January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

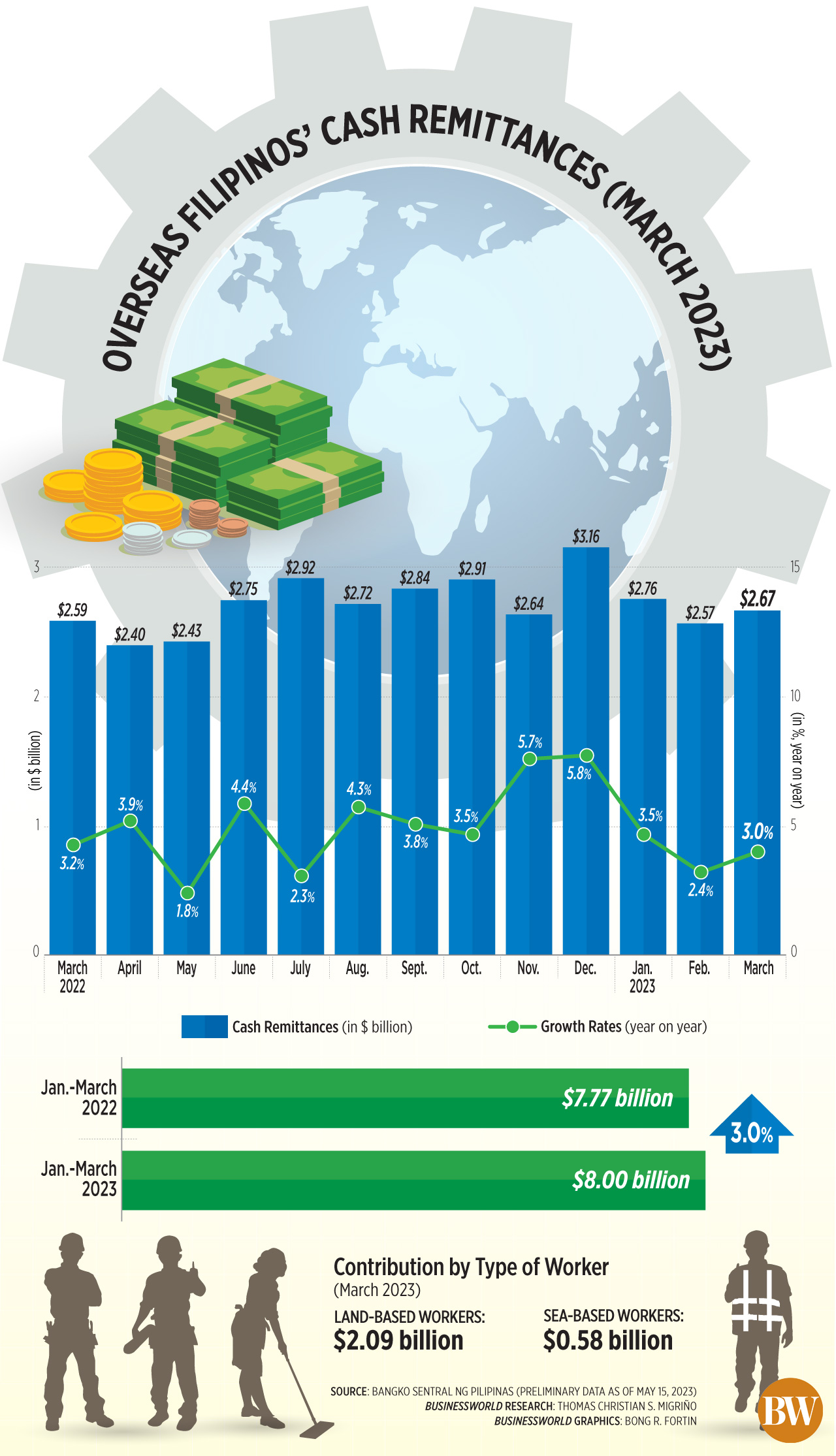

Cash remittances up 3% in March

MONEY SENT HOME by overseas Filipinos jumped by 3% in March amid the improving economic outlook in host countries.

Data released by the Bangko Sentral ng Pilipinas (BSP) on Monday showed cash remittances sent through banks jumped to USD 2.67 billion in March, from USD 2.59 billion in the same month in 2022.

This is the biggest monthly inflow recorded since the USD 2.76-billion cash remittances seen in January.

The March remittance growth is also the fastest in two months or since the 3.5% print in January.

The March remittance growth is also the fastest in two months or since the 3.5% print in January.

“The expansion in cash remittances in March 2023 was due to the growth in receipts from land- and sea-based workers,” the central bank said in a statement.

In March, remittances sent by land-based workers jumped by 3.3% to USD 2.09 billion from last year’s USD 2.02 billion, while those sent by sea-based workers increased by 1.8% to USD 583 million from USD 570 million a year ago.

China Banking Corp. Chief Economist Domini S. Velasquez said the higher remittances were likely driven by improving economic outlooks in advanced economies.

“The US looks to be heading for a soft landing with the recession now only expected in the fourth quarter and the labor market still robust. Meanwhile, the euro area and the UK are now projected to dodge a recession altogether this year,” she said.

Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said the 3% remittance growth was in line with expectations.

“I believe this remittances uptick is consistent with what we have seen as the persistence of domestic consumption demand in the last GDP print released,” he said.

The Philippine economy grew by 6.4% in the first quarter, easing from 8% in the same period in 2022 amid elevated inflation and slower consumer spending.

Household consumption, which contributes around three-fourths to GDP, expanded by 6.3%. However, this was slower than the 7% growth in the previous quarter, and 10% a year earlier.

For the first three months of the year, cash remittances rose by 3% to USD 8.002 billion, from USD 7.77 billion in the comparable period last year.

This was mainly due to higher inflows from the United States, Singapore, Saudi Arabia, and the United Arab Emirates (UAE).

By country, the United States, Singapore, Saudi Arabia, Japan, the United Kingdom, the UAE, Canada, Qatar, Taiwan, and Hong Kong accounted for 79.2% of total cash remittances in the first quarter.

Meanwhile, personal remittances, which include inflows in kind, went up by 3% to USD 2.97 billion from USD 2.89 billion in March 2022.

This brought personal remittances 3% higher to USD 8.91 billion in the first quarter, from the USD 8.65 billion recorded in the comparable period in 2022.

Mr. Asuncion forecasts annual remittance growth at 2.4% this year, before picking up to 3% by 2024.

“We’ve factored in the recessionary risks overhang of advanced economies. We anticipate the potential growth slowdown particularly that of the US economy where majority of remittances are said to come from,” he added.

However, persistent inflation in Europe, especially in the UK, may prevent Filipinos from sending more money home, Ms. Velasquez said.

This could keep remittance growth “tepid” in the coming months, she added.

The BSP expects remittances to grow by 3% this year. — By Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld