April 2024 Economic Updates: Elevated inflation and the prospects of rate cuts

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP keeps rates steady

DOWNLOAD

DOWNLOAD

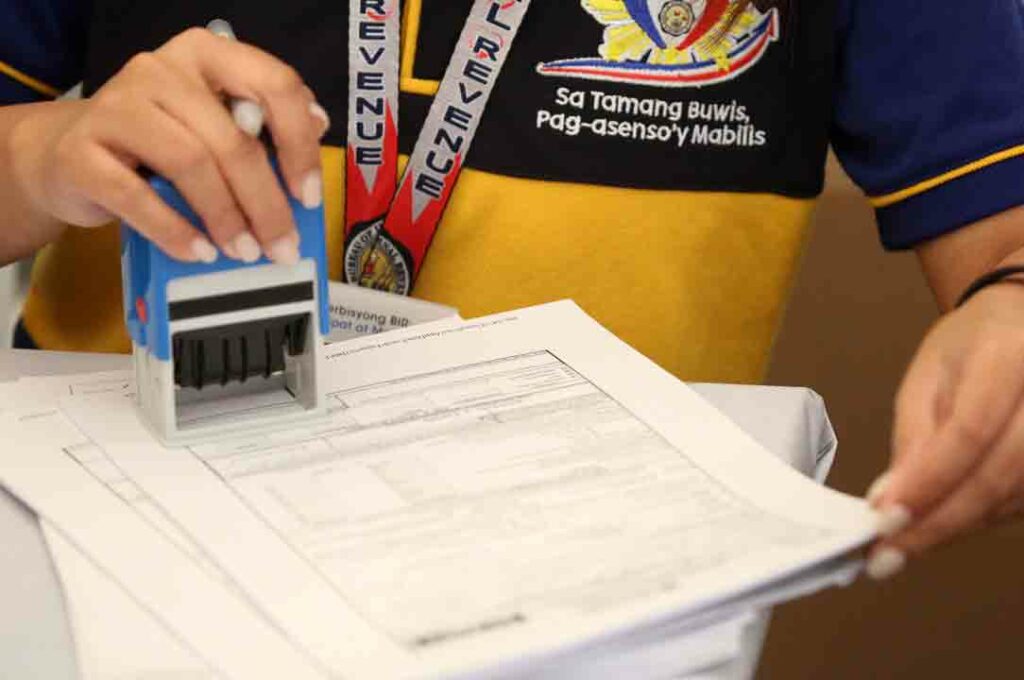

Inflation Update (April 5, 2024)

DOWNLOAD

DOWNLOAD

TODAY’S REPORT

TODAY’S REPORT

The Gist

Your Morning Fix

- An auction of a record USD 70 billion worth of five-year US Treasury notes pushed bond yields higher and had weighed on equities, with the 10-year yield up 4 basis points (bps) at 4.642%.

- Disappointing forecasts from Facebook parent Meta Platforms sparked a sell-off in tech stocks in after-hours trading, raising concerns on whether the industry that has powered the bull market in equities has run too far.

- Indonesia’s central bank, whose main mandate is currency stability, defied expectations and raised its policy rate for the first time since October by 25 basis points to 6.25% to support the rupiah. Markets had previously expected Bank Indonesia to start cutting rates in the third quarter.

- The Philippine Government’s budget gap shrank by 6.82% to PHP 195.9 billion in March amid a dip in tax collection and muted spending.

- The term deposit facility of the Bangko Sentral ng Pilipinas fetched bids amounting to P250.346 billion on Wednesday, well above the P190-billion offering as well as the P224.66 billion tenders for a P280-billion offer seen a week ago. Banks asked for yields ranging from 6.5% to 6.54%, narrower than the 6.52% to 6.565% band seen a week earlier.

- The Bases Conversion and Development Authority has remitted PHP 1.1 billion to the Bureau of the Treasury, doubling the dividends it remitted a year earlier.

The Gist

The Gist

EXCLUSIVE STORIES FROM METROBANK

EXCLUSIVE STORIES FROM METROBANKSTORIES FROM METROBANK

Exclusive Articles

Filter By Topic

Filter By Topic

Markets

Wealth

Filter By Topic

Markets

Wealth

Peso GS Weekly: Defensive bidding seen amid bearish market sentiment

The treasury may still reject the 20-year auction despite pessimism in the market.

April 2024 Economic Updates: Elevated inflation and the prospects of rate cuts

We have retained our forecasts for 2024 as the trend for inflation looks inauspicious.

Stock Market Weekly: Rising bond yields, ascent of the US dollar to weigh on local stocks

We expect the market to trade sideways with a downward bias this week.

Ask Your Advisor: Should I continue to hold my Saudi Arabia, Oman, and Bahrain sovereign bonds?

Iran’s volley of deadly drones and missiles aimed at Israel renewed tensions in the Middle East. Investors holding bonds issued by Saudi Arabia, Oman, and Bahrain wonder whether big losses are expected, or if it is time to buy more.

Peso GS Weekly: Expect bonds to trade higher amid risks

The bond market will continue to demand for more premium amid upbeat US data, geopolitical tensions in the Middle East, and local inflation risks.

Where should you put your money during market lulls?

Investors don’t want their money to sleep. They want their money to work and earn even in times of uncertainty and market doldrums. Money market funds are good options.

Philippine News

Worldwide News From Reuters

Worldwide News From ReutersFrom Around The Globe

Money Sense

Where should you put your money during market lulls?

Investors don’t want their money to sleep. They want their money to work and earn even in times of uncertainty and market doldrums. Money market funds are good options.

Weighing the risks and opportunities in global corporate bonds

CreditSights, our credits research partner, generally has a positive outlook for 2024. Investors, however, still need to keep an eye on challenges.

Make 2024 a year for real estate investing

Real estate may be in for a comeback this year as the economy improves.

What’s your offshore strategy for 2024?

After assessing events in the markets in 2023, we have come up with some broad recommendations that you can consider this year.

Shaping your investment strategy in 2024

This year was a good one for fixed income markets. Are things about to change in 2024?

Explainer Articles

Explainer ArticlesThe Impact of Interest Rates on Bond Prices

For some, the relationship of interest rates with bonds can be tricky to understand. However, the best way to explain it is by using it in specific scenarios.

Key Points

- What are bonds?

- How does the inverse relationship work?

- How are different bond types affected by interest rates?

- What causes yields to increase and decrease?

- Be a smart investor with Metrobank

Videos

VideosGet More Insights

Webinars

See All Webinars

Investor Series: An Introduction to Estate Planning

In this webinar organized by the CFA Society Philippines, Wanda Beltran, Metrobank Head of the Accounts Management Division under the Trust Banking Group, shares some hard-earned lessons about poor estate planning and some tools and tips that can help people build an equitable legacy for their loved ones. September 1, 2023

Estate Planning: Building a Legacy for the Future

Watch this webinar to get a head start on estate planning. November 8, 2022

Outlook 2022: Recover. Restart. Rebalance.

Watch this episode of the Market Movers entitled “Outlook 2022: Recover. Restart. Rebalance. March 31, 2022 Webinars

Webinars

Inflation Updates (December 5, 2023)

We have revised our inflation forecasts downward to 6.0% in 2023 and 4.3% in 2024.