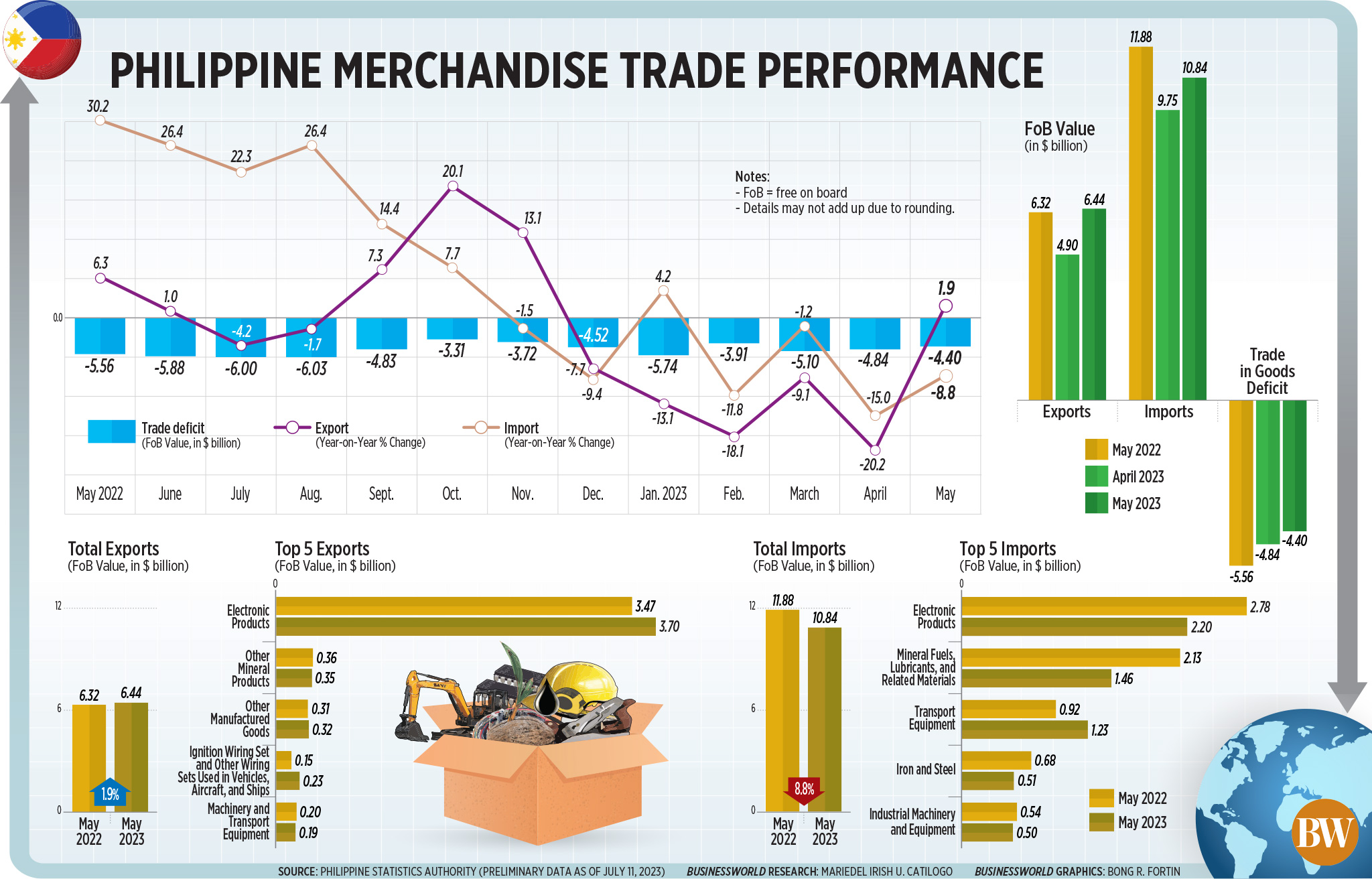

Trade deficit narrows to USD4.4B in May

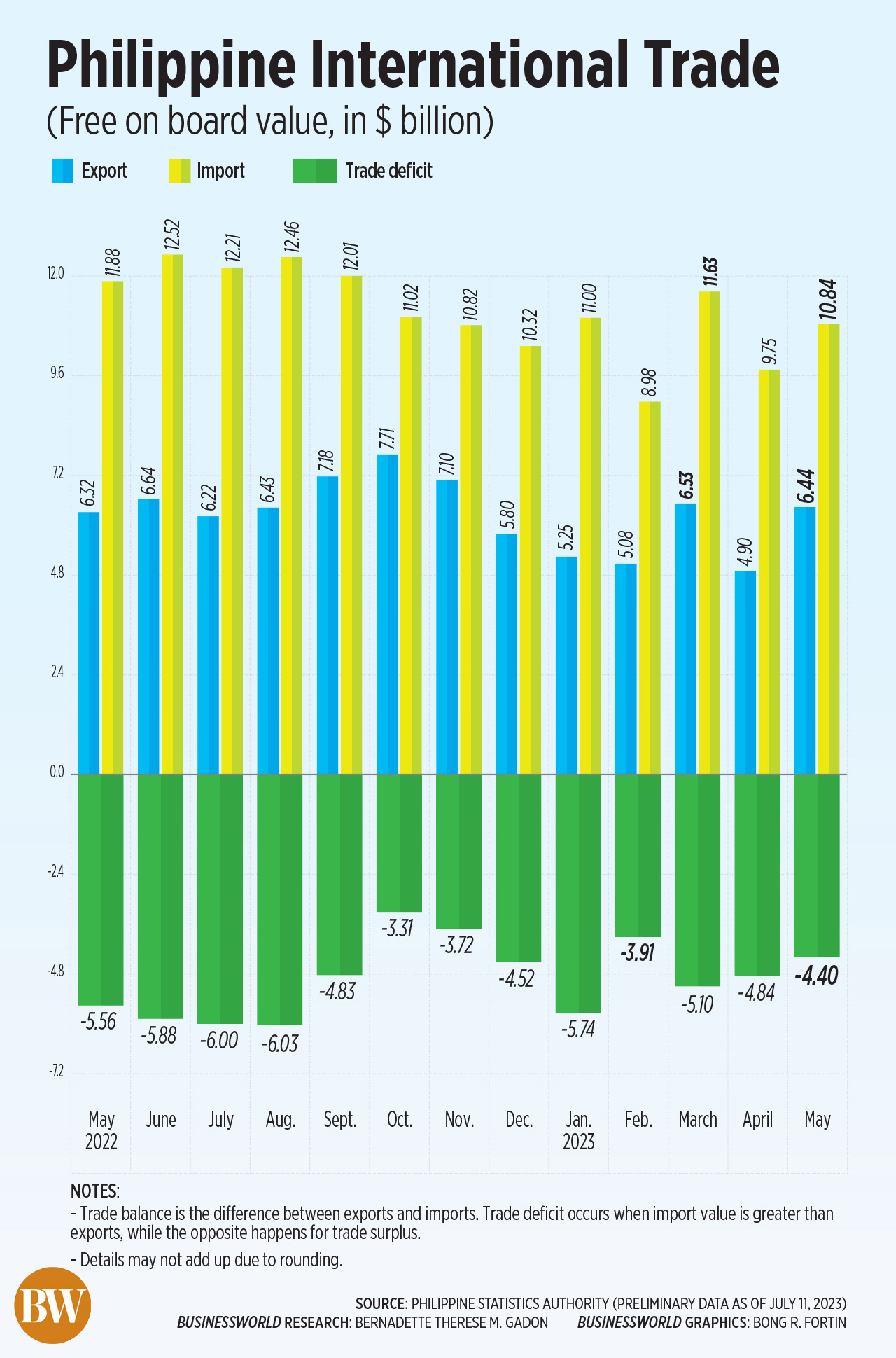

The Philippines’ trade deficit narrowed to a three-month low in May as exports expanded for the first time in six months while the decline in imports slowed, data from the Philippine Statistics Authority (PSA) showed.

According to PSA data, the country’s balance of trade in goods stood at a USD 4.4-billion deficit in May, slimmer than the revised USD 4.84-billion gap in April and USD 5.56-billion deficit in May 2022.

This was the smallest trade deficit in three months or since the USD 3.91-billion deficit in February.

The Philippines has incurred a trade deficit for the last eight years or since the trade surplus of USD 64.95 million in May 2015.

Merchandise exports grew by 1.9% to USD 6.44 billion in May, ending five straight months of decline and recording the fastest growth since the 13.1% logged in November 2022. This was a reversal of the revised 20.2% drop in April but still lower than 6.3% growth in May last year.

May’s export level was the highest in two months or since the USD 6.53 billion in March.

Meanwhile, imports fell by 8.8% to USD 10.84 billion in May, slower than the revised 15% decline in April and a reversal of the 30.2% growth in May 2022.

While May marked the fourth straight month of decline, the value of imports was the biggest in two months or since the USD 11.63 billion in March.

In the first five months of the year, exports fell by 11.5% to USD 28.21 billion, while imports slipped by 6.6% to USD 52.2 billion. This was below the government’s 1% and 2% growth targets for exports and imports, respectively, for this year.

This brought the trade deficit to USD 23.99 billion in the January-to-May period, nearly flat from the USD 23.96-billion gap in the same period last year.

This brought the trade deficit to USD 23.99 billion in the January-to-May period, nearly flat from the USD 23.96-billion gap in the same period last year.

“Exports managed to surprise on the upside with a sharp recovery in electronics shipments. Meanwhile, imports remained in contraction with almost all subsectors in the red, save for consumer imports,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

Mr. Mapa noted that the narrower trade deficit “suggests that there will be less pressure on the Philippine peso to weaken as demand for foreign currency dips relative to last year.”

Manufactured goods, which accounted for 81% of the country’s total export receipts, rose by 4.5% year on year to USD 5.2 billion in May.

Electronic products, which made up nearly three-fourths of manufactured goods and more than a half of total exports in May, grew by 6.7% to USD 3.7 billion. Almost half of total exports came from semiconductors, which jumped by 15.9% to USD 3.12 billion.

Meanwhile, orders of raw materials and intermediate goods in May fell by 12.3% to USD 4.05 billion. These accounted for nearly 40% of the total May import bill.

In May, imports of capital goods declined by 5.9% to USD 3.16 billion, while the imports of consumer goods grew by 24.7% to USD 2.13 billion.

Mineral fuels, lubricants and related materials fell by 31.7% year on year to USD 1.46 billion.

“Capital and raw materials stayed in contraction, pointing to slowing capital formation which in turn will cap growth in the coming quarters,” Mr. Mapa said.

China was the main destination of Philippine-made goods in May. Exports to China stood at USD 1.07 billion, or 16.6% of the total exports.

Other top export destinations were United States which accounted for 15.7% or $1.01 billion and Japan which accounted for 14.4% or USD 930.56 million.

Likewise, China was also the main source of imports, accounting for 24% of the total or USD 2.6 billion of the total import bill in May.

It was followed by Indonesia with an 8.5% share or USD 917.05 million and Japan with 7.3% or USD 794.92 million.

Philippine Exporters Confederation, Inc. President Sergio R. Ortiz-Luis, Jr. said the exports growth will continue despite supply chain problems.

“The expansion will continue in June, but not higher than the export print in June 2022. Export will also continue expanding in the coming months but not in the degree that government wanted to,” said Mr. Ortiz-Luis in a telephone interview.

However, he expressed confidence the government’s 1% exports growth target will be achieved.

“Import had slowed down due to possible decrease in the importation of food items, we continue to import raw materials for production, but there are supplies not available especially in the electronics,” Mr. Ortiz-Luis said. — Lourdes O. Pilar, Researcher

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld